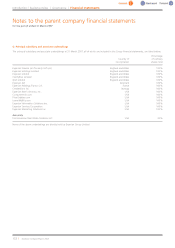

Experian 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report2007 |127

2007

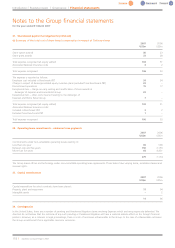

H. Debtors – due within one year £m

Amounts owed by subsidiary undertakings 0.1

Taxation recoverable 1.6

1.7

2007

I. Creditors – amounts due within one year £m

Amounts owed to subsidiary undertakings 88.7

Accruals 0.3

Other creditors 0.4

Overdraft 0.7

90.1

At 31 March 2007, the Company had undrawn committed borrowing facilities of £1,250m, all of which expires more than two years after the

balance sheet date.

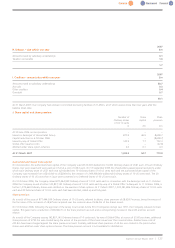

J. Share capital and share premium

Number of ShareShare

Ordinary shares capital premium

of US 10 cents

m £m £m

At 30 June 2006 on incorporation –––

Issued on demerger of Home Retail Group 877.4 46.9 8,628.7

Capital reduction on 6 October 2006 – – (8,628.7)

Issued by way of Global Offer 142.9 7.7 792.3

Global offer issuance costs – – (22.8)

Allotted under share option schemes 2.0 0.1 4.3

At 31 March 2007 1,022.3 54.7 773.8

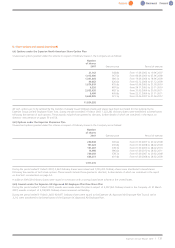

Authorised and issued share capital

On incorporation, the authorised share capital of the Company was US$10,000 divided into 10,000 Ordinary shares of US$1 each. Of such Ordinary

shares, two were issued and were paid up in full at a cost of US$2 each. On 13 September 2006 the shareholders passed special resolutions under

which each Ordinary share of US$1 each was sub-divided into 10 Ordinary shares of 10 US cents each and the authorised share capital of the

Company was increased from US$10,000 to US$200m by the creation of 1,999,900,000 additional Ordinary shares of 10 US cents each. The 20

Ordinaryshares of 10 US cents then in issue wereconverted in to Deferred shares of 10 US cents each.

On 10 October 2006, the Company issued 877,444,999 Ordinary shares of 10 US cents each in connection with the demerger and on 11 October

2006 the Company issued a further 142,857,143 Ordinary shares of 10 US cents each by way of a Global Offer. Subsequent to 11 October 2006, a

further 1,979,664 Ordinary shares were allotted on the exercise of share options. At 31 March 2007, 1,022,281,806 Ordinary shares of 10 US cents

each and 20 Deferred shares of 10 US cents each had been allotted, called up and fully paid.

Share premium

As a result of the issue of 877,444,999 Ordinary shares of 10 US cents, referred to above, share premium of £8,628.7m arose, being the excess of

the fair value of the net assets of £8,675.6m acquired over the nominal value of £46.9m of the shares issued.

On 10 October 2006, following the approval of the Jersey Court under Article 63 of Companies (Jersey) Law 1991, the Company reduced its share

capital. This gave rise to a reduction of £8,628.7m in the sharepremium account and a corresponding increase in the profit and loss account

reserve.

As a result of the Company issuing 142,857,143 Ordinary shares of 10 cents each, by way of Global Offer, at a price of £5.60 per share, additional

share premium of £792.3m was created being the excess of the proceeds of the shares issued over their nominal value. Related issue costs of

£22.8m have been charged against the share premium account. Similarly, additional share premium of £4.3m was created in the period when

shares were allotted under share option schemes. The share premium account is not available for distribution.