Wells Fargo 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

LOANS 90 DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans included in this category are 90 days or more past due

as to interest or principal and still accruing, because they are

(1) well-secured and in the process of collection or (2) real estate

1-4 family first mortgage loans or consumer loans exempt

under regulatory rules from being classified as nonaccrual.

The total of loans 90 days or more past due and still

accruing was $5,073 million, $3,606 million, $2,578 million,

$2,337 million and $672 million at December 31, 2006, 2005,

2004, 2003 and 2002, respectively. At December 31, 2006,

2005, 2004 and 2003, the total included $3,913 million,

$2,923 million, $1,820 million and $1,641 million, respectively,

in advances pursuant to our servicing agreements to GNMA

mortgage pools whose repayments are insured by the FHA

or guaranteed by the Department of Veterans Affairs. Before

clarifying guidance issued in 2003 as to classification as loans,

GNMA advances were included in other assets. Table 16

provides detail by loan category excluding GNMA advances.

Loans 90 days or more past due and still accruing for

other revolving credit and installment loans, which includes

auto loans, increased $326 million from $290 million in 2005

to $616 million in 2006, with approximately $235 million

due to the auto portfolio.

ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses, which consists of the

allowance for loan losses and the reserve for unfunded credit

commitments, is management’s estimate of credit losses

inherent in the loan portfolio at the balance sheet date. We

assume that our allowance for credit losses as a percentage

of charge-offs and nonaccrual loans will change at different

points in time based on credit performance, loan mix and

collateral values. Any loan with past due principal or interest

that is not both well-secured and in the process of collection

generally is charged off (to the extent that it exceeds the fair

value of any related collateral) based on loan category after

a defined period of time. Also, a loan is charged off when

classified as a loss by either internal loan examiners or regu-

latory examiners. The detail of the changes in the allowance

for credit losses, including charge-offs and recoveries by loan

category, is in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements.

At December 31, 2006, the allowance for loan losses

was $3.76 billion, or 1.18% of total loans, compared

with $3.87 billion, or 1.25%, at December 31, 2005. The

allowance for credit losses was $3.96 billion, or 1.24% of

total loans, at December 31, 2006, and $4.06 billion, or

1.31%, at December 31, 2005. These ratios fluctuate from

period to period and the decrease in the ratios of the allowance

for loan losses and the allowance for credit losses to total

loans in 2006 was primarily due to a continued shift toward

a higher percentage of consumer loans in our portfolio,

including auto and other consumer loans and some small

business loans, which have shorter loss emergence periods,

as well as home mortgage loans, which tend to have lower

credit loss rates that emerge over a longer time frame compared

with other consumer products. We have historically experi-

enced the lowest credit losses on our residential real estate

secured consumer loan portfolio. The reserve for unfunded

credit commitments was $200 million at December 31,

2006, and $186 million at December 31, 2005.

The ratio of the allowance for credit losses to total nonac-

crual loans was 238% and 303% at December 31, 2006 and

2005, respectively. This ratio may fluctuate significantly from

period to period due to such factors as the mix of loan types

in the portfolio, borrower credit strength and the value and

marketability of collateral. Over half of nonaccrual loans

were home mortgages, auto and other consumer loans at

December 31, 2006. Nonaccrual loans are generally written

down to fair value less cost to sell at the time they are placed

on nonaccrual and accounted for on a cost recovery basis.

The provision for credit losses totaled $2.20 billion in

2006, $2.38 billion in 2005 and $1.72 billion in 2004. In

2005, the provision included $100 million in excess of net

charge-offs, which was our estimate of probable credit losses

related to Hurricane Katrina. Since that time, we identified

and recorded approximately $50 million of Katrina-related

losses. Because we do not anticipate any further credit losses

attributable to Katrina, we released the remaining $50 million

balance in 2006.

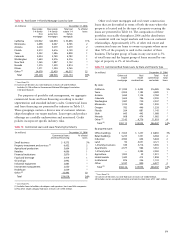

Table 16: Loans 90 Days or More Past Due and Still Accruing

(Excluding Insured/Guaranteed GNMA Advances)

(in millions) December 31,

2006 2005 2004 2003 2002

Commercial and

commercial real estate:

Commercial $15 $ 18 $ 26 $ 87 $ 92

Other real estate

mortgage 313 6 9 7

Real estate construction 3 9 6 611

Total commercial

and commercial

real estate 21 40 38 102 110

Consumer:

Real estate

1-4 family

first mortgage 154 103 148 117 104

Real estate

1-4 family junior

lien mortgage 63 50 40 29 18

Credit card 262 159 150 134 130

Other revolving credit

and installment 616 290 306 271 282

Total consumer 1,095 602 644 551 534

Foreign 44 41 76 43 28

Total $1,160 $683 $758 $696 $672