Wells Fargo 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

with 14% at the end of 2005. These loans are diversified

among the larger metropolitan areas in California, with no

single area consisting of more than 3% of our total loans.

Changes in real estate values and underlying economic con-

ditions for these areas are monitored continuously within

our credit risk management process.

Some of our real estate 1-4 family mortgage loans,

including first mortgage and home equity products, include an

interest-only feature as part of the loan terms. At December 31,

2006, such loans were approximately 19% of total loans,

compared with 26% at the end of 2005. Substantially all of

these loans are considered to be prime or near prime. We do

not offer option adjustable-rate mortgage products, nor do

we offer variable-rate mortgage products with fixed payment

amounts, commonly referred to within the financial services

industry as negative amortizing mortgage loans.

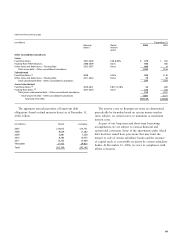

A summary of the major categories of loans outstanding is

shown in the following table. Outstanding loan balances

reflect unearned income, net deferred loan fees, and unamor-

tized discount and premium totaling $3,113 million and

$3,918 million at December 31, 2006 and 2005, respectively.

Loan concentrations may exist when there are amounts

loaned to borrowers engaged in similar activities or similar

types of loans extended to a diverse group of borrowers that

would cause them to be similarly impacted by economic or

other conditions. At December 31, 2006 and 2005, we did

not have concentrations representing 10% or more of our

total loan portfolio in commercial loans and lease financing

by industry or commercial real estate loans (other real estate

mortgage and real estate construction) by state or property

type. Our real estate 1-4 family mortgage loans

to borrowers in the state of California represented approxi-

mately 11% of total loans at December 31, 2006, compared

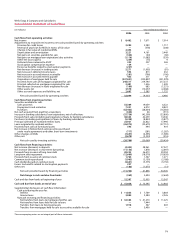

Note 6: Loans and Allowance for Credit Losses

(in millions) December 31,

2006 2005 2004 2003 2002

Commercial and commercial real estate:

Commercial $ 70,404 $ 61,552 $ 54,517 $ 48,729 $ 47,292

Other real estate mortgage 30,112 28,545 29,804 27,592 25,312

Real estate construction 15,935 13,406 9,025 8,209 7,804

Lease financing 5,614 5,400 5,169 4,477 4,085

Total commercial and commercial real estate 122,065 108,903 98,515 89,007 84,493

Consumer:

Real estate 1-4 family first mortgage 53,228 77,768 87,686 83,535 44,119

Real estate 1-4 family junior lien mortgage 68,926 59,143 52,190 36,629 28,147

Credit card 14,697 12,009 10,260 8,351 7,455

Other revolving credit and installment 53,534 47,462 34,725 33,100 26,353

Total consumer 190,385 196,382 184,861 161,615 106,074

Foreign 6,666 5,552 4,210 2,451 1,911

Total loans $319,116 $310,837 $287,586 $253,073 $192,478

For certain extensions of credit, we may require collateral,

based on our assessment of a customer’s credit risk. We hold

various types of collateral, including accounts receivable,

inventory, land, buildings, equipment, autos, financial instru-

ments, income-producing commercial properties and residen-

tial real estate. Collateral requirements for each customer

may vary according to the specific credit underwriting, terms

and structure of loans funded immediately or under a com-

mitment to fund at a later date.

A commitment to extend credit is a legally binding agree-

ment to lend funds to a customer, usually at a stated interest

rate and for a specified purpose. These commitments have

fixed expiration dates and generally require a fee. When we

make such a commitment, we have credit risk. The liquidity

requirements or credit risk will be lower than the contractual

amount of commitments to extend credit because a signifi-

cant portion of these commitments are expected to expire

without being used. Certain commitments are subject to loan

agreements with covenants regarding the financial perfor-

mance of the customer or borrowing base formulas that

must be met before we are required to fund the commitment.

We use the same credit policies in extending credit for

unfunded commitments and letters of credit that we use in

making loans. For information on standby letters of credit,

see Note 24.

In addition, we manage the potential risk in credit com-

mitments by limiting the total amount of arrangements, both

by individual customer and in total, by monitoring the size

and maturity structure of these portfolios and by applying

the same credit standards for all of our credit activities.