Wells Fargo 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

would have been classified as an operating cash inflow if

we had not adopted FAS 123(R).

Pro forma net income and earnings per common share

information are provided in the following table as if we

accounted for employee stock option plans under the fair

value method of FAS 123 in 2005 and 2004.

Stock options granted in each of our February 2005

and February 2004 annual grants, under our Long-Term

Incentive Compensation Plan (the Plan), fully vested upon

grant, resulting in full recognition of stock-based compensation

expense for both grants in the year of the grant under the

fair value method in the table above. Stock options granted

in our 2003 and 2002 annual grants under the Plan vest over

a three-year period, and expense reflected in the table for

these grants is recognized over the vesting period.

Earnings Per Common Share

We present earnings per common share and diluted earnings

per common share. We compute earnings per common share

by dividing net income (after deducting dividends on preferred

stock) by the average number of common shares outstanding

during the year. We compute diluted earnings per common

share by dividing net income (after deducting dividends on

preferred stock) by the average number of common shares

outstanding during the year, plus the effect of common stock

equivalents (for example, stock options, restricted share

rights and convertible debentures) that are dilutive.

Derivatives and Hedging Activities

We recognize all derivatives in the balance sheet at fair value.

On the date we enter into a derivative contract, we designate

the derivative as (1) a hedge of the fair value of

a recognized asset or liability, including hedges of foreign

currency exposure, (“fair value” hedge), (2) a hedge of a

forecasted transaction or of the variability of cash flows to

be received or paid related to a recognized asset or liability

(“cash flow” hedge) or (3) held for trading, customer

accommodation or asset/liability risk management purposes,

including economic hedges not qualifying under FAS 133,

Accounting for Derivative Instruments and Hedging Activities

(“free-standing derivative”). For a fair value hedge, we record

changes in the fair value of the derivative and, to the extent

that it is effective, changes in the fair value of the hedged

asset or liability attributable to the hedged risk, in current

period earnings in the same financial statement category as

the hedged item. For a cash flow hedge, we record changes

in the fair value of the derivative to the extent that it is

effective in other comprehensive income. We subsequently

reclassify these changes in fair value to net income in the

same period(s) that the hedged transaction affects net income

in the same financial statement category as the hedged item.

For free-standing derivatives, we report changes in the fair

values in current period noninterest income.

For fair value and cash flow hedges qualifying under FAS

133, we formally document at inception the relationship

between hedging instruments and hedged items, our risk

management objective, strategy and our evaluation of effec-

tiveness for our hedge transactions. This includes linking all

derivatives designated as fair value or cash flow hedges to

specific assets and liabilities in the balance sheet or to specific

forecasted transactions. Periodically, as required, we also

formally assess whether the derivative we designated in each

hedging relationship is expected to be and has been highly

effective in offsetting changes in fair values or cash flows of

the hedged item using the regression analysis method or, in

some cases, the dollar offset method.

We discontinue hedge accounting prospectively when

(1) a derivative is no longer highly effective in offsetting

changes in the fair value or cash flows of a hedged item,

(2) a derivative expires or is sold, terminated, or exercised,

(3) a derivative is dedesignated as a hedge, because it is

unlikely that a forecasted transaction will occur, or (4) we

determine that designation of a derivative as a hedge is no

longer appropriate.

When we discontinue hedge accounting because a deriva-

tive no longer qualifies as an effective fair value hedge, we

continue to carry the derivative in the balance sheet at its

fair value with changes in fair value included in earnings,

and no longer adjust the previously hedged asset or liability

for changes in fair value. Previous adjustments to the hedged

item are accounted for in the same manner as other compo-

nents of the carrying amount of the asset or liability.

When we discontinue cash flow hedge accounting because

the hedging instrument is sold, terminated, or no longer

designated (dedesignated), the amount reported in other

comprehensive income up to the date of sale, termination or

dedesignation continues to be reported in other comprehensive

income until the forecasted transaction affects earnings.

When we discontinue cash flow hedge accounting because

it is probable that a forecasted transaction will not occur, we

continue to carry the derivative in the balance sheet at its fair

value with changes in fair value included in earnings, and

immediately recognize gains and losses that were accumulated

in other comprehensive income in earnings.

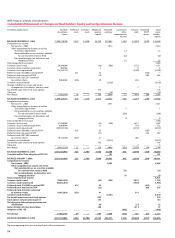

(in millions, except per Year ended December 31,

share amounts) 2005 2004

Net income, as reported $7,671 $7,014

Add: Stock-based employee compensation

expense included in reported net

income, net of tax 1 2

Less:Total stock-based employee

compensation expense under the

fair value method for all awards,

net of tax (188) (275)

Net income, pro forma $7,484 $6,741

Earnings per common share

As reported $ 2.27 $ 2.07

Pro forma 2.22 1.99

Diluted earnings per common share

As reported $ 2.25 $ 2.05

Pro forma 2.19 1.97