Wells Fargo 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Wells Fargo & Company is a $482 billion diversified financial

services company providing banking, insurance, investments,

mortgage banking and consumer finance through banking stores,

the internet and other distribution channels to consumers,

businesses and institutions in all 50 states of the U.S. and in

other countries. We ranked fifth in assets and fourth in market

value of our common stock among U.S. bank holding companies

at December 31, 2006. When we refer to “the Company,”

“we,” “our” or “us” in this Report, we mean Wells Fargo &

Company and Subsidiaries (consolidated). When we refer to

“the Parent,” we mean Wells Fargo & Company.

We had another exceptional year in 2006, with record

diluted earnings per share of $2.49, record net income of

$8.5 billion, both up 11%, and exceptional, broad-based

performance across our more than 80 businesses. All com-

mon share and per share disclosures in this Report reflect the

two-for-one stock split in the form of a 100% stock dividend

distributed August 11, 2006.

Over the past twenty years, our annual compound growth

rate in earnings per share was 14% and our annual compound

growth rate in revenue was 12%. Our total annual compound

stockholder return of 14% the past five years was more than

double the S&P 500®—and at 15% almost double for the

past ten years. We far out-paced the S&P 500 the past 15 and

20 years with total annual compound shareholder returns

of 18% and 21%, respectively—periods with almost every

economic cycle and economic condition a financial institution

can experience. Our primary strategy, consistent for 20 years,

is to satisfy all our customers’ financial needs, help them

succeed financially and, through cross-selling, gain market

share, wallet share and earn 100% of their business.

Our growth in earnings per share was driven by revenue

growth. Our primary sources of earnings are lending and

deposit taking activities, which generate net interest income,

and providing financial services that generate fee income.

Revenue grew 8% to a record $35.7 billion from

$32.9 billion in 2005. The breadth and depth of our business

model resulted in very strong and balanced growth across

product sources (net interest income up 8%, noninterest

income up 9%) and across businesses (double-digit revenue

and/or profit growth in regional banking, business direct,

wealth management, credit and debit card, corporate trust,

commercial banking, asset-based lending, asset management,

real estate brokerage, insurance, international, commercial

real estate, corporate banking and specialized financial services).

We have stated in the past that to consistently grow over

the long term, successful companies must invest in their core

businesses and in maintaining strong balance sheets. We con-

tinued to make investments in 2006 by opening 109 regional

banking stores. We grew our sales and service force by adding

4,497 team members (full-time equivalents) in 2006, including

1,914 retail platform bankers. We continued to be #1 in many

categories of financial services nationally, including retail

mortgage originations, home equity lending, small business

lending, agricultural lending, internet banking, and provider of

financial services to middle-market companies in the western U.S.

Our solid financial performance enables us to be one of

the top givers to non-profits among all U.S. companies.

Wells Fargo Bank, N.A. continued to be rated as “Aaa,” the

highest possible credit rating issued by Moody’s Investors

Service, and was upgraded in February 2007 to “AAA,” the

highest possible credit rating issued by Standard & Poor’s

Ratings Services. Of the more than 1,100 financial institutions

and 70 national banking systems covered by S&P globally,

this upgrade makes our bank one of only two banks world-

wide to have S&P’s “AAA” credit rating. Our bank is now

the only U.S. bank to have the highest possible credit rating

from both Moody’s and S&P.

Our vision is to satisfy all our customers’ financial needs,

help them succeed financially, be recognized as the premier

financial services company in our markets and be one of

America’s great companies. Our primary strategy to achieve

this vision is to increase the number of products our customers

buy from us and to give them all the financial products that

fulfill their needs. Our cross-sell strategy and diversified

business model facilitate growth in strong and weak economic

cycles, as we can grow by expanding the number of products

Overview

This Annual Report, including the Financial Review and the Financial Statements and related Notes, has forward-looking

statements, which may include forecasts of our financial results and condition, expectations for our operations and business,

and our assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results might

differ significantly from our forecasts and expectations due to several factors. Please refer to the “Risk Factors” section of this

Report for a discussion of some of the factors that may cause results to differ.

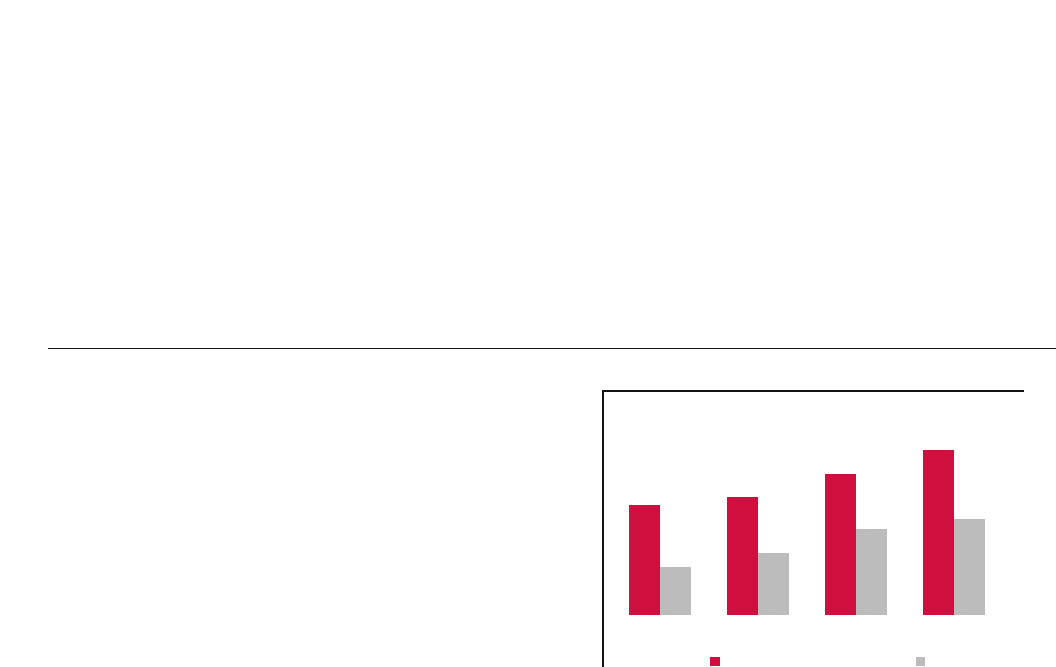

14%

6

15

12

18

11

10 15 20

5 years

(percent) Wells Fargo Common Stock S&P 500

LONG-TERM PERFORMANCE – TOTAL COMPOUND ANNUAL

STOCKHOLDER RETURN (Including reinvestment of dividends)

21

8

Financial Review