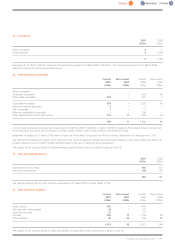

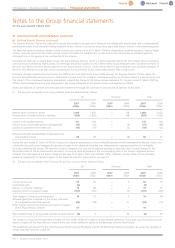

Experian 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

Notes to the Group financial statements

for the year ended 31 March 2007

94 |Experian Annual Report2007

24. Retirement benefit assets/obligations (continued)

(a) Defined Benefit Schemes (continued)

The Experian Pension Scheme has rules which specify the benefits to be paid and is financed accordingly with assets being held in independently

administered funds. A full actuarial funding valuation of this scheme is carried out every three years with interim reviews in the intervening years.

The latest full actuarial funding valuation of the scheme was carried out as at 31 March 2004 by independent, qualified actuaries, Watson Wyatt

Limited, using the projected unit credit method. Under this method of valuation the current service cost will increase as members approach

retirement due to the ageing active membership of the scheme.

Following the demerger of Home Retail Group, the Argos Pension Scheme, which is a defined benefit scheme for Home Retail Group employees,

continued to be operated by that business. On demerger the pension rights of certain Home Retail Group employees who had been members of

the then GUS Pension Scheme were transferred to the Argos Pension Scheme. Certain Home Retail Group employees who had been members of

the then GUS Money Purchase Plan will be transferred to the Home Retail Group Stakeholder Pension Plan in due course.

Following changes introduced by the Finance Act 2004 which took effect from 6 April 2006 (A-Day), the Experian Pension Scheme, being the

principal defined benefit pension scheme, implemented revised terms for members exchanging pension at retirement date for a tax-free lump sum.

The impact of the consequent update in assumptions reduced the charge to the Group income statement for the year ended 31 March 2007 by

US$2m and increased the actual gain recognised in the Group statement of recognised income and expense by US$6m.

Assets and liabilities of overseas schemes have been transferred through the purchase of annuities for all liabilities of the plans.

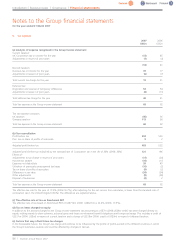

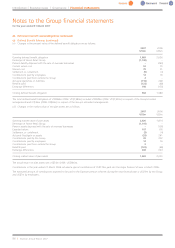

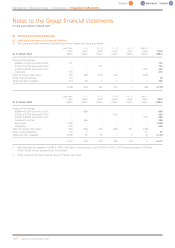

(i) The amounts recognised in the Group balance sheet are determined as follows:

UK Overseas Total

2007 2006 2007 2006 2007 2006

US$m US$m US$m US$m US$m US$m

Market value of schemes’ assets 1,069 1,952 –68 1,069 2,020

Present value of funded schemes’ liabilities (928) (1,852) –(68) (928) (1,920)

Surplus in the funded schemes 141 100 ––141 100

Present value of unfunded pension arrangements (37) (42) –(6) (37) (48)

Liability for post-retirement healthcare (19) (19) –(2) (19) (21)

Retirement benefit asset/(liability) recognised in the

Group balance sheet 85 39 –(8) 85 31

During the year ended 31 March 2006 the Group put in place arrangements to secure unfunded pension benefit arrangements already in place for

certain directors and senior managers by granting charges to an independent trustee over independently managed portfolios of marketable

securities owned by the Group. The amount of assets charged in this way will be adjusted annually to keep the ratio of assets charged to the

discounted value of the accrued benefits secured in this way as close as possible to the corresponding ratio in the Group’s registered pension

schemes. The total value of the assets charged in this way at 31 March 2007 was US$29m (2006: US$28m). Further details of the unfunded

pension arrangements for directors appear in the report on directors’ remuneration on page 57.

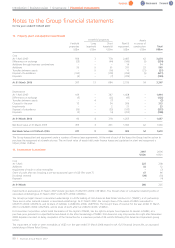

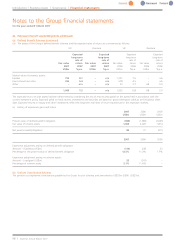

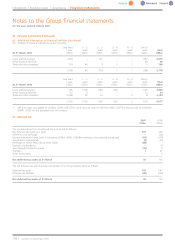

(ii) The amounts recognised in the Group profit and loss account reserve were as follows:

UK Overseas Total

2007 2006 2007 2006 2007 2006

US$m US$m US$m US$m US$m US$m

Current service cost 53 65 –553 70

Curtailment gain (6) –––(6) –

Interest on schemes’ liabilities 78 88 –378 91

Expected return on schemes’ assets (107) (100) –(3) (107) (103)

Total charge to Group income statement 18 53 –518 58

Actuarial (gain)/loss recognised in the Group statement

of recognised income and expense (65) (44) –31 (65) (13)

Other charge to profit and loss account reserve in respect

of the Argos Pension Scheme 41 –––41 –

Total (credit)/charge to Group profit and loss account reserve (6) 9–36 (6) 45

The charge to Group income statement includes US$17m (2006: US$41m) in respect of discontinued operations. The charge to profit and loss account

reserve in respect of the Argos Pension Scheme forms part of the dividend in specie on the demerger of Home Retail Group.

The curtailment gain arises from the restructuring of the UK Account Processing and the UK Marketing Solutions businesses, as well as the cessation of

certain corporate functions in GUS plc.