Wells Fargo 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

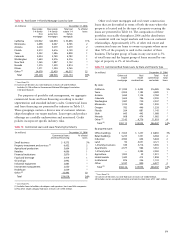

2004 2003 2002

Average Yields/ Interest Average Yields/ Interest Average Yields/ Interest

balance rates income/ balance rates income/ balance rates income/

expense expense expense

$ 4,254 1.49% $ 64 $ 4,174 1.16% $ 49 $ 2,961 1.73% $ 51

5,286 2.75 145 6,110 2.56 156 4,747 3.58 169

1,161 4.05 46 1,286 4.74 58 1,770 5.57 95

3,501 8.00 267 2,424 8.62 196 2,106 8.33 167

21,404 6.03 1,248 18,283 7.37 1,276 26,718 7.23 1,856

3,604 5.16 180 2,001 6.24 120 2,341 7.18 163

25,008 5.91 1,428 20,284 7.26 1,396 29,059 7.22 2,019

3,395 7.72 236 3,302 7.75 240 3,029 7.74 232

33,065 6.24 1,977 27,296 7.32 1,890 35,964 7.25 2,513

32,263 5.38 1,737 58,672 5.34 3,136 39,858 6.13 2,450

8,201 3.56 292 7,142 3.51 251 5,380 4.69 252

49,365 5.77 2,848 47,279 6.08 2,876 46,520 6.80 3,164

28,708 5.35 1,535 25,846 5.44 1,405 25,413 6.17 1,568

8,724 5.30 463 7,954 5.11 406 7,925 5.69 451

5,068 6.23 316 4,453 6.22 277 4,079 6.32 258

91,865 5.62 5,162 85,532 5.80 4,964 83,937 6.48 5,441

87,700 5.44 4,772 56,252 5.54 3,115 32,669 6.69 2,185

44,415 5.18 2,300 31,670 5.80 1,836 25,220 7.07 1,783

8,878 11.80 1,048 7,640 12.06 922 6,810 12.27 836

33,528 9.01 3,022 29,838 9.09 2,713 24,072 10.28 2,475

174,521 6.38 11,142 125,400 6.85 8,586 88,771 8.20 7,279

3,184 15.30 487 2,200 18.00 396 1,774 18.90 335

269,570 6.23 16,791 213,132 6.54 13,946 174,482 7.48 13,055

1,709 3.81 65 1,626 4.57 74 1,436 4.87 72

$354,348 5.97 21,071 $318,152 6.16 19,502 $264,828 7.04 18,562

$ 3,059 0.44 13 $ 2,571 0.27 7 $ 2,494 0.55 14

122,129 0.69 838 106,733 0.66 705 93,787 0.95 893

18,850 2.26 425 20,927 2.53 529 24,278 3.21 780

29,750 1.43 427 25,388 1.20 305 8,191 1.86 153

8,843 1.40 124 6,060 1.11 67 5,011 1.58 79

182,631 1.00 1,827 161,679 1.00 1,613 133,761 1.43 1,919

26,130 1.35 353 29,898 1.08 322 33,278 1.61 536

67,898 2.41 1,637 53,823 2.52 1,355 42,158 3.33 1,404

— — — 3,306 3.66 121 2,780 4.23 118

276,659 1.38 3,817 248,706 1.37 3,411 211,977 1.88 3,977

77,689 — — 69,446 — — 52,851 — —

$354,348 1.08 3,817 $318,152 1.08 3,411 $264,828 1.51 3,977

4.89% $17,254 5.08% $16,091 5.53% $14,585

$ 13,055 $ 13,433 $ 13,820

10,418 9,905 9,737

32,758 36,123 33,340

$ 56,231 $ 59,461 $ 56,897

$ 79,321 $ 76,815 $ 63,574

18,764 20,030 17,054

35,835 32,062 29,120

(77,689) (69,446) (52,851)

$ 56,231 $ 59,461 $ 56,897

$410,579 $377,613 $321,725

(5) Nonaccrual loans and related income are included in their respective loan categories.

(6) At December 31, 2003, upon adoption of FIN 46 (revised December 2003), Consolidation of Variable Interest Entities (FIN 46(R)), these balances were reflected in

long-term debt. See Note 12 (Long-Term Debt) to Financial Statements for more information.

(7) Includes taxable-equivalent adjustments primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate was 35% for all

years presented.