Experian 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

gaming and entertainment provider, and Eiger Systems

has been successfully integrated, following its acquisition

in June 2006.

We have previously announced our intention to integrate

UK marketing data, processing and database

management activities into a single business unit,

Experian Integrated Marketing. This will provide a single

point of sale for Experian’s services, an improved

customer proposition and significant cost savings.

Restructuring costs, which will be charged against EBIT,

are expected to be about $12m, of which about $8m

was incurred in the year, with the balance in the year to

March 2008. We expect full payback of the

reorganisation costs in the year to March 2009.

Interactive

Comprises CreditExpert (online credit reports, scores and

monitoring services sold direct to consumers)

Interactive grew sales by 176% over the year. This

excellent performance reflects the strength of demand

for CreditExpert, which benefited from growth in

membership and higher volumes of credit reports

delivered, driven by television and radio advertising and

the strength of marketing partnerships, for example with

AOL, Yahoo and MSN.

Financial review

Total sales from continuing activities were

$843m, up 17% at constant exchange rates

compared to the same period last year. Organic growth

was 7%. The contribution to sales growth from

acquisitions during the year was 10%.

EBIT from continuing activities was $221m, an increase

of 16% at constant exchange rates over last year, prior

to the restructuring charge of $8m. The EBIT margin,

before the restructuring charge, was 26.2% (2006:

26.4%), with the slight decline reflecting the first time

inclusion of ClarityBlue, which has margins below the

average for Experian UK and Ireland. Improved operating

leverage and ongoing cost containment otherwise drove

margin enhancement in the other principal activities.

Experian Annual Report 2007 | 27

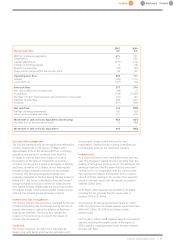

12 months to 31 March 2007 2006 Growth3Organic

$m $m % growth3

%

Sales

- Credit Services 266 245 33

- Decision Analytics 215 185 9 8

- Marketing Solutions 329 236 31 1

- Interactive 33 11 176 176

Total – continuing activities 843 677 17 7

Discontinuing activities164 81 na

Total UK and Ireland 907 758 13

EBIT – UK and Ireland 221 179 16

Restructuring charge (8) - na

EBIT – continuing activities 212 179 12

Discontinuing activities124 36 na

Total UK and Ireland 236 215 4

EBIT margin226.2% 26.4%

1 Discontinuing activities include UK account processing

2 EBIT margin for continuing activities only, before restructuring charge

3 Growth at constant FX rates

Sales from continuing activities

in the UK and Ireland

were up 17%

17%