Wells Fargo 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

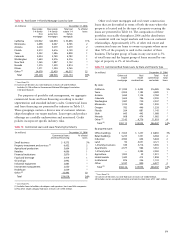

59

WELLS FARGO FINANCIAL. In January 2006, Wells Fargo

Financial Canada Corporation (WFFCC), a wholly-owned

Canadian subsidiary of Wells Fargo Financial, Inc. (WFFI),

qualified for distribution with the provincial securities

exchanges in Canada $7.0 billion (Canadian) of issuance

authority. During 2006, WFFCC issued $1.6 billion

(Canadian) in senior notes. At December 31, 2006, the

remaining issuance capacity for WFFCC was $5.4 billion

(Canadian). WFFI also issued $450 million (U.S.) in private

placements in 2006.

Comparison of 2005 with 2004

Net income in 2005 increased 9% to a record $7.67 billion

from $7.01 billion in 2004. Diluted earnings per common

share increased 10% to a record $2.25 in 2005 from $2.05

in 2004. Our earnings growth in 2005 from 2004 was broad

based, with nearly every consumer and commercial business

line achieving double-digit profit growth, including regional

banking, wealth management, corporate trust, business

direct, asset-based lending, student lending, consumer credit,

commercial real estate and international trade services. Both

Capital Management

We have an active program for managing stockholder capital.

We use capital to fund organic growth, acquire banks and

other financial services companies, pay dividends and repur-

chase our shares. Our objective is to produce above-market

long-term returns by opportunistically using capital when

returns are perceived to be high and issuing/accumulating

capital when such costs are perceived to be low.

From time to time the Board authorizes the Company

to repurchase shares of our common stock. Although we

announce when the Board authorizes share repurchases, we

typically do not give any public notice before we repurchase

our shares. Various factors determine the amount and timing

of our share repurchases, including our capital requirements,

the number of shares we expect to issue for acquisitions and

employee benefit plans, market conditions (including the

trading price of our stock), and legal considerations. These

factors can change at any time, and there can be no assur-

ance as to the number of shares we will repurchase or when

we will repurchase them.

Historically, our policy has been to repurchase shares

under the “safe harbor” conditions of Rule 10b-18 of the

Exchange Act including a limitation on the daily volume of

repurchases. Rule 10b-18 imposes an additional daily volume

limitation on share repurchases during a pending merger or

acquisition in which shares of our stock will constitute some or

all of the consideration. Our management may determine that

during a pending stock merger or acquisition when the safe

harbor would otherwise be available, it is in our best interest

to repurchase shares in excess of this additional daily volume

limitation. In such cases, we intend to repurchase shares in

compliance with the other conditions of the safe harbor,

including the standing daily volume limitation that applies

whether or not there is a pending stock merger or acquisition.

In 2005, the Board authorized the repurchase of up to

150 million additional shares of our outstanding common

stock. In June 2006, the Board authorized the repurchase of

up to 50 million additional shares of our outstanding common

stock. During 2006, we repurchased 59 million shares of our

common stock. At December 31, 2006, the total remaining

common stock repurchase authority was 62 million shares.

On June 27, 2006, the Board declared a two-for-one

stock split in the form of a 100% stock dividend on our

common stock which was distributed August 11, 2006, to

stockholders of record at the close of business August 4, 2006.

We distributed one share of common stock for each share of

common stock issued and outstanding or held in the treasury

of the Company. Also, in June 2006, the Board declared an

increase in the quarterly common stock dividend to 56 cents

per share, up 4 cents, or 8%. The cash dividend was on a

pre-split basis and was payable September 1, 2006, to stock-

holders of record at the close of business August 4, 2006.

Our potential sources of capital include retained earnings

and issuances of common and preferred stock. In 2006, retained

earnings increased $4.7 billion, predominantly as a result

of net income of $8.5 billion less dividends of $3.6 billion.

In 2006, we issued $2.1 billion of common stock (including

shares issued for our ESOP plan) under various employee

benefit and director plans and under our dividend reinvest-

ment and direct stock purchase programs.

The Company and each of our subsidiary banks are

subject to various regulatory capital adequacy requirements

administered by the Federal Reserve Board and the OCC.

Risk-based capital guidelines establish a risk-adjusted ratio

relating capital to different categories of assets and off-balance

sheet exposures. At December 31, 2006, the Company and

each of our covered subsidiary banks were “well capitalized”

under applicable regulatory capital adequacy guidelines. See

Note 25 (Regulatory and Agency Capital Requirements) to

Financial Statements for additional information.

net interest income and noninterest income for 2005 grew

solidly from 2004 and virtually all of our fee-based products

had double-digit revenue growth. We took significant actions

to reposition our balance sheet in 2005 designed to improve

yields on earning assets, including the sale of $48 billion of

our lowest-yielding ARMs, resulting in $119 million of sales-

related losses, and the sale of $17 billion of debt securities,

including low-yielding fixed-income securities, resulting in

$120 million of losses.