Wells Fargo 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

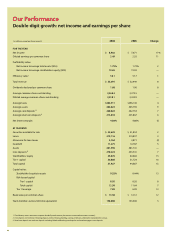

Among Our Achievements:

• Diluted earnings per share, a record $2.49, up 11 percent.

• Net income, a record $8.5 billion, up 11 percent.

• Revenue, a record $35.7 billion—the most important measure

of success in our industry—rose 8 percent, up 12 percent in

businesses other than Wells Fargo Home Mortgage.

• The quarterly cash dividend on our common stock increased

almost 8 percent to 28 cents a share—the 19th consecutive

year our dividend has increased and 13th-largest dividend

payout of any U.S. public company. Since 1989, our dividend

has increased at a compound annual growth rate of 15 percent.

• Return on equity—19.65 percent (after-tax profit for every

shareholder dollar)—and return on assets of 1.75 percent

(after-tax profit for every $100 of assets).

• Our stock split two for one—our company’s eighth stock

split in 47 years.

• Our stock price reached a record-high close of $36.81 on

October 18, 2006.

• Total return on our stock this year, including reinvested

dividends, was 17 percent, exceeding the S&P 500®—

and the total market value of our company rose 14 percent

to $120 billion.

Again this year, our talented team—158,000 strong and pulling

together for our customers—achieved outstanding results, among

the best not just in financial services but all industries.

To Our Owners,

Richard M. Kovacevich, Chairman and CEO (right);

John G. Stumpf, President and COO