Wells Fargo 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

1,320

9

329 128

167

153 224

113

174 28

62 39

66

69

22

24

738 38

291

561421

66

115

109

122 79 78 63

68 72

51

23

9

44

9

10

14

57

526 77 38

52

33 41 56

58

138

250

44

1

14

9

2

6

6

54

47

17

3

• Are there fees we should eliminate because customers do not

perceive a fair value for them?

• Can we reduce the number of “800” numbers we offer to

customers from our different business lines? When a customer

calls one of them, can we automatically route them to the

right “800” number so we can satisfy their need or solve

their problem faster? The answer is “yes.”We’ve installed

technology the last three years to do just that.

• How can we make sure we don’t ask our customers time and

again for information about them we already have? For example,

when customers use one of our 6,700+ ATMs and they always

select English or Spanish or Chinese as their preferred language,

we shouldn’t ask them every time which language they prefer.

We already know! The old saying is still true—“I wish I knew

what I already know.” All our ATMs remember customers’

preferred withdrawal amount. We’re testing technology to

remember customers’ preferred ATM language.

Our “One Wells Fargo”Goal is Simple

We must help our team members serve our customers faster and

more easily so that every interaction we have with our customers

—about 5,000 every minute of every day—appears to the

customer to be simple, obvious, intuitive, usable, practical and,

where possible, tailored to their special need of the moment. If we

do that, our customers—who want us to know them, understand

them, acknowledge them and reward them—will reward us with

even more of their business, which will generate double-digit

growth in revenue, earnings per share and stock price.

We’re asking questions such as:

• We have hundreds of different products—picture a crowded

menu board at a fast food restaurant. Can we reduce and

simplify the menu, and thereby reduce customer confusion,

our own costs and processing errors? For example, we’re

thoroughly analyzing how our customers use our checking

products so we can make them easier to understand and use.

• When a customer comes to us with a problem—especially

through our Wells Fargo Phone Bank centers—how can we

increase the likelihood that we can fix the customer’s problem

the first time? (Our batting average now is only about .333—

great for baseball, not good enough for our customers.) If we

can’t fix it right away, how can we ensure that we give the

customer periodic updates on the status of our investigation

and specify the date we’ll solve it?

• How can we speak more conversationally in letters to our

customers so they don’t have to scratch their heads and say,

“What are they talking about?” We’ve all had this experience

as customers. In a disclosure statement, for example, why

use banking terms such as “debits” and “credits”? Why

say “rolling consecutive twelve month billing cycle period,”

as one company recently did, when it meant “the next

12 months”?

• How can we make it easier for our customers to access

information about their accounts, safely and securely, and with

less paper? A text-messaging society that gets information

at search engine speed doesn’t understand overnight “batch

processing” of paper checks.

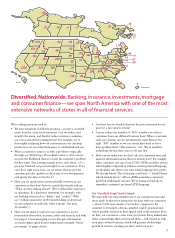

Diversified. Nationwide. Banking, insurance, investments, mortgage

and consumer finance—we span North America with one of the most

extensive networks of stores in all of financial services.

Puerto Rico

Hawaii