Wells Fargo 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

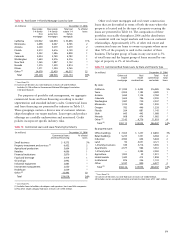

Table 4: Analysis of Changes in Net Interest Income

(in millions) Year ended December 31,

2006 over 2005 2005 over 2004

Volume Rate Total Volume Rate Total

Increase (decrease) in interest income:

Federal funds sold, securities purchased under resale

agreements and other short-term investments $ 2 $ 99 $ 101 $ 22 $ 78 $ 100

Trading assets (17) 72 55 34245

Debt securities available for sale:

Securities of U.S. Treasury and federal agencies (5) 6 1 (6) (2) (8)

Securities of U.S. states and political subdivisions (13) (8) (21) (9) 8 (1)

Mortgage-backed securities:

Federal agencies 1,040 4 1,044 (84) (2) (86)

Private collateralized mortgage obligations 93 54 147 86 17 103

Other debt securities 173 — 173 45 (15) 30

Mortgages held for sale 230 303 533 378 98 476

Loans held for sale (146) 47 (99) (240) 94 (146)

Loans:

Commercial and commercial real estate:

Commercial 529 860 1,389 570 533 1,103

Other real estate mortgage 16 296 312 21 280 301

Real estate construction 278 157 435 142 135 277

Lease financing 12 (10) 2 10 (17) (7)

Consumer:

Real estate 1-4 family first mortgage (1,441) 607 (834) (555) 799 244

Real estate 1-4 family junior lien mortgage 620 827 1,447 658 721 1,379

Credit card 247 108 355 218 49 267

Other revolving credit and installment 730 365 1,095 844 (72) 772

Foreign 205 (55) 150 212 (63) 149

Other (10) 10 — (5) 8 3

Total increase in interest income 2,543 3,742 6,285 2,310 2,691 5,001

Increase (decrease) in interest expense:

Deposits:

Interest-bearing checking 12 60 72 33538

Market rate and other savings 75 1,276 1,351 52 984 1,036

Savings certificates 337 273 610 96 135 231

Other time deposits 167 530 697 (32) 515 483

Deposits in foreign offices 376 220 596 45 188 233

Short-term borrowings (88) 336 248 (30) 421 391

Long-term debt 186 1,072 1,258 305 924 1,229

Total increase in interest expense 1,065 3,767 4,832 439 3,202 3,641

Increase (decrease) in net interest income

on a taxable-equivalent basis $ 1,478 $ (25) $1,453 $1,871 $ (511) $1,360

Table 4 allocates the changes in net interest income on

a taxable-equivalent basis to changes in either average

balances or average rates for both interest-earning assets

and interest-bearing liabilities. Because of the numerous

simultaneous volume and rate changes during any period,

it is not possible to precisely allocate such changes between

volume and rate. For this table, changes that are not solely

due to either volume or rate are allocated to these categories

in proportion to the percentage changes in average volume

and average rate.

Noninterest Income

We earn trust, investment and IRA fees from managing and

administering assets, including mutual funds, corporate trust,

personal trust, employee benefit trust and agency assets. At

December 31, 2006, these assets totaled $983 billion, up 26%

from $783 billion at December 31, 2005. Generally, trust,

investment and IRA fees are based on the market value of the

assets that are managed, administered, or both. The increase

in these fees in 2006 was due to continued strong growth

across all the trust and investment management businesses.

We also receive commissions and other fees for providing

services to full-service and discount brokerage customers.

At December 31, 2006 and 2005, brokerage assets totaled

$115 billion and $97 billion, respectively. Generally, these fees

include transactional commissions, which are based on the

number of transactions executed at the customer’s direction,

or asset-based fees, which are based on the market value of

the customer’s assets. The increase in these fees in 2006 was

primarily due to continued growth in asset-based fees.

Card fees increased 20% to $1,747 million in 2006 from

$1,458 million in 2005, mostly due to increases in credit

card accounts and credit and debit card transaction volume.

Purchase volume on debit and credit cards was up 21%

from a year ago and average card balances were up 19%.

Mortgage banking noninterest income was $2,311 million

in 2006 compared with $2,422 million in 2005. With the

adoption of FAS 156 in 2006 and measuring our residential

MSRs at fair value, net servicing income includes both changes

in the fair value of MSRs during the period as well as changes

in the value of derivatives (economic hedges) used to hedge

the MSRs. An additional $158 million ($101 million after

tax) increase in the value of MSRs upon remeasurement

to fair value under FAS 156 in 2006 was recorded as an

adjustment to the beginning balance of retained earnings in

stockholders’ equity. Prior to adoption of FAS 156, servicing

income included net derivative gains and losses (primarily the

ineffective portion of the change in value of derivatives used

to hedge MSRs under FAS 133, Accounting for Derivative