Wells Fargo 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

takes for consumer behavior to fully react to interest rate

changes, as well as the time required for processing a new

application, providing the commitment, and securitizing and

selling the loan, interest rate changes will impact origination

and servicing fees with a lag. The amount and timing of the

impact on origination and servicing fees will depend on the

magnitude, speed and duration of the change in interest rates.

Under FAS 156, which we adopted January 1, 2006, we

have elected to use the fair value measurement method to

initially measure and carry our residential MSRs, which rep-

resent substantially all of our MSRs. Under this method, the

initial measurement of fair value of MSRs at the time we sell

or securitize mortgage loans is recorded as a component of

net gains on mortgage loan origination/sales activities. The

carrying value of MSRs reflects changes in fair value at the

end of each quarter and changes are included in net servicing

income, a component of mortgage banking noninterest

income. If the fair value of the MSRs increases, income is

recognized; if the fair value of the MSRs decreases, a loss is

recognized. We use a dynamic and sophisticated model to

estimate the fair value of our MSRs. While the valuation

of MSRs can be highly subjective and involve complex

judgments by management about matters that are inherently

unpredictable, changes in interest rates influence a variety

of assumptions included in the periodic valuation of MSRs.

Assumptions affected include prepayment speed, expected

returns and potential risks on the servicing asset portfolio,

the value of escrow balances and other servicing valuation

elements impacted by interest rates.

A decline in interest rates increases the propensity for

refinancing, reduces the expected duration of the servicing

portfolio and therefore reduces the estimated fair value of

MSRs. This reduction in fair value causes a charge to income

(net of any gains on free-standing derivatives (economic

hedges) used to hedge MSRs). We may choose to not fully

hedge all of the potential decline in the value of our MSRs

resulting from a decline in interest rates because the potential

increase in origination/servicing fees in that scenario provides

a partial “natural business hedge.” In a rising rate period,

when the MSRs may not be fully hedged with free-standing

derivatives, the change in the fair value of the MSRs that

can be recaptured into income will typically—although not

always—exceed the losses on any free-standing derivatives

hedging the MSRs. In 2006, the decrease in the fair value of

our MSRs and losses on free-standing derivatives used to

hedge the MSRs totaled $154 million.

Hedging the various sources of interest rate risk in mort-

gage banking is a complex process that requires sophisticated

modeling and constant monitoring. While we attempt to

balance these various aspects of the mortgage business, there

are several potential risks to earnings:

• MSRs valuation changes associated with interest rate

changes are recorded in earnings immediately within

the accounting period in which those interest rate

changes occur, whereas the impact of those same

changes in interest rates on origination and servicing

fees occur with a lag and over time. Thus, the mortgage

business could be protected from adverse changes in

interest rates over a period of time on a cumulative

basis but still display large variations in income from

one accounting period to the next.

• The degree to which the “natural business hedge” off-

sets changes in MSRs valuations is imperfect, varies at

different points in the interest rate cycle, and depends

not just on the direction of interest rates but on the

pattern of quarterly interest rate changes.

• Origination volumes, the valuation of MSRs and hedging

results and associated costs are also impacted by many

factors. Such factors include the mix of new business

between ARMs and fixed-rated mortgages, the relation-

ship between short-term and long-term interest rates,

the degree of volatility in interest rates, the relationship

between mortgage interest rates and other interest rate

markets, and other interest rate factors. Many of these

factors are hard to predict and we may not be able to

directly or perfectly hedge their effect.

• While our hedging activities are designed to balance

our mortgage banking interest rate risks, the financial

instruments we use may not perfectly correlate with the

values and income being hedged. For example, the change

in the value of ARMs production held for sale from

changes in mortgage interest rates may or may not be

fully offset by Treasury and LIBOR index-based financial

instruments used as economic hedges for such ARMs.

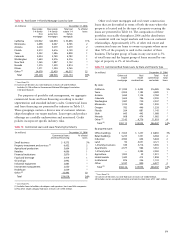

The total carrying value of our residential and commer-

cial MSRs was $18.0 billion at December 31, 2006, and

$12.5 billion, net of a valuation allowance of $1.2 billion, at

December 31, 2005. The weighted-average note rate on the

owned servicing portfolio was 5.92% at December 31, 2006,

and 5.72% at December 31, 2005. Our total MSRs were

1.41% of mortgage loans serviced for others at December

31, 2006, compared with 1.44% at December 31, 2005.

As part of our mortgage banking activities, we enter into

commitments to fund residential mortgage loans at specified

times in the future. A mortgage loan commitment is an interest

rate lock that binds us to lend funds to a potential borrower

at a specified interest rate and within a specified period of

time, generally up to 60 days after inception of the rate lock.

These loan commitments are derivative loan commitments if

the loans that will result from the exercise of the commitments

will be held for sale. Under FAS 133, Accounting for Derivative

Instruments and Hedging Activities (as amended), these

derivative loan commitments are recognized at fair value in

the balance sheet with changes in their fair values recorded

as part of mortgage banking noninterest income. Consistent

with SEC Staff Accounting Bulletin No. 105, Application of

Accounting Principles to Loan Commitments, we record no

value for the loan commitment at inception. Subsequent to

inception, we recognize the fair value of the derivative loan

commitment based on estimated changes in the fair value of

the underlying loan that would result from the exercise of

that commitment and on changes in the probability that

the loan will not fund within the terms of the commitment

(referred to as a fall-out factor). The value of that loan is