Experian 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

Notes to the Group financial statements

for the year ended 31 March 2007

92 |Experian Annual Report2007

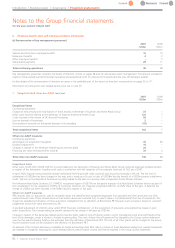

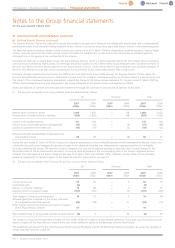

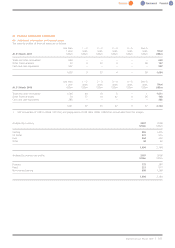

21. Loans and borrowings

Current Non-current Current Non-current

2007 2007 2006 2006

US$m US$m US$m US$m

€548m 4.125% Euronotes 2007 751 – – 688

£350m 6.375% Eurobonds 2009 – 721 – 620

£334m 5.625% Euronotes 2013 – 627 – 595

Perpetual Securities (issued by Home Retail Group) ––– 386

Bank loans ––50 1,308

Overdrafts 273 – 245 –

1,024 1,348 295 3,597

Present value of obligations under finance leases 1–82

1,025 1,348 303 3,599

During the year ended 31 March 2007, 4.125% Euronotes 2007 with a notional value of €20m and 5.625% Euronotes 2013 with a notional value

of £16m were redeemed.

The effective interest rate of Euronotes and Eurobonds approximates to the nominal rate indicated above. The effective interest rate of the Perpetual

Securities is 4.6% (2006: 4.6%). The effective interest rate for overdrafts at 31 March 2007 is 4.3% (2006: 4.9%) and for bank loans at 31 March

2006 was 3.9%.

All the borrowings of the Group shown above are unsecured. Finance lease obligations are effectively secured as the rights to the leased assets

revert to the lessor in the event of default.

The analysis of the maturity profile for non-current items is given in note 26.

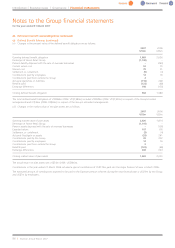

2007 2006

The minimum lease payments payable under finance leases comprise: US$m US$m

Not later than one year 18

Later than one year and not later than five years –2

Total minimum lease payments 110

Future finance charges on finance leases ––

Present value of finance leases (as shown above) 110

The present value of finance leases consists of:

Not later than one year 18

Later than one year and not later than five years –2

Total present value 110

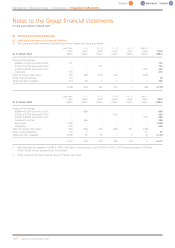

On 12 July 2006, GUS plc entered into a 5-year multi-currency revolving credit facility of US$2,450m. On 17 November 2006, Experian Group Limited

acceded to this facility as a borrower and a guarantor. At the balance sheet date there were no drawings made under this facility.

At 31 March 2007, the Group had undrawn committed borrowing facilities of US$2,450m (2006: US$923m) of which US$nil (2006: US$174m)

expires within one year of the balance sheet date and US$2,450m (2006: US$749m) expires more than two years after the balance sheet date. These

facilities arein place for general corporate purposes including the financing of acquisitions.

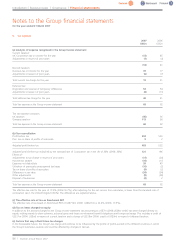

22. Analysis of net debt – non-GAAP measure

2007 2006

US$m US$m

Cash and cash equivalents (net of overdrafts) 634 139

Derivatives hedging loans and borrowings (6) 81

Debt due within one year (729) (49)

Finance leases (1) (10)

Debt due after more than one year (1,306) (3,598)

Net debt at the end of the financial year (1,408) (3,437)

Continuing operations (1,408) (3,277)

Discontinued operations –(160)

Net debt at the end of the financial year (1,408) (3,437)