Wells Fargo 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

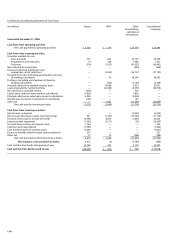

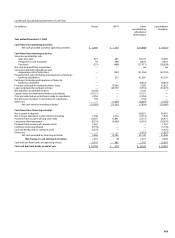

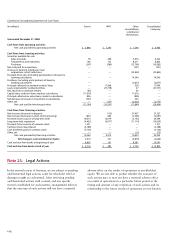

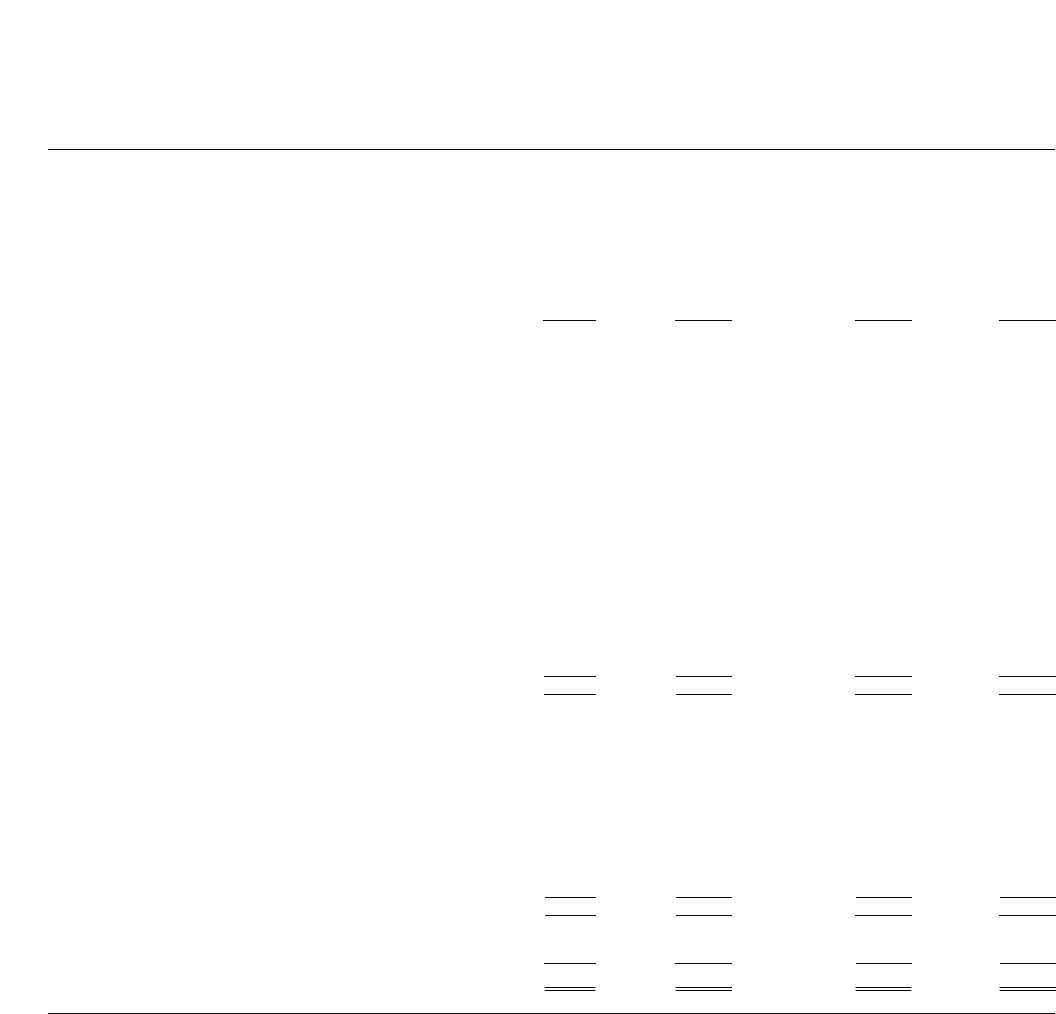

Condensed Consolidating Statement of Cash Flows

(in millions) Parent WFFI Other Consolidated

consolidating Company

subsidiaries/

eliminations

Year ended December 31, 2006

Cash flows from operating activities:

Net cash provided by operating activities $ 3,536 $ 1,179 $ 27,379 $ 32,094

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 353 822 52,129 53,304

Prepayments and maturities 14 259 7,048 7,321

Purchases (378) (1,032) (61,052) (62,462)

Net cash paid for acquisitions — — (626) (626)

Increase in banking subsidiaries’ loan

originations, net of collections — (2,003) (35,727) (37,730)

Proceeds from sales (including participations) of loans

by banking subsidiaries — 50 38,293 38,343

Purchases (including participations) of loans by

banking subsidiaries — (202) (5,136) (5,338)

Principal collected on nonbank entities’loans — 19,998 3,923 23,921

Loans originated by nonbank entities — (22,382) (4,592) (26,974)

Net advances to nonbank entities (500) — 500 —

Capital notes and term loans made to subsidiaries (7,805) — 7,805 —

Principal collected on notes/loans made to subsidiaries 4,926 — (4,926) —

Net decrease (increase) in investment in subsidiaries (145) — 145 —

Other, net —1,081 (11,540) (10,459)

Net cash used by investing activities (3,535) (3,409) (13,756) (20,700)

Cash flows from financing activities:

Net decrease in deposits — — (4,452) (4,452)

Net increase (decrease) in short-term borrowings 931 (1,297) (10,790) (11,156)

Proceeds from issuance of long-term debt 13,448 8,670 (1,863) 20,255

Long-term debt repayment (7,362) (5,217) (30) (12,609)

Proceeds from issuance of common stock 1,764 — — 1,764

Common stock repurchased (1,965) — — (1,965)

Cash dividends paid on common stock (3,641) — — (3,641)

Excess tax benefits related to stock option payments 227 — — 227

Other, net 12 70 (268) (186)

Net cash provided (used) by financing activities 3,414 2,226 (17,403) (11,763)

Net change in cash and due from banks 3,415 (4) (3,780) (369)

Cash and due from banks at beginning of year 10,794 474 4,129 15,397

Cash and due from banks at end of year $14,209 $ 470 $ 349 $ 15,028