Wells Fargo 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Instruments and Hedging Activities (as amended)), amortiza-

tion and MSRs impairment, which are all influenced by both

the level and direction of mortgage interest rates.

Servicing fees (included in net servicing income) grew to

$3,525 million in 2006 from $2,457 million in 2005 largely

due to a 47% increase in the portfolio of mortgage loans

serviced for others, which was $1.28 trillion at December 31,

2006, up from $871 billion a year ago. In July 2006, we

acquired a $140 billion mortgage servicing portfolio from

Washington Mutual, Inc. The change in the value of MSRs net

of economic hedging results in 2006 was a loss of $154 million.

The interest rate-related effect (impairment provision net of

hedging results) in 2005 was a gain of $521 million.

Net gains on mortgage loan origination/sales activities

were $1,116 million in 2006, up from $1,085 million in 2005,

primarily due to higher loan sales. Residential real estate

origination and co-issue volume (shown in Table 6 on the

right) totaled $398 billion in 2006, up from $366 billion in

2005. We do not have credit risk for most of these originations

Net losses on debt securities were $19 million for 2006,

compared with $120 million for 2005. Net gains from equity

investments were $738 million in 2006, compared with

$511 million in 2005, primarily reflecting the continued

strong performance of our venture capital business.

We routinely review our investment portfolios and recognize

impairment write-downs based primarily on issuer-specific

factors and results, and our intent to hold such securities.

We also consider general economic and market conditions,

including industries in which venture capital investments

are made, and adverse changes affecting the availability of

venture capital. We determine impairment based on all of

the information available at the time of the assessment, with

particular focus on the severity and duration of specific

security impairments, but new information or economic

developments in the future could result in recognition of

additional impairment.

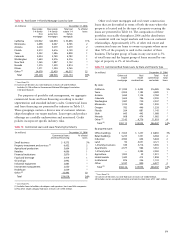

Table 5: Noninterest Income

(in millions) Year ended December 31, % Change

2006 2005 2004 2006/ 2005/

2005 2004

Service charges on

deposit accounts $ 2,690 $ 2,512

$ 2,417 7% 4%

Trust and investment fees:

Trust,investment and IRA fees 2,033 1,855

1,509 10 23

Commissions and all other fees

704 581 607 21 (4)

Total trust and

investment fees

2,737 2,436 2,116 12 15

Card fees

1,747 1,458 1,230 20 19

Other fees:

Cash network fees

184 180 180 2—

Charges and fees on loans

976 1,022 921 (5) 11

All other

897 727 678 23 7

Total other fees

2,057 1,929 1,779 78

Mortgage banking:

Servicing income,net

893 987 1,037 (10) (5)

Net gains on mortgage loan

origination/sales activities

1,116 1,085 539 3101

All other

302 350 284 (14) 23

Total mortgage banking

2,311 2,422 1,860 (5) 30

Operating leases

783 812 836 (4) (3)

Insurance

1,340 1,215 1,193 10 2

Trading assets

544 571 523 (5) 9

Net losses on debt

securities available for sale

(19) (120) (15) (84) 700

Net gains from

equity investments

738 511 394 44 30

All other

812 699 576 16 21

Total

$15,740 $14,445 $12,909 912

Table 6: Residential Real Estate Origination and Co-Issue Volume (1)

(in billions) December 31,

2006 2005

Residential real estate first

mortgage loans:

Retail

$117 $139

Correspondent/Wholesale

(2) 232 176

Home equity loans and lines

39 39

Wells Fargo Financial

10 12

Total

(2) $398 $366

(1) Consists of residential real estate originations from all channels.

(2) Includes $104 billion and $48 billion of co-issue volume for 2006 and 2005,

respectively. Under co-issue arrangements, we become the servicer when the

correspondent securitizes the related loans.

because we sell or securitize most of the mortgages we

originate. In 2006, 26% of our total mortgage origination

volume, and about 65% of non-prime originations, were

made under co-issue arrangements, where we act exclusively

as the loan servicer and a third party correspondent securitizes

the loans. Under co-issue arrangements, we do not assume

any credit risk, because third parties assume all credit risk.

We also do not assume the seller’s liabilities normally associated

with residential real estate originations, such as exposure

associated with standard representations and warranties or

early payment buyback obligations. Loan sales were $271 billion

in 2006 and $251 billion in 2005. The 1-4 family first mortgage

unclosed pipeline was $48 billion at year-end 2006 and $50 billion

at year-end 2005.