Wells Fargo 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Earnings Performance

Net Interest Income

Net interest income is the interest earned on debt securities,

loans (including yield-related loan fees) and other interest-

earning assets minus the interest paid for deposits and long-

term and short-term debt. The net interest margin is the

average yield on earning assets minus the average interest

rate paid for deposits and our other sources of funding. Net

interest income and the net interest margin are presented on

a taxable-equivalent basis to consistently reflect income from

taxable and tax-exempt loans and securities based on a 35%

marginal tax rate.

Net interest income on a taxable-equivalent basis was

$20.1 billion in 2006, compared with $18.6 billion in 2005,

an increase of 8%, reflecting solid loan growth (other than

ARMs) and a relatively stable net interest margin. In 2006,

we incurred noninterest expense of $31 million on the extin-

guishment of approximately $800 million of trust preferred

securities (included in junior subordinated long-term debt).

Because we were able to refinance this debt at a rate approx-

imately 200 basis points lower, our net interest expense will

be reduced by approximately $320 million over the next

twenty years.

Our net interest margin was 4.83% for 2006 and 4.86%

for 2005. With short-term interest rates now above 5%, our

cumulative sales of ARMs and debt securities since mid-2004

have had a positive impact on our net interest margin and net

interest income. We have completed our sales of over $90 billion

of ARMs since mid-2004 with the sales of $26 billion of ARMs

in second quarter 2006. In addition, taking advantage of

market volatility during second quarter 2006, we sold our

lowest-yielding debt securities and added to our portfolio of

long-term debt securities at yields of approximately 6.25%

—nearly 200 basis points higher than the cyclical low in yields.

Average earning assets increased $32.3 billion to

$415.8 billion in 2006 from $383.5 billion in 2005. Loans

averaged $306.9 billion in 2006, compared with $296.1 billion

in 2005. Average mortgages held for sale were $42.9 billion

in 2006 and $39.0 billion in 2005. Debt securities available for

sale averaged $53.6 billion in 2006 and $33.1 billion in 2005.

Average core deposits are an important contributor to

growth in net interest income and the net interest margin.

This low-cost source of funding rose 7% from 2005. Average

core deposits were $260.0 billion and $242.8 billion and

funded 53.5% and 54.5% of average total assets in 2006

and 2005, respectively. Total average retail core deposits,

which exclude Wholesale Banking core deposits and retail

mortgage escrow deposits, for 2006 grew $12.0 billion, or

6%, from 2005. Average mortgage escrow deposits were

$18.2 billion in 2006 and $16.7 billion in 2005. Savings

certificates of deposits increased on average to $32.4 billion

in 2006 from $22.6 billion in 2005 and noninterest-bearing

checking accounts and other core deposit categories increased

on average to $227.7 billion in 2006 from $220.1 billion in 2005.

Total average interest-bearing deposits increased to

$223.8 billion in 2006 from $194.6 billion in 2005, largely

due to organic growth.

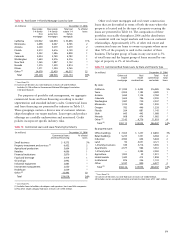

Table 3 presents the individual components of net interest

income and the net interest margin.