Wells Fargo 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Other real estate mortgages and real estate construction

loans that are diversified in terms of both the state where the

property is located and by the type of property securing the

loans are presented in Table 14. The composition of these

portfolios was stable throughout 2006 and the distribution

is consistent with our target markets and focus on customer

relationships. Approximately 25% of other real estate and

construction loans are loans to owner-occupants where more

than 50% of the property is used in the conduct of their

business. The largest group of loans in any one state is 5%

of total loans and the largest group of loans secured by one

type of property is 3% of total loans.

For purposes of portfolio risk management, we aggregate

commercial loans and lease financing according to market

segmentation and standard industry codes. Commercial loans

and lease financing are presented by industry in Table 13.

These groupings contain a diverse mix of customer relation-

ships throughout our target markets. Loan types and product

offerings are carefully underwritten and monitored. Credit

policies incorporate specific industry risks.

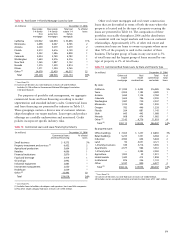

Table 13: Commercial Loans and Lease Financing by Industry

(in millions) December 31, 2006

Commercial loans % of total

and lease financing loans

Small business $ 9,575 3%

Property investment and services (1) 6,452 2

Agricultural production 5,604 2

Retailers 4,696 1

Financial institutions 3,870 1

Food and beverage 3,414 1

Oil and gas 2,992 *

Industrial equipment 2,883 *

Investment management 2,050 *

Healthcare 2,039 *

Other (2) 32,443 10

Total $76,018 24%

* Less than 1%.

(1) Includes loans to builders, developers and operators, trusts and title companies.

(2) No other single category had loans in excess of $1,943 million.

Table 12: Real Estate 1-4 Family Mortgage Loans by State

(in millions) December 31, 2006

Real estate Real estate Total real % of total

1-4 family 1-4 family estate 1-4 loans

first junior lien family

mortgage mortgage mortgage

California $10,902 $24,994 $ 35,896 11%

Minnesota 2,698 4,067 6,765 2

Arizona 2,200 3,079 5,279 2

Florida 2,513 2,616 5,129 2

Texas 3,252 1,586 4,838 1

Colorado 2,034 2,749 4,783 1

Washington 1,640 2,576 4,216 1

New York 1,265 1,887 3,152 *

Nevada 1,275 1,539 2,814 *

Illinois 1,371 1,394 2,765 *

Other (1) 24,078 22,439 46,517 15

Total $53,228 $68,926 $122,154 38%

* Less than 1%.

(1) Consists of 40 states; no state had loans in excess of $2,676 million.

Includes $4,156 million in Government National Mortgage Association

early pool buyouts.

Table 14: Commercial Real Estate Loans by State and Property Type

(in millions) December 31, 2006

Other real Real Total % of

estate estate commercial total

mortgage construction real estate loans

By state:

California $11,590 $ 4,495 $16,085 5%

Texas 2,904 1,185 4,089 1

Arizona 1,650 1,134 2,784 *

Colorado 1,604 786 2,390 *

Washington 1,587 720 2,307 *

Minnesota 1,335 595 1,930 *

Oregon 782 446 1,228 *

Florida 264 881 1,145 *

Utah 645 443 1,088 *

Nevada 608 474 1,082 *

Other (1) 7,143 4,776 11,919 4

Total (2) $30,112 $15,935 $46,047 14%

By property type:

Office buildings $ 7,655 $ 1,237 $ 8,892 3%

Retail buildings 5,233 1,351 6,584 2

Industrial 4,960 644 5,604 2

Land 90 4,031 4,121 1

1-4 family structures 189 3,716 3,905 1

Apartments 2,577 984 3,561 1

1-4 family land — 2,382 2,382 *

Agriculture 1,902 29 1,931 *

Hotels/motels 1,443 415 1,858 *

Institutional 876 256 1,132 *

Other 5,187 890 6,077 2

Total (2) $30,112 $15,935 $46,047 14%

* Less than 1%.

(1) Consists of 40 states; no state had loans in excess of $1,002 million.

(2) Includes owner-occupied real estate and construction loans of $11,661 million.