Experian 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

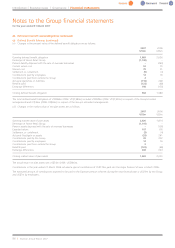

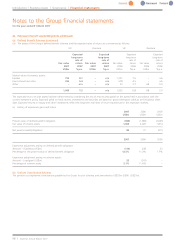

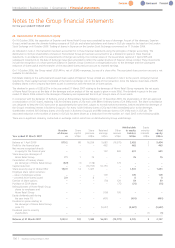

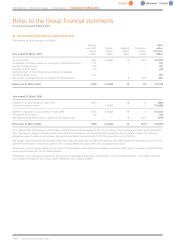

28. Reconciliation of movements in equity

On 10 October 2006, the separation of Experian and Home Retail Group was completed by way of demerger. As part of the demerger, Experian

Group Limited became the ultimate holding company of GUS plc and related subsidiaries and shares in GUS plc ceased to be listed on the London

Stock Exchange on 6 October 2006. Trading of shares in Experian on the London Stock Exchange commenced on 11 October 2006.

As indicated in note 2, this transaction has been accounted for in these financial statements using the principles of merger accounting. The

distribution to GUS plc shareholders of shares in Home Retail Group plc has been accounted for as a dividend in specie in these financial

statements. In accordance with the requirements of merger accounting, the nominal values of the issued share capital at 1 April 2005 and

subsequent movements to the date of demerger have been amended to reflect the capital structure of Experian Group Limited. These movements

include the recognition of a share premium balance in Experian Group Limited on a reorganisation prior to the demerger and the subsequent

reduction of share capital and the transfer of the associated share premium account to retained earnings.

On 11 October 2006, the Group raised US$1,441m, net of US$43m expenses, by way of a share offer. The associated share premium account is not

available for distribution.

Full details relating to the authorised and issued share capital of Experian Group Limited are contained in note J to the parent company financial

statements. Share capital has been translated at the historic exchange rate on the date of the transaction. Since the balance sheet date, 29,605

Ordinary shares in the Company have been issued in connection with the exercise of share options.

The dividend in specie of US$5,627m in the year ended 31 March 2007 relating to the demerger of Home Retail Group represents the net assets

of Home Retail Group as at the date of the demerger and an analysis of the net assets is given in note 30(b). The dividend in specie in the year

ended 31 March 2006 related to the demerger of Burberry and represented the GUS plc Group’s share of its net assets.

In connection with the demerger of Burberry and at an Extraordinary General Meeting on 13 December 2005, the shareholders of GUS plc approved

aconsolidation of GUS shares, replacing 1,023m Ordinary shares of 25p each with 880m Ordinary shares of 29 3/43p each. The share consolidation

was designed to keep the GUS share price at approximately the same level, subject to normal market movements, before and after the demerger of

the Group’s remaining interest in BurberryGroup plc. For every 1,000 Ordinary shares of 25p each held immediately prior to the demerger,

shareholders received 305 Ordinary shares of 0.05p each in Burberry Group plc and 860 Ordinary shares of 29 3/43p each in GUS plc. The

associated reduction in the number of shares in GUS plc has been shown as a deduction from the number at 1 April 2005 in the following tables.

There are no significant statutory, contractual or exchange control restrictions on distributions by Group undertakings.

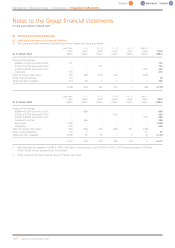

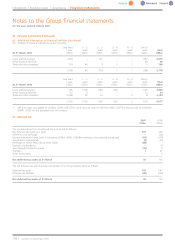

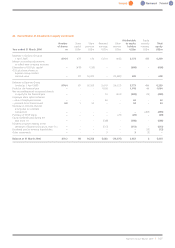

Attributable Equity

Number Share Share Retained Other to equity minority Total

of shares capital premium earnings reserves holders interests equity

Year ended 31 March 2007 m US$m US$m US$m US$m US$m US$m US$m

Balance at 1 April 2006 879.2 88 16,256 5,683 (16,575) 5,452 25,454

Profit for the financial year –––462–462 1463

Net income recognised directly

in equity for the financial year –– – 132 469 601 –601

Share issues pre demerger of

Home Retail Group 7.1 175 – – 76 –76

Cancellation of treasuryshares

pre demerger of Home Retail Group (8.9) (1) (178) – 179 –––

Capital reduction –– (16,153) 16,153 – –––

Share issues by way of Global Offer 142.9 14 1,427 – – 1,441 –1,441

Employee share option schemes:

–value of employee services –––109–109 –109

–proceeds from shares issued 2.0 –8–– 8–8

Exercise of share options –– – (70) 129 59 –59

Purchase of ESOP shares –– – – (75) (75) –(75)

Relinquishment of Home Retail Group

shares to employees and

Home Retail Group –– – (100) 100 –––

Equity dividends paid during

the year (note 11) –– – (401) – (401) –(401)

Dividend in specie relating to

the demerger of Home Retail Group

(note 11) –– – (5,627) – (5,627) –(5,627)

Dividends paid to minority

shareholders ––––– –(1) (1)

Balance at 31 March 2007 1,022.3 102 1,435 16,341 (15,773) 2,105 2 2,107

Notes to the Group financial statements

for the year ended 31 March 2007

106 |Experian Annual Report2007