Wells Fargo 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Beginning on page 10 of this report, we tell the stories of

11 of our customers. Each came to us with an everyday financial

problem or need all of us are familiar with—how to qualify for

a home equity loan, what to do when your checking account is

overdrawn through no fault of your own, or how to manage

personal finances after the death of a spouse. They did not see

themselves as coming to our bank, our mortgage company, our

website, our investment businesses, our consumer finance

company or our insurance business. They came to Wells Fargo,

period, because that’s the way they see us. In many of these

situations a Wells Fargo team member took personal responsibility

to make sure that our businesses—collaborating together

(sometimes dozens or hundreds of our team members behind the

curtain)—satisfied the customer’s financial need smoothly and

simply. In most of these situations, we not only satisfied that

need but earned even more of that customer’s business.

Diversified. Nationwide. And Growing!

Despite the challenges and uncertainty ahead for our economy

and our industry in 2007, we’re as optimistic, as ever, about our

ability to satisfy all our customers’ financial needs and help them

succeed financially. We have one vision. We’ve made steady,

measurable progress toward it for more than 20 years. We have

an effective, time-tested business model. We have great people.

We have a very strong, well-understood culture. We have one

of the broadest, most extensive product lines in our industry.

We’re also in the fastest-growing markets in the United States,

the world’s most dynamic, prosperous national economy.

One of our best-kept secrets is our recent growth in the

eastern United States. Almost half our Wells Fargo Home

Mortgage and Wells Fargo Financial stores in the United States

are in states outside our Community Banking states, and almost

one of every five of our Wholesale Banking offices is east of

the Mississippi. In Florida, for example, we have 133 stores

(mortgage, consumer finance and commercial banking), and

we’re one of its 40 largest private employers. We have 51 stores

in Maryland, headquarters for our national Corporate Trust

business, and we’re one of that state’s 50 largest private employers.

In Pennsylvania, we employ almost 2,000 team members,

have 55 stores, and it’s national headquarters for our Auto

Finance business.

We have no compelling need for a retail banking presence in

the eastern United States. That’s because we have such tremendous

untapped opportunity for more market share growth in our

community banking states in the Midwest, the Southwest,

the Rockies, the West and the Pacific Northwest. We estimate

we have only about 3 percent market share of total household

financial assets in those states. Consider the approximate

population growth rates of just nine of our fastest-growing

Community Banking states:

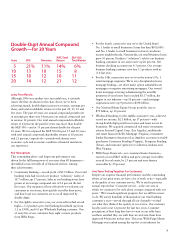

More Growth Ahead

2000–2005 2005–2025

Population Growth Projected*

Nevada +17.7% +64.2%

Arizona +14.4 +62.4

Texas + 9.2 +35.5

Idaho + 8.7 +31.7

Utah + 8.3 +33.4

Colorado + 7.4 +19.6

California + 6.4 +22.9

Washington + 5.3 +28.9

Oregon + 5.1 +26.1

United States + 5.0 +18.3

We must help our team members

serve our customers faster and

more easily so that every

customer interaction is simple,

obvious and intuitive.

* Sources:

www.census.gov/population/projections/PressTab6.xls

www.infoplease.com/ipa/A0763098.html