Wells Fargo 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117117

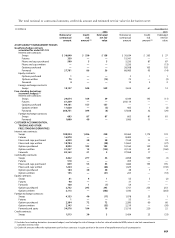

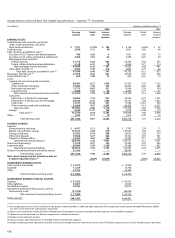

(in millions) December 31,

2006 2005

Notional or Credit Estimated Notional or Credit Estimated

contractual risk net fair contractual risk net fair

amount amount(2) value amount amount(2) value

ASSET/LIABILITY MANAGEMENT HEDGES

Qualifying hedge contracts

accounted for under FAS 133

Interest rate contracts:

Swaps $ 36,840 $ 530 $ 158 $ 30,634 $ 263 $ 37

Futures 339 — — 15,341 — —

Floors and caps purchased 500 5 5 5,250 87 87

Floors and caps written —— — 5,250 — (13)

Options purchased —— — 26,508 103 103

Forwards 27,781 86 36 86,985 95 (14)

Equity contracts:

Options purchased 1— — 311

Options written 75 — (15) 75 — (3)

Forwards 4— — 15 2 2

Foreign exchange contracts:

Swaps 10,157 548 539 3,614 61 12

Free-standing derivatives

(economic hedges)

(1)

Interest rate contracts:

Swaps 29,674 164 39 6,344 145 (11)

Futures 61,339 — — 254,114 — —

Options purchased 94,101 157 157 ———

Options written 11,620 — (5) 405 1 (3)

Forwards 260,751 394 (8) 37,838 32 (29)

Foreign exchange contracts:

Swaps 603 87 87 603 81 81

Forwards 1,000 49 — 1,000 11 —

CUSTOMER ACCOMMODATION,

TRADING AND OTHER

FREE-STANDING DERIVATIVES

Interest rate contracts:

Swaps 100,944 1,286 230 92,462 1,175 133

Futures 16,870 — — 8,400 — —

Floors and caps purchased 6,929 30 30 7,169 33 33

Floors and caps written 10,704 — (20) 12,653 — (27)

Options purchased 8,993 102 102 10,160 129 129

Options written 31,237 15 (133) 41,124 41 (160)

Forwards 83,163 21 5 37,968 17 —

Commodity contracts:

Swaps 3,422 277 34 2,858 599 (1)

Futures 518 — — 455 — —

Floors and caps purchased 839 55 55 1,686 195 195

Floors and caps written 1,224 — (66) 1,629 — (130)

Options purchased 184 30 30 48 7 7

Options written 155 — (31) 203 — (33)

Equity contracts:

Swaps 81 4 1 55 5 (2)

Futures 90 — — 31 — —

Forwards 160 1 (7) 54 — —

Options purchased 2,732 295 295 1,751 253 253

Options written 2,113 — (302) 1,542 — (263)

Foreign exchange contracts:

Swaps 4,133 40 (17) 1,078 35 1

Futures 1— — 53 — —

Options purchased 2,384 72 72 2,280 60 60

Options written 2,145 — (55) 2,219 — (59)

Forwards and spots 34,576 194 19 21,516 220 22

Credit contracts:

Swaps 1,513 30 3 5,454 23 (33)

(1) Includes free-standing derivatives (economic hedges) used to hedge the risk of changes in the fair value of residential MSRs, interest rate lock commitments

and other interests held.

(2) Credit risk amounts reflect the replacement cost for those contracts in a gain position in the event of nonperformance by all counterparties.

The total notional or contractual amounts, credit risk amount and estimated net fair value for derivatives were: