Wells Fargo 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

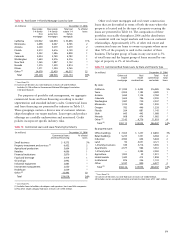

Table 11: Contractual Obligations

(in millions) Note(s) to Less than 1-3 3-5 More than Indeterminate Total

Financial Statements 1 year years years 5 years maturity (1)

Contractual payments by period:

Deposits 10 $71,254 $ 4,753 $ 1,125 $ 256 $232,855 $310,243

Long-term debt (2) 7, 12 14,741 18,640 23,941 29,823 — 87,145

Operating leases 7 567 870 574 1,135 — 3,146

Purchase obligations (3) 326 589 10 2 — 927

Total contractual obligations $86,888 $24,852 $25,650 $31,216 $232,855 $401,461

(1) Includes interest-bearing and noninterest-bearing checking, and market rate and other savings accounts.

(2) Includes capital leases of $12 million.

(3) Represents agreements to purchase goods or services.

these commitments were approximately $705 million. Our

other investment commitments, principally related to affordable

housing, civic and other community development initiatives,

were approximately $400 million at December 31, 2006.

In the ordinary course of business, we enter into indemni-

fication agreements, including underwriting agreements relating

to our securities, securities lending, acquisition agreements, and

various other business transactions or arrangements. For more

information, see Note 24 (Guarantees) to Financial Statements.

Contractual Obligations

In addition to the contractual commitments and arrange-

ments described above, which, depending on the nature of

the obligation, may or may not require use of our resources,

we enter into other contractual obligations in the ordinary

course of business, including debt issuances for the funding

of operations and leases for premises and equipment.

Table 11 summarizes these contractual obligations at

December 31, 2006, except obligations for short-term bor-

rowing arrangements and pension and postretirement benefit

plans. More information on those obligations is in Note 11

(Short-Term Borrowings) and Note 15 (Employee Benefits

and Other Expenses) to Financial Statements. The table also

excludes other commitments more fully described under

“Off-Balance Sheet Arrangements, Variable Interest Entities,

Guarantees and Other Commitments.”

We enter into derivatives, which create contractual

obligations, as part of our interest rate risk management

process, for our customers or for other trading activities.

See “Asset/Liability and Market Risk Management” in this

Report and Note 26 (Derivatives) to Financial Statements

for more information.

Transactions with Related Parties

FAS 57, Related Party Disclosures, requires disclosure of

material related party transactions, other than compensation

arrangements, expense allowances and other similar items

in the ordinary course of business. We had no related party

transactions required to be reported under FAS 57 for the

years ended December 31, 2006, 2005 and 2004.

Credit Risk Management Process

Our credit risk management process provides for decentral-

ized management and accountability by our lines of business.

Our overall credit process includes comprehensive credit

policies, judgmental or statistical credit underwriting, fre-

quent and detailed risk measurement and modeling, exten-

sive credit training programs and a continual loan review

and audit process. In addition, regulatory examiners review

and perform detailed tests of our credit underwriting, loan

administration and allowance processes.

Managing credit risk is a company-wide process. We have

credit policies for all banking and nonbanking operations

incurring credit risk with customers or counterparties that

provide a prudent approach to credit risk management. We

use detailed tracking and analysis to measure credit perfor-

mance and exception rates and we routinely review and

modify credit policies as appropriate. We have corporate

data integrity standards to ensure accurate and complete

credit performance reporting for the consolidated company.

We strive to identify problem loans early and have dedicated,

specialized collection and work-out units.

The Chief Credit Officer, who reports directly to the

Chief Executive Officer, provides company-wide credit over-

sight. Each business unit with direct credit risks has a credit

officer and has the primary responsibility for managing its

own credit risk. The Chief Credit Officer delegates authority,

limits and other requirements to the business units. These

delegations are routinely reviewed and amended if there are

significant changes in personnel, credit performance or busi-

ness requirements. The Chief Credit Officer is a member of

the Company’s Management Committee. The Chief Credit

Officer provides a quarterly credit review to the Credit

Committee of the Board of Directors and meets with them

periodically.

Risk Management