Experian 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

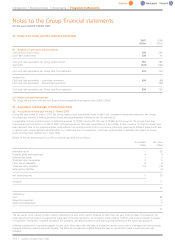

31. Share-based payment arrangements (continued)

Risk-free rate – Rates are obtained from the UK Government Debt Management Office website which details historical prices and yields for gilt

strips.

Expected option life to exercise: Experian Share Option Plans – The Experian Share Option Plans vest 50% after 3 years and 50% after 4

years. The expected life is 4 years for the 50% that vest after 3 years and 4.85 years for the 50% that vest after 4 years.

Expected option life to exercise: former GUS plans – The 1998 Approved and Non-Approved Executive Share Option Schemes had expected

lives of 4 years, the North American Stock Option Plan had an expected life of 3.75 years and the Savings related share option schemes had

expected lives of either 3 or 5 years.

Share price on grant date: Experian Share Option Plans – The majority of the grants were made on 11 October 2006. As this was Experian’s

first trading day, the weighted average price of trades was used. For subsequent grants, the closing price on the day of grant was used.

Share price on grant date: former GUS plans – The closing price on the day the options were granted.

Option exercise price – Exercise price as stated in the term of each award.

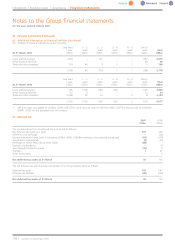

The weighted average estimated fair values and the inputs into the Black-Scholes models, for the Experian Share Option Plans, are as follows:

Weighted

average

2007

Fair value (£) 1.26

Shareprice on grant date (£) 5.63

Exercise price (£) 5.61

Expected volatility 28.0%

Expected dividend yield 3.3%

Risk-free rate 4.9%

Expected option life to exercise 4.43 years

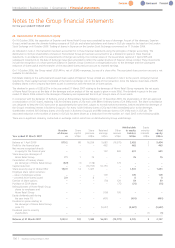

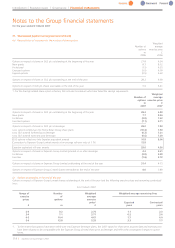

The weighted average estimated fair values and the inputs into the Black-Scholes models, for the former GUS plans, are as follows:

The 1998 Approved and

Non-Approved Executive The North America Stock Savings related share

Arrangements ShareOption Schemes Option Plan option schemes

Weighted Weighted Weighted Weighted Weighted Weighted

average average average average average average

200712006 200712006 200712006

Fair value (£) 2.06 1.60 2.00 1.52 n/a 2.46

Share price on grant date (£) 9.35 8.53 9.35 8.48 n/a 8.96

Exercise price (£) 9.26 8.61 9.26 8.59 n/a 6.87

Expected volatility 29.4% 27.8% 29.1% 27.4% n/a 25.5%

Expected dividend yield 3.5% 4.0% 3.5% 4.0% n/a 3.8%

Risk-free rate 4.7% 4.3% 4.7% 4.3% n/a 4.1%

Expected option life to exercise 4years 4years 3.75 years 3.75 years n/a 3.56 years

1. Weighted average for the period up to demerger.

Options over GUS plc shares granted in the period from 1 April 2006 to demerger had a weighted average fair value of £2.03 (2006: £1.82).

Experian Annual Report2007 |113