Wells Fargo 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Net charge-offs in 2006 were 0.73% of average total

loans, compared with 0.77% in 2005 and 0.62% in 2004.

Credit losses for auto loans increased $160 million in 2006

partially due to growth and seasoning, but largely due to

collection capacity constraints and restrictive payment exten-

sion practices that occurred when Wells Fargo Financial inte-

grated its prime and non-prime auto loan businesses during

2006. Net charge-offs in 2005 included the additional credit

losses from the change in bankruptcy laws and conforming

Wells Fargo Financial’s charge-off practices to FFIEC guide-

lines. A portion of these bankruptcy charge-offs represent an

acceleration of charge-offs that would have likely occurred in

2006. The increase in consumer bankruptcies in 2005 pri-

marily impacted our credit card, unsecured consumer loans

and lines, auto and small business portfolios.

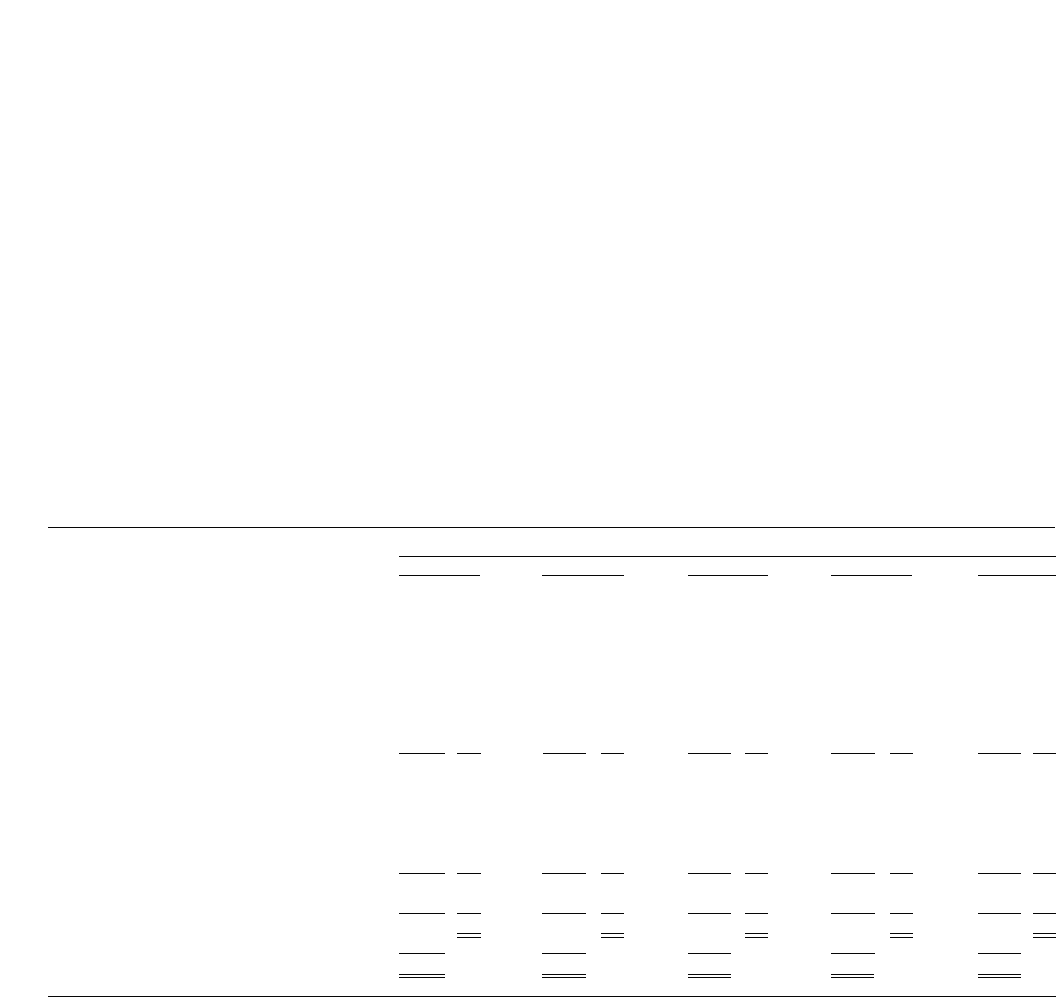

Table 17 presents the allocation of the allowance for credit

losses by type of loans. The decrease of $93 million in the

allowance for credit losses from year-end 2005 to year-end

2006 was primarily due to the release of remaining Katrina

reserves of $50 million previously discussed. Changes in the

allowance reflect changes in statistically derived loss esti-

mates, historical loss experience, current trends in borrower

risk and/or general economic activity on portfolio perfor-

mance, and management’s estimate for imprecision and

uncertainty. At December 31, 2006, the entire allowance

was assigned to individual portfolio types to better reflect

our view of risk in these portfolios. The allowance for credit

losses includes a combination of baseline loss estimates and a

range of imprecision or uncertainty specific to each portfolio

segment previously categorized as unallocated.

Table 17: Allocation of the Allowance for Credit Losses

(in millions) December 31,

2006 2005 2004 2003 2002

Loans Loans Loans Loans Loans

as % as %as %as %as %

of total of total of total of total of total

loans loans loans loans loans

Commercial and commercial real estate:

Commercial $1,051 22% $ 926 20% $ 940 19% $ 917 19% $ 865 24%

Other real estate mortgage 225 9 253 9 298 11 444 11 307 13

Real estate construction 109 5 115 4 46 3 63 3 53 4

Lease financing 40 2 51 2 30 2 40 2 75 2

Total commercial and commercial real estate 1,425 38 1,345 35 1,314 35 1,464 35 1,300 43

Consumer:

Real estate 1-4 family first mortgage 186 17 229 25 150 31 176 33 104 23

Real estate 1-4 family junior lien mortgage 168 21 118 19 104 18 92 15 62 15

Credit card 606 5 508 4 466 4 443 3 386 4

Other revolving credit and installment 1,434 17 1,060 15 889 11 802 13 597 14

Total consumer 2,394 60 1,915 63 1,609 64 1,513 64 1,149 56

Foreign 145 2 149 2 139 1 95 1 86 1

Total allocated 3,964 100% 3,409 100% 3,062 100% 3,072 100% 2,535 100%

Unallocated component of allowance (1) — 648 888 819 1,284

Total $3,964 $4,057 $3,950 $3,891 $3,819

(1) At December 31, 2006, we changed our estimate of the allocation of the allowance for credit losses. At December 31, 2006, the portion of the allowance assigned to

individual portfolio types includes an amount for imprecision or uncertainty to better reflect our view of risk in these portfolios. In prior years, this portion of the

allowance was associated with the portfolio as a whole, rather than with an individual portfolio type and was categorized as unallocated.

We consider the allowance for credit losses of $3.96 billion

adequate to cover credit losses inherent in the loan portfolio,

including unfunded credit commitments, at December 31, 2006.

Given that the majority of our loan portfolio is consumer

loans, for which losses tend to emerge within a relatively

short, predictable timeframe, and that a significant portion

of the allowance for credit losses relates to estimated credit

losses associated with consumer loans, management believes

that the provision for credit losses for consumer loans,

absent any significant credit event, will closely track the level

of related net charge-offs. The process for determining the

adequacy of the allowance for credit losses is critical to our

financial results. It requires difficult, subjective and complex

judgments, as a result of the need to make estimates about the

effect of matters that are uncertain. (See “Financial Review –

Critical Accounting Policies – Allowance for Credit Losses.”)

Therefore, we cannot provide assurance that, in any particular

period, we will not have sizeable credit losses in relation to

the amount reserved. We may need to significantly adjust the

allowance for credit losses, considering current factors at the

time, including economic or market conditions and ongoing

internal and external examination processes. Our process for

determining the adequacy of the allowance for credit losses

is discussed in “Financial Review – Critical Accounting

Policies – Allowance for Credit Losses” and Note 6 (Loans

and Allowance for Credit Losses) to Financial Statements.