Experian 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2007 |31

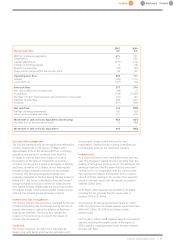

2007 2006

Group cash flow $m $m

EBIT for continuing operations 825 727

Depreciation 237 204

Capital expenditure (275) (212)

Change in working capital 5 (12)

Retained in associate (22) (20)

Share option charge within benchmark profit 34 30

Operating cash flow 804 717

Interest (106) (111)

Corporation tax (121) (32)

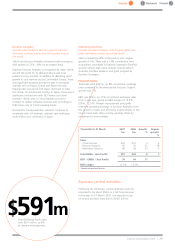

Free cash flow 577 574

Net cash outflow from exceptionals (98) (7)

Acquisitions (118) (1,420)

Purchase of other financial assets and investment in associates (42) (41)

Disposal of subsidiary 258 643

Dividends (401) (508)

Net cash flow 176 (759)

Foreign exchange movements 166 (20)

Other investing related cash flows 121 618

Movement in cash and cash equivalents (continuing) 463 (161)

Net debt flow of discontinued activities 32 (188)

Movement in cash and cash equivalents 495 (349)

Currency risk management

The Group’s reported profit can be significantly affected by

currency movements. In the year to 31 March 2007

approximately 35% of the Group’s EBIT from continuing

operations was earned in currencies other than the

US dollar. In order to reduce the impact of currency

fluctuations on the value of investments in overseas

countries, the Group has a policy of borrowing in Sterling

and Euros, as well as in US dollars, and of entering into

forward foreign exchange contracts in its key overseas

currencies. The Group’s principal borrowings were

originally undertaken in Sterling. During the year ended 31

March 2007, the Group continued to enter into forward

foreign exchange contracts to sell the US dollar and the

Euro against Sterling. Additionally, the Group has a policy

of hedging foreign currency denominated transactions by

entering into forward foreign exchange contracts.

Interest rate risk management

The Group’s interest rate exposure is managed by the use

of fixed and floating rate borrowings and by the use of

interest rate swaps to adjust the balance of fixed and

floating rate liabilities. The Group also spreads the

duration of its borrowings to smooth the impact of

interest rate fluctuations.

Credit risk

The Group‘s exposure to credit risk is managed by

dealing only with banks and financial institutions with

strong credit ratings, within limits set for each

organisation. Dealing activity is closely controlled and

counter-party positions are monitored regularly.

Interest costs

At $146m net finance costs were $44m lower than last

year. The changes in capital structure resulting from the

settling of intra-group lending prior to the demerger, the

demerger itself and the IPO mean that the prior year’s

interest cost is not comparable with the current year’s.

The reported net interest line benefits from a credit to

interest of $16m relating to the excess of the expected

return on pension assets over the interest on pension

liabilities (2006: $9m).

At 31 March 2007, Experian had net debt of $1,408m,

including the net proceeds from the equity issue in

October 2006 of $1,441m.

Assuming the $1.4bn equity had been raised at 1 April

2006, the pro forma net interest expense would have been

$65m (H1: $30m; H2: $35m), including a similar

pension credit.

For the year to March 2008, Experian expects a net interest

expense, including the pension credit, in the region of

$70m, based on acquistion spend since the year-end and

forecast cash flows.