Experian 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction | Business review | Governance | Financial statements

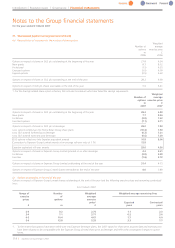

B. Basis of preparation and significant accounting policies (continued)

ESOP Trust shares

The Experian Group Limited Employee Share Trust (‘the Trust’) is a separately administered trust. Liabilities of the Trust are guaranteed by the

Company and the assets of the Trust mainly comprise shares in the Company. The assets, liabilities and expenses of the Trust are included in the

Company’s financial statements as if they were the Company’s own. Such shares held by the Trust are shown as a deduction from equity

shareholders’ funds at cost.

Share-based payments

The Group has a number of equity settled, share-based compensation plans. These include awards in respect of shares in the Company made at or

after demerger together with awards previously made in respect of shares in GUS plc which were rolled-over into awards in respect of shares in the

Company at demerger. The issuance by the Company of share incentives to employees of its subsidiaries represents additional capital contributions

and therefore an increase in the Company’s investment in group undertakings with a corresponding increase in equity shareholders’ funds.

The fair value of options and shares granted is recognised after taking into account the Company’s best estimate of the number of awards expected

to vest. The Company revises the vesting estimate at each balance sheet date and non market performance conditions are included in the vesting

estimates. Amounts are recognised over the vesting period. Fair value is measured at the date of grant using whichever of the Black-Scholes, Monte

Carlo model and closing market price is most appropriate to the award. Market based performance conditions are included in the fair value

measurement on grant date and are not revised for actual performance.

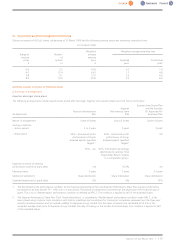

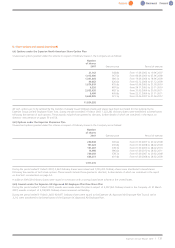

C. Operating loss

The operating loss is stated after charging:

2007

(i) Staff costs: £m

Directors’ fees 0.4

Wages and salaries 0.2

Total 0.6

(ii) Fees payable to the Company’s auditor and its associates:

Fees payable to Company’sauditor for the audit of the parent company financial statements were£30,000

Fees payable to Company’sauditor for the audit of the group financial statements 0.3

Fees payable to Company’s auditor and its associates for other services:

Services in respect of the demerger (included in exceptional items) 0.6

Total 0.9

(iii) Exceptional items:

Costs incurred relating to the demerger of Home Retail Group and Experian 4.6

The Company employed an average of one employee during the period. Executive directors of the Company are employed by other companies

within the Group.

Details of the remuneration of directors are given in the auditable part of the report on directors’ remuneration on pages 52 to 57.

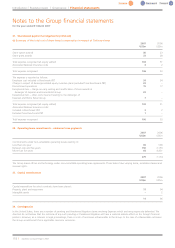

During the period the Company paid an interim equity dividend of £20.4m to shareholders and there was a dividend in specie to shareholders of

£3,497.6m relating to the demerger of Home Retail Group. The directors propose a further dividend of 11.5 cents per share for the period ended

31 March 2007. This dividend is not included as a liability in the current year financial statements as it has not been declared. For further details see

note 11 in the Experian Group financial statements.

124 |Experian Annual Report2007

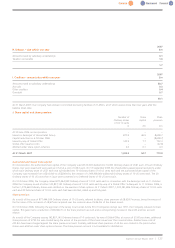

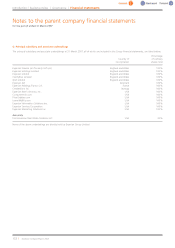

Notes to the parent company financial statements

for the period ended 31 March 2007