Wells Fargo 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111111

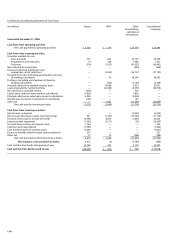

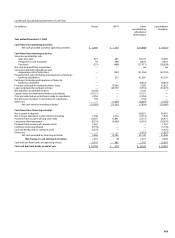

Condensed Consolidating Statement of Cash Flows

(in millions) Parent WFFI Other Consolidated

consolidating Company

subsidiaries/

eliminations

Year ended December 31, 2005

Cash flows from operating activities:

Net cash provided (used) by operating activities $ 5,396 $ 1,159 $(15,888)$ (9,333)

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 631 281 18,147 19,059

Prepayments and maturities 90 248 6,634 6,972

Purchases (231) (486) (27,917) (28,634)

Net cash acquired from acquisitions — — 66 66

Increase in banking subsidiaries’ loan

originations, net of collections — (953) (41,356) (42,309)

Proceeds from sales (including participations) of loans by

banking subsidiaries — 232 42,007 42,239

Purchases (including participations) of loans by

banking subsidiaries — — (8,853) (8,853)

Principal collected on nonbank entities’loans — 19,542 3,280 22,822

Loans originated by nonbank entities — (29,757) (3,918) (33,675)

Net advances to nonbank entities (3,166) — 3,166 —

Capital notes and term loans made to subsidiaries (10,751) — 10,751 —

Principal collected on notes/loans made to subsidiaries 2,950 — (2,950) —

Net decrease (increase) in investment in subsidiaries 194 — (194) —

Other, net — (1,059) (6,697) (7,756)

Net cash used by investing activities (10,283) (11,952) (7,834) (30,069)

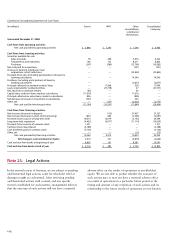

Cash flows from financing activities:

Net increase in deposits — — 38,961 38,961

Net increase (decrease) in short-term borrowings 1,048 3,344 (2,514) 1,878

Proceeds from issuance of long-term debt 18,297 11,891 (3,715) 26,473

Long-term debt repayment (8,216) (4,450) (5,910) (18,576)

Proceeds from issuance of common stock 1,367 — — 1,367

Common stock repurchased (3,159) — — (3,159)

Cash dividends paid on common stock (3,375) — — (3,375)

Other, net — — (1,673) (1,673)

Net cash provided by financing activities 5,962 10,785 25,149 41,896

Net change in cash and due from banks 1,075 (8) 1,427 2,494

Cash and due from banks at beginning of year 9,719 482 2,702 12,903

Cash and due from banks at end of year $ 10,794 $ 474 $ 4,129 $ 15,397