Wells Fargo 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

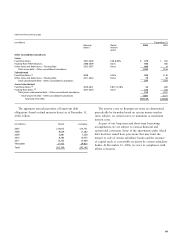

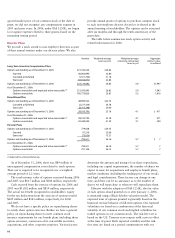

(in millions) Year ended December 31,

2006 2005 2004 2003 2002

Balance, beginning of year $ 4,057 $ 3,950 $ 3,891 $ 3,819 $ 3,717

Provision for credit losses 2,204 2,383 1,717 1,722 1,684

Loan charge-offs:

Commercial and commercial real estate:

Commercial (414) (406) (424) (597) (716)

Other real estate mortgage (5) (7) (25) (33) (24)

Real estate construction (2) (6) (5) (11) (40)

Lease financing (30) (35) (62) (41)(21)

Total commercial and commercial real estate (451) (454) (516) (682) (801)

Consumer:

Real estate 1-4 family first mortgage (103) (111) (53) (47) (39)

Real estate 1-4 family junior lien mortgage (154) (136) (107) (77) (55)

Credit card (505) (553) (463) (476) (407)

Other revolving credit and installment (1,685) (1,480) (919) (827) (770)

Total consumer (2,447) (2,280) (1,542) (1,427) (1,271)

Foreign (281) (298) (143) (105) (84)

Total loan charge-offs (3,179) (3,032) (2,201) (2,214) (2,156)

Loan recoveries:

Commercial and commercial real estate:

Commercial 111 133 150 177 162

Other real estate mortgage 19 16 17 11 16

Real estate construction 313 6 11 19

Lease financing 21 21 26 8 —

Total commercial and commercial real estate 154 183 199 207 197

Consumer:

Real estate 1-4 family first mortgage 26 21 6 10 8

Real estate 1-4 family junior lien mortgage 36 31 24 13 10

Credit card 96 86 62 50 47

Other revolving credit and installment 537 365 220 196 205

Total consumer 695 503 312 269 270

Foreign 76 63 24 19 14

Total loan recoveries 925 749 535 495 481

Net loan charge-offs (2,254) (2,283) (1,666) (1,719) (1,675)

Other (43) 7 8 69 93

Balance, end of year $ 3,964 $ 4,057 $ 3,950 $ 3,891 $ 3,819

Components:

Allowance for loan losses $ 3,764 $ 3,871 $ 3,762 $ 3,891 $ 3,819

Reserve for unfunded credit commitments (1) 200 186 188 — —

Allowance for credit losses $ 3,964 $ 4,057 $ 3,950 $ 3,891 $ 3,819

Net loan charge-offs as a percentage of average total loans 0.73% 0.77% 0.62% 0.81% 0.96%

Allowance for loan losses as a percentage of total loans 1.18% 1.25% 1.31% 1.54% 1.98%

Allowance for credit losses as a percentage of total loans 1.24 1.31 1.37 1.54 1.98

(1) Effective September 30, 2004, we transferred the portion of the allowance for loan losses related to commercial lending commitments and letters of credit to other liabilities.

The allowance for credit losses consists of the allowance for loan losses and the reserve for unfunded credit commitments.

Changes in the allowance for credit losses were: