Wells Fargo 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

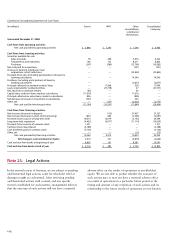

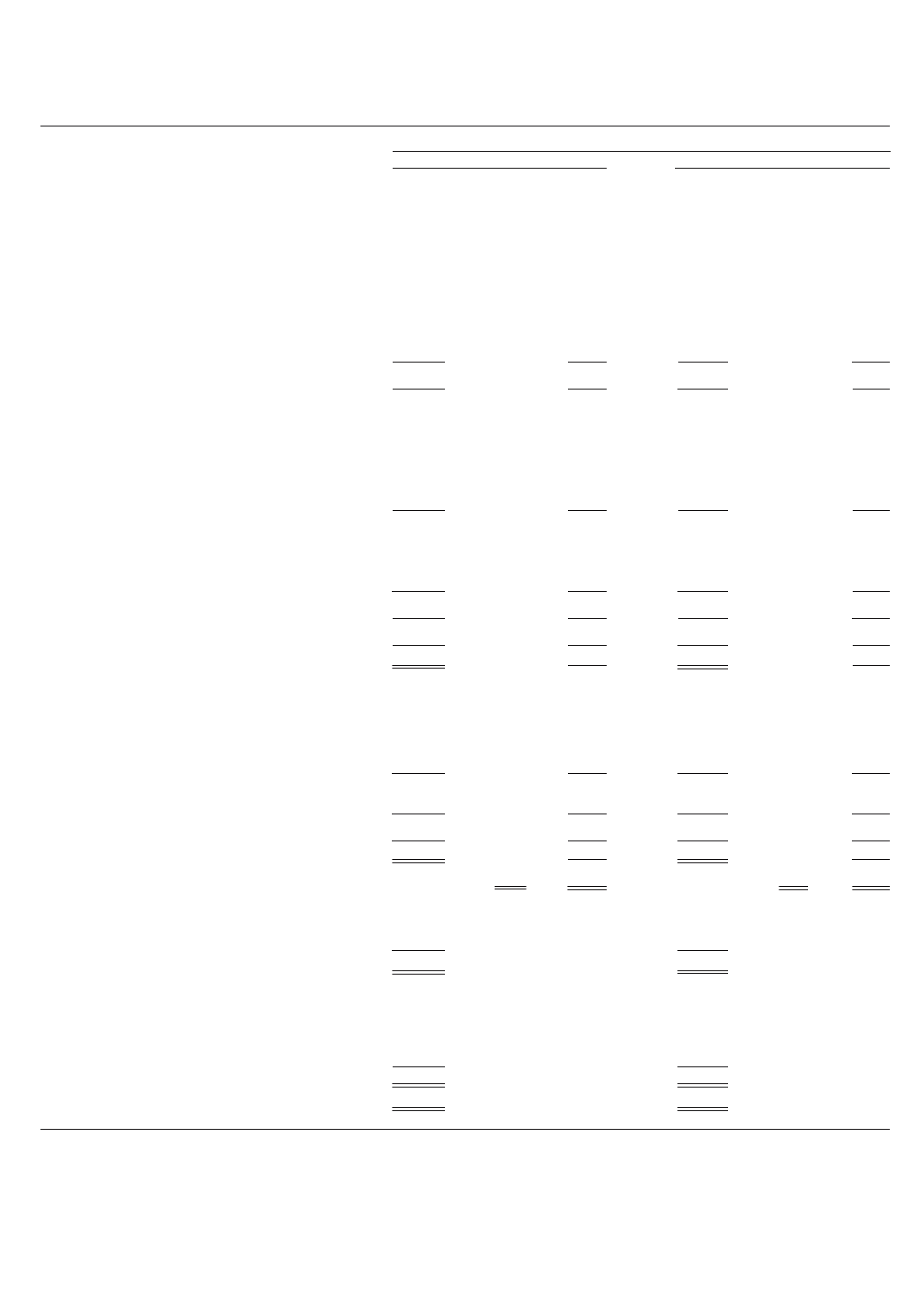

Average Balances,Yields and Rates Paid (Taxable-Equivalent Basis)— Quarterly (1)(2) (Unaudited)

(in millions) Quarter ended December 31,

2006 2005

Average Yields/ Interest Average Yields/ Interest

balance rates income/ balance rates income/

expense expense

EARNING ASSETS

Federal funds sold, securities purchased

under resale agreements and other

short-term investments $ 7,751 5.19% $ 102 $ 5,158 3.64% $ 47

Trading assets 3,950 5.12 50 5,061 3.82 48

Debt securities available for sale (3):

Securities of U.S. Treasury and federal agencies 786 4.28 9 1,051 3.90 10

Securities of U.S. states and political subdivisions 3,406 7.62 62 3,256 8.22 64

Mortgage-backed securities:

Federal agencies 31,718 6.20 483 23,545 5.94 347

Private collateralized mortgage obligations 5,130 6.19 78 8,060 5.71 114

Total mortgage-backed securities 36,848 6.20 561 31,605 5.88 461

Other debt securities (4) 6,406 7.20 115 4,843 6.79 82

Total debt securities available for sale (4) 47,446 6.40 747 40,755 6.12 617

Mortgages held for sale (3) 37,878 6.62 627 42,036 5.97 628

Loans held for sale (3) 659 7.60 13 603 6.41 10

Loans:

Commercial and commercial real estate:

Commercial 68,402 8.27 1,426 61,297 7.35 1,135

Other real estate mortgage 29,882 7.49 563 28,425 6.84 489

Real estate construction 15,775 8.07 321 13,040 7.26 239

Lease financing 5,500 5.66 78 5,347 5.77 77

Total commercial and commercial real estate 119,559 7.93 2,388 108,109 7.13 1,940

Consumer:

Real estate 1-4 family first mortgage 50,836 7.53 961 76,233 6.75 1,291

Real estate 1-4 family junior lien mortgage 68,208 8.16 1,403 58,157 7.28 1,067

Credit card 13,737 13.30 457 11,326 12.81 363

Other revolving credit and installment 53,206 9.67 1,297 46,593 9.13 1,071

Total consumer 185,987 8.80 4,118 192,309 7.84 3,792

Foreign 6,620 11.97 199 5,278 13.08 174

Total loans (5) 312,166 8.54 6,705 305,696 7.68 5,906

Other 1,333 5.17 18 1,415 4.49 16

Total earning assets $411,183 8.01 8,262 $400,724 7.23 7,272

FUNDING SOURCES

Deposits:

Interest-bearing checking $ 4,477 3.11 35 $ 3,797 1.79 17

Market rate and other savings 135,673 2.69 918 132,042 1.86 619

Savings certificates 36,382 4.33 398 26,610 3.26 219

Other time deposits 19,838 5.27 264 33,321 4.07 341

Deposits in foreign offices 24,425 4.65 286 14,347 3.71 135

Total interest-bearing deposits 220,795 3.42 1,901 210,117 2.51 1,331

Short-term borrowings 13,470 4.77 162 25,395 3.79 242

Long-term debt 85,809 5.20 1,120 79,169 4.19 832

Total interest-bearing liabilities 320,074 3.95 3,183 314,681 3.04 2,405

Portion of noninterest-bearing funding sources 91,109 — — 86,043 — —

Total funding sources $411,183 3.08 3,183 $400,724 2.39 2,405

Net interest margin and net interest income on

a taxable-equivalent basis (6) 4.93% $5,079 4.84% $4,867

NONINTEREST-EARNING ASSETS

Cash and due from banks $ 12,379 $ 13,508

Goodwill 11,259 10,780

Other 47,764 43,469

Total noninterest-earning assets $ 71,402 $ 67,757

NONINTEREST-BEARING FUNDING SOURCES

Deposits $ 91,259 $ 90,937

Other liabilities 25,687 23,049

Stockholders’ equity 45,565 39,814

Noninterest-bearing funding sources used to

fund earning assets (91,109) (86,043)

Net noninterest-bearing funding sources $ 71,402 $ 67,757

TOTAL ASSETS $482,585 $468,481

(1) Our average prime rate was 8.25% and 6.97% for the quarters ended December 31, 2006 and 2005, respectively.The average three-month London Interbank Offered Rate (LIBOR)

was 5.37% and 4.34% for the same quarters, respectively.

(2) Interest rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields are based on amortized cost balances computed on a settlement date basis.

(4) Includes certain preferred securities.

(5) Nonaccrual loans and related income are included in their respective loan categories.

(6) Includes taxable-equivalent adjustments primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate was 35% for both quarters presented.

122