Wells Fargo 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

Note 23: Legal Actions

In the normal course of business, we are subject to pending

and threatened legal actions, some for which the relief or

damages sought are substantial. After reviewing pending

and threatened actions with counsel, and any specific

reserves established for such matters, management believes

that the outcome of such actions will not have a material

adverse effect on the results of operations or stockholders’

equity. We are not able to predict whether the outcome of

such actions may or may not have a material adverse effect

on results of operations in a particular future period as the

timing and amount of any resolution of such actions and its

relationship to the future results of operations are not known.

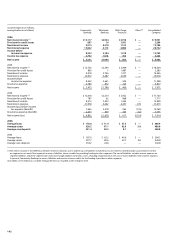

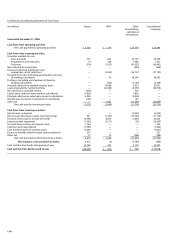

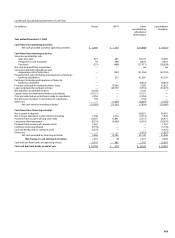

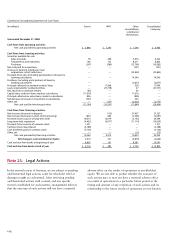

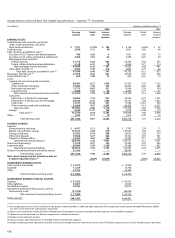

Condensed Consolidating Statement of Cash Flows

(in millions) Parent WFFI Other Consolidated

consolidating Company

subsidiaries/

eliminations

Year ended December 31, 2004

Cash flows from operating activities:

Net cash provided by operating activities $ 3,848 $1,297 $1,340 $ 6,485

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 78 268 5,976 6,322

Prepayments and maturities 160 152 8,511 8,823

Purchases (207) (580) (15,796) (16,583)

Net cash paid for acquisitions — — (331) (331)

Increase in banking subsidiaries’ loan

originations, net of collections — — (33,800) (33,800)

Proceeds from sales (including participations) of loans by

banking subsidiaries — — 14,540 14,540

Purchases (including participations) of loans by

banking subsidiaries — — (5,877) (5,877)

Principal collected on nonbank entities’loans — 17,668 328 17,996

Loans originated by nonbank entities — (27,778) 27 (27,751)

Net advances to nonbank entities (92) — 92 —

Capital notes and term loans made to subsidiaries (11,676) — 11,676 —

Principal collected on notes/loans made to subsidiaries 896 — (896) —

Net decrease (increase) in investment in subsidiaries (353) — 353 —

Other, net — (121) (2,652) (2,773)

Net cash used by investing activities (11,194) (10,391) (17,849) (39,434)

Cash flows from financing activities:

Net increase (decrease) in deposits — (110) 27,437 27,327

Net increase (decrease) in short-term borrowings (831) 683 (2,549) (2,697)

Proceeds from issuance of long-term debt 19,610 12,919 (3,135) 29,394

Long-term debt repayment (4,452) (4,077) (11,110) (19,639)

Proceeds from issuance of common stock 1,271 — — 1,271

Common stock repurchased (2,188) — — (2,188)

Cash dividends paid on common stock (3,150) — — (3,150)

Other, net — — (13)(13)

Net cash provided by financing activities 10,260 9,415 10,630 30,305

Net change in cash and due from banks 2,914 321 (5,879) (2,644)

Cash and due from banks at beginning of year 6,805 161 8,581 15,547

Cash and due from banks at end of year $ 9,719 $ 482 $ 2,702 $ 12,903