Wells Fargo 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

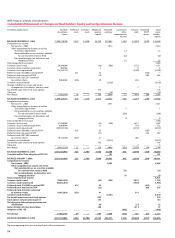

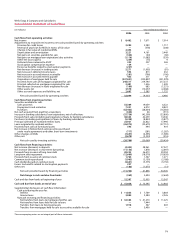

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Income

(in millions, except per share amounts) Year ended December 31,

2006 2005 2004

INTEREST INCOME

Trading assets $ 225 $ 190 $ 145

Securities available for sale 3,278 1,921 1,883

Mortgages held for sale 2,746 2,213 1,737

Loans held for sale 47 146 292

Loans 25,611 21,260 16,781

Other interest income 332 232 129

Total interest income 32,239 25,962 20,967

INTEREST EXPENSE

Deposits 7,174 3,848 1,827

Short-term borrowings 992 744 353

Long-term debt 4,122 2,866 1,637

Total interest expense 12,288 7,458 3,817

NET INTEREST INCOME 19,951 18,504 17,150

Provision for credit losses 2,204 2,383 1,717

Net interest income after provision for credit losses 17,747 16,121 15,433

NONINTEREST INCOME

Service charges on deposit accounts 2,690 2,512 2,417

Trust and investment fees 2,737 2,436 2,116

Card fees 1,747 1,458 1,230

Other fees 2,057 1,929 1,779

Mortgage banking 2,311 2,422 1,860

Operating leases 783 812 836

Insurance 1,340 1,215 1,193

Net losses on debt securities available for sale (19) (120) (15)

Net gains from equity investments 738 511 394

Other 1,356 1,270 1,099

Total noninterest income 15,740 14,445 12,909

NONINTEREST EXPENSE

Salaries 7,007 6,215 5,393

Incentive compensation 2,885 2,366 1,807

Employee benefits 2,035 1,874 1,724

Equipment 1,252 1,267 1,236

Net occupancy 1,405 1,412 1,208

Operating leases 630 635 633

Other 5,528 5,249 5,572

Total noninterest expense 20,742 19,018 17,573

INCOME BEFORE INCOME TAX EXPENSE 12,745 11,548 10,769

Income tax expense 4,263 3,877 3,755

NET INCOME $ 8,482 $ 7,671 $ 7,014

EARNINGS PER COMMON SHARE $ 2.52 $ 2.27 $ 2.07

DILUTED EARNINGS PER COMMON SHARE $ 2.49 $ 2.25 $ 2.05

DIVIDENDS DECLARED PER COMMON SHARE $ 1.08 $ 1.00 $ 0.93

Average common shares outstanding 3,368.3 3,372.5 3,384.4

Diluted average common shares outstanding 3,410.1 3,410.9 3,426.7

The accompanying notes are an integral part of these statements.

Financial Statements