Wells Fargo 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

affected primarily by changes in interest rates and the passage

of time. The value of the MSRs is recognized only after the

servicing asset has been contractually separated from the

underlying loan by sale or securitization.

Outstanding derivative loan commitments expose us to

the risk that the price of the loans underlying the commit-

ments might decline due to increases in mortgage interest

rates from inception of the rate lock to the funding of the

loan. To minimize this risk, we utilize Treasury futures, for-

wards and options, Eurodollar futures and forward contracts

as economic hedges against the potential decreases in the

values of the loans that could result from the exercise of the

loan commitments. We expect that these derivative financial

instruments will experience changes in fair value that will

either fully or partially offset the changes in fair value of the

derivative loan commitments.

MARKET RISK – TRADING ACTIVITIES

From a market risk perspective, our net income is exposed

to changes in interest rates, credit spreads, foreign exchange

rates, equity and commodity prices and their implied volatili-

ties. The primary purpose of our trading businesses is to

accommodate customers in the management of their market

price risks. Also, we take positions based on market expecta-

tions or to benefit from price differences between financial

instruments and markets, subject to risk limits established

and monitored by Corporate ALCO. All securities, foreign

exchange transactions, commodity transactions and deriva-

tives—transacted with customers or used to hedge capital

market transactions with customers—are carried at fair

value. The Institutional Risk Committee establishes and

monitors counterparty risk limits. The notional or contractual

amount, credit risk amount and estimated net fair value

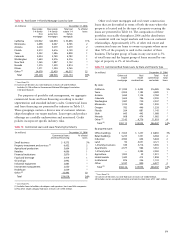

of all customer accommodation derivatives at December 31,

2006 and 2005, are included in Note 26 (Derivatives) to

Financial Statements. Open, “at risk” positions for all trading

business are monitored by Corporate ALCO.

The standardized approach for monitoring and reporting

market risk for the trading activities is the value-at-risk (VAR)

metrics complemented with factor analysis and stress testing.

VAR measures the worst expected loss over a given time

interval and within a given confidence interval. We measure

and report daily VAR at 99% confidence interval based on

actual changes in rates and prices over the past 250 days.

The analysis captures all financial instruments that are

considered trading positions. The average one-day VAR

throughout 2006 was $15 million, with a lower bound of

$10 million and an upper bound of $35 million.

MARKET RISK – EQUITY MARKETS

We are directly and indirectly affected by changes in the

equity markets. We make and manage direct equity invest-

ments in start-up businesses, emerging growth companies,

management buy-outs, acquisitions and corporate recapital-

izations. We also invest in non-affiliated funds that make

similar private equity investments. These private equity

investments are made within capital allocations approved by

management and the Board of Directors (the Board). The

Board reviews business developments, key risks and historical

returns for the private equity investments at least annually.

Management reviews these investments at least quarterly and

assesses them for possible other-than-temporary impairment.

For nonmarketable investments, the analysis is based on facts

and circumstances of each investment and the expectations for

that investment’s cash flows and capital needs, the viability

of its business model and our exit strategy. Private equity

investments totaled $1.67 billion at December 31, 2006,

and $1.54 billion at December 31, 2005.

We also have marketable equity securities in the available

for sale investment portfolio, including securities relating to

our venture capital activities. We manage these investments

within capital risk limits approved by management and the

Board and monitored by Corporate ALCO. Gains and losses

on these securities are recognized in net income when realized

and other-than-temporary impairment may be periodically

recorded when identified. The initial indicator of impairment

for marketable equity securities is a sustained decline in

market price below the amount recorded for that investment.

We consider a variety of factors, such as: the length of time

and the extent to which the market value has been less than

cost; the issuer’s financial condition, capital strength, and

near-term prospects; any recent events specific to that issuer

and economic conditions of its industry; and our investment

horizon in relationship to an anticipated near-term recovery

in the stock price, if any. The fair value of marketable equity

securities was $796 million and cost was $592 million at

December 31, 2006, and $900 million and $558 million,

respectively, at December 31, 2005.

Changes in equity market prices may also indirectly affect

our net income (1) by affecting the value of third party assets

under management and, hence, fee income, (2) by affecting

particular borrowers, whose ability to repay principal and/or

interest may be affected by the stock market, or (3) by affecting

brokerage activity, related commission income and other

business activities. Each business line monitors and manages

these indirect risks.

LIQUIDITY AND FUNDING

The objective of effective liquidity management is to ensure

that we can meet customer loan requests, customer deposit

maturities/withdrawals and other cash commitments effi-

ciently under both normal operating conditions and under

unpredictable circumstances of industry or market stress.

To achieve this objective, Corporate ALCO establishes and

monitors liquidity guidelines that require sufficient asset-

based liquidity to cover potential funding requirements and

to avoid over-dependence on volatile, less reliable funding

markets. We set these guidelines for both the consolidated

balance sheet and for the Parent to ensure that the Parent

is a source of strength for its regulated, deposit-taking

banking subsidiaries.

Debt securities in the securities available for sale portfolio

provide asset liquidity, in addition to the immediately liquid

resources of cash and due from banks and federal funds

sold, securities purchased under resale agreements and other

short-term investments. The weighted-average expected