Wells Fargo 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

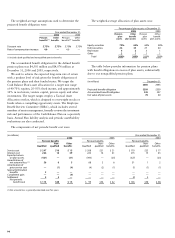

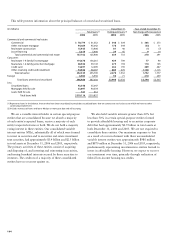

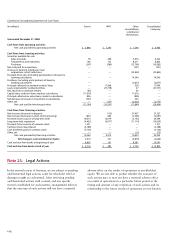

(in billions) December 31,

2006 2005

Loans serviced for others (1) $1,280 $ 871

Owned loans serviced (2) 86 118

Total owned servicing 1,366 989

Sub-servicing 19 27

Total managed servicing portfolio $1,385 $1,016

Ratio of MSRs to related loans

serviced for others 1.41% 1.44%

(1) Consists of 1-4 family first mortgage and commercial mortgage loans.

(2) Consists of mortgages held for sale and 1-4 family first mortgage loans.

The components of our managed servicing portfolio were:

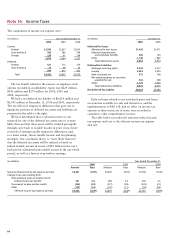

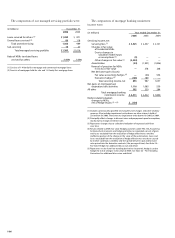

(in millions) Year ended December 31,

2006 2005 2004

Servicing income, net:

Servicing fees (1) $ 3,525 $ 2,457 $ 2,101

Changes in fair value

of residential MSRs:

Due to changes in

valuation model inputs

or assumptions (2) (9) ——

Other changes in fair value (3) (2,444) ——

Amortization (34) (1,991) (1,826)

Reversal of provision for MSRs

in excess of fair value —378 208

Net derivative gains (losses):

Fair value accounting hedges (4) —(46) 554

Economic hedges (5) (145)189 —

Total servicing income, net 893 987 1,037

Net gains on mortgage loan

origination/sales activities 1,116 1,085 539

All other 302 350 284

Total mortgage banking

noninterest income $ 2,311 $ 2,422 $ 1,860

Market-related valuation

changes to MSRs,

net of hedge results (2) + (5) $ (154)

(1) Includes contractually specified servicing fees, late charges and other ancillary

revenues. Also includes impairment write-downs on other interests held of

$26 million for 2006.There were no impairment write-downs for 2005 or 2004.

(2) Principally reflects changes in discount rates and prepayment speed assumptions,

mostly due to changes in interest rates.

(3) Represents changes due to collection/realization of expected cash flows

over time.

(4) Results related to MSRs fair value hedging activities under FAS 133, Accounting

for Derivative Instruments and Hedging Activities (as amended), consist of gains

and losses excluded from the evaluation of hedge effectiveness and the

ineffective portion of the change in the value of these derivatives. Gains and

losses excluded from the evaluation of hedge effectiveness are those caused

by market conditions (volatility) and the spread between spot and forward

rates priced into the derivative contracts (the passage of time). See Note 26 –

Fair Value Hedges for additional discussion and detail.

(5) Represents results from free-standing derivatives (economic hedges) used to

hedge the risk of changes in fair value of MSRs. See Note 26 – Free-Standing

Derivatives for additional discussion and detail.

The components of mortgage banking noninterest

income were: