Wells Fargo 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Long-Term Results

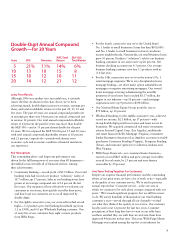

Although 2006 was another very successful year, it certainly

wasn’t the first. As shown in the chart above, we’ve been

achieving annual, double-digit increases in revenue, earnings per

share, and total stockholder return over the past 20, 15, 10 and

five years. The past 20 years our annual compound growth rate

in earnings per share was 14 percent; our annual compound rate

in revenue 12 percent. Our total annual compound stockholder

return of 14 percent the past five years was more than double

the S&P 500 —and at 15 percent almost double for the past

10 years. We far outpaced the S&P 500 the past 15 and 20 years

with total annual compound shareholder returns of 18 percent

and 21 percent, respectively—periods with almost every

economic cycle and economic condition a financial institution

can experience.

Full Horsepower

This outstanding short- and long-term performance was

driven by the full horsepower of our more than 80 businesses—

diversified across virtually all of financial services. Among

their achievements:

• Community Banking—record profit of $5.5 billion. Our retail

banking team had record core product “solutions” (sales) of

18.7 million, up 17 percent. Sales in our banking stores have

grown at an average compound rate of 14 percent the last

five years. Our measures of how effectively we welcome our

customers in our stores, how quickly our teller lines move,

and how loyal our customers are to us all improved by

double digits.

• For the eighth consecutive year, our cross-sell reached record

highs—5.2 products per retail banking household (up from

3.2 in 1998), and 6.0 per Wholesale Banking customer. One

of every five of our customers buys eight or more products

from Wells Fargo.

• For the fourth consecutive year we’re the United States’

No. 1 lender to small businesses (loans less than $100,000)

and No. 1 lender to small businesses in low-to-moderate

income neighborhoods. Nationwide, our small business loans

grew 30 percent. Products (“solutions”) sold to our business

banking customers in our stores were up 26 percent. Net

business checking accounts rose 4.3 percent. Our average

business banking customer now has 3.3 products with us

(3.0 last year).

• For the 14th consecutive year we were the nation’s No. 1

retail mortgage originator. We’re very disciplined in home

mortgage lending—we don’t make option adjustable-rate

mortgages or negative amortizing mortgages. Our owned

home mortgage servicing (administering the monthly

payments of your home loan) reached $1.37 trillion, the

largest in our industry—up 38 percent—and mortgage

originations were up 9 percent to $398 billion.

• Our National Home Equity Group portfolio rose to

$79 billion, up 10 percent.

• Wholesale Banking, for the eighth consecutive year, achieved

record net income, $2.1 billion, up 17 percent—with

strong double-digit growth in revenue and loans across its

businesses. We acquired commercial real estate investment

advisor Secured Capital Corp. (Los Angeles), multifamily

real estate financier Reilly Mortgage (Virginia), investment

banker Barrington Associates (Los Angeles), accounts receivable

purchasers Commerce Funding (Virginia), Evergreen Funding

(Texas), and insurance agencies in California, Indiana and

West Virginia.

• Wells Fargo Financial—our consumer finance business—

earned a record $865 million and grew average receivables

secured by real estate, by 25 percent and auto finance

receivables by 29 percent.

One Team. Pulling Together. For Customers.

Despite our superior financial performance and the outstanding

efforts of our great team, we have a lot of work to do—especially

in the quality of our customer service. We’ve said in previous

annual reports that “Customer service…is the one area in

which we continue to be only about average compared with our

peers.” We’ve made significant progress, but we still have more

to do. We survey hundreds of thousands of our retail banking

customers a year— served through all our channels—to find

out what they think of the quality of our service. Our customer

loyalty scores rose 32 percent the last two years. Customer

perceptions of how long they have to wait in our teller lines

and how satisfied they are with how we welcome them have

improved 44 percent in that time. This year, Wells Fargo Home

Mortgage was ranked among the top five in its industry for

Double-Digit Annual Compound

Growth—for 20 Years

WFC Total S&P 500

Years EPS Revenue Return Total Return

5 21% 11% 14% 6%

10 13 10 15 8

15 18 12 18 11

20 14 12 21 12