Wells Fargo 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

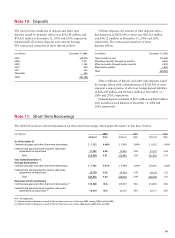

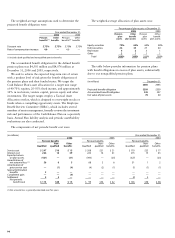

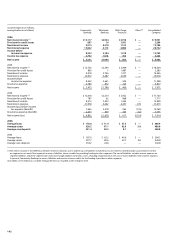

(in millions) December 31, 2006

Pension benefits

Non- Other

Qualified qualified benefits

Net loss $494 $ 76 $144

Net prior service credit (7) (21) (46)

Net transition obligation — — 3

$487 $ 55 $101

The net loss and net prior service credit for the defined

benefit pension plans that will be amortized from accumulated

other comprehensive income into net periodic benefit cost

in 2007 are $44 million and $2 million, respectively. The net

loss and net prior service credit for the other defined benefit

postretirement plans that will be amortized from accumulated

other comprehensive income into net periodic benefit cost in

2007 are $5 million and $4 million, respectively.

(in millions) December 31, 2005

Pension benefits

Non- Other

Qualified qualified benefits

Funded status (1) $ 899 $(277) $(339)

Employer contributions in December —24

Unrecognized net actuarial loss 615 42 131

Unrecognized net transition asset ——3

Unrecognized prior service cost (25)(11)(51)

Accrued benefit income (cost) $1,489 $(244) $(252)

Amounts recognized in the balance sheet consist of:

Prepaid benefit cost $1,489 $— $—

Accrued benefit liability — (245) (252)

Accumulated other comprehensive income — 1 —

Accrued benefit income (cost) $1,489 $(244) $(252)

(1) Fair value of plan assets at year end less projected benefit obligation at year end.

Amounts recognized in accumulated other comprehensive

income (pre tax) for the year ended December 31, 2006,

consist of:

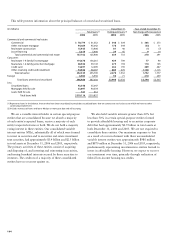

(in millions) December 31,

2006 2005

Pension benefits Pension benefits

Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits

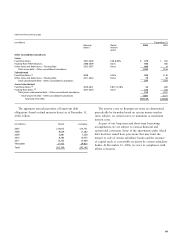

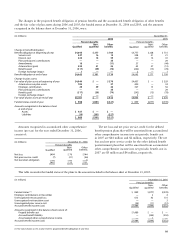

Change in benefit obligation:

Benefit obligation at beginning of year $4,045 $ 277 $ 709 $3,777 $ 228 $ 751

Service cost 247 16 15 208 21 21

Interest cost 224 16 39 220 14 41

Plan participants’ contributions ——35 ——29

Amendments 18 — (11) 37 — (44)

Actuarial loss (gain) 225 31 26 43 27 (12)

Benefits paid (317) (39) (74) (242) (13) (78)

Foreign exchange impact 1 — — 2 — 1

Benefit obligation at end of year $4,443 $301 $739 $4,045 $277 $709

Change in plan assets:

Fair value of plan assets at beginning of year $4,944 $ — $ 370 $4,457 $ — $ 329

Actual return on plan assets 703 — 37 400 — 34

Employer contribution 20 39 44 327 13 56

Plan participants’ contributions ——35 ——29

Benefits paid (317) (39) (74) (242) (13) (78)

Foreign exchange impact 1 — — 2 — —

Fair value of plan assets at end of year $5,351 $ — $ 412 $4,944 $ — $ 370

Funded status at end of year $ 908 $(301) $(327) $ 899 $(277) $(339)

Amounts recognized in the balance sheet

at end of year:

Assets $ 927 $ — $ —

Liabilities (19) (301) (327)

$ 908 $(301) $(327)

The changes in the projected benefit obligation of pension benefits and the accumulated benefit obligation of other benefits

and the fair value of plan assets during 2006 and 2005, the funded status at December 31, 2006 and 2005, and the amounts

recognized in the balance sheet at December 31, 2006, were:

This table reconciles the funded status of the plans to the amounts included in the balance sheet at December 31, 2005.