Wells Fargo 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

1. Investments, Brokerage, Private Banking, Insurance

About 16 percent of our earnings come from these businesses

that are so important to our customers’ financial well-being.

Our goal: 25 percent.

• Private Banking: average loans,up 8%; average deposits, up 15%.

• Private bankers: 800, up 16% (690,‘05)

• Core deposits: up 7%.

• Brokerage assets under administration: $115 billion, up 19%.

•WellsTrade® brokerage assets: $11.5 billion, up 32%.

• Wealth Management professionals: 3,800,up 8%.

• Mutual fund assets managed: $126 billion, up 12%.

• Customers referred from bankers to insurance team: up 100%.

2. Going for Gr-eight!—Product Packages

Our average banking household has 5.2 products with us.

Our average Wholesale Banking customer has 6.0—our

average commercial banking customer more than seven. Our

goal is eight products per customer. Already, one of every

five of our customers has eight or more products with us.

The average U.S. banking customer has about 16.

• Two-thirds of our new checking account customers buy

a Wells Fargo PackageSM (checking account and three other

products such as debit card,credit card, online banking,

savings account,home equity loan).

• Added 1,900+ bankers in our stores.

3. Doing It Right for the Customer

Be “one Wells Fargo”advocates for our customers,put them

at the center of all we do, and give them such outstanding

service and advice that they’ll give us all their business and

rave about us to their family, friends and business associates.

• Launched mortgage industry’s first comprehensive program

to help nonprime customers achieve financial success.

• Launched “one Wells Fargo”initiatives to make it easier for our

customers to do business with us.

4. Banking with a Mortgage, Home Equity

and Consumer Finance Loan

All our mortgage and consumer finance customers in our

Community Banking states should bank with us. All our

banking customers who need a mortgage or a home equity

loan should get it through Wells Fargo.

• Homeowner-customers who have mortgage products with us:

21.2% (17.3%, ’01).

• Homeowner-customers with home equity products with us:

16.6% (12.6%, ’01).

5. Wells Fargo Cards in Every Wallet

Every one of our bank customers should have an active credit card

and debit card with us.

• Households with Wells Fargo credit card: 35.3% (23.2%, ’01).

• Checking account customers with Wells Fargo debit card: 90.7%

(83.3%, ’01).

• Business Banking customers with Wells Fargo credit card: 22.9%

(16.6%, ’04).

• Business Banking checking account customers with Wells Fargo

debit card: 66.2% (49.5%, ’04).

6. When,Where and How

Integrate all delivery channels—stores, ATMs, Wells Fargo Phone

Bankcenters, wellsfargo.com, direct mail, interactive video—to

match them with when, where and how our customers want to

be served.

• Opened 109 Community Banking stores and 21 Wholesale

Banking offices.

• About seven of every 10 of our Wholesale Banking customers

are active online users of our Commercial Electronic Office®

(CEO®)service to run their businesses more efficiently.

• Active online internet customers: 8.5 million (2/3 of all

consumer checking account customers), up 18%.

• Active online small business customers: 800,000, up 25%.

• 400+ of our ATMs in the Bay Area now accept deposits with

no envelopes required—a service we plan to expand across

our 23 banking states.

7. “Information-Based” Marketing

Offer the right product to the right customer at the right

time at every point of customer contact.

• Customers accepted 11.5 million tailored product offers through

our stores,phone banks and wellsfargo.com (10.2 million,’05)

• Launched My Savings PlanSM—online tool to set savings goals,

amounts, time frames and measure progress.

• My Spending Report attracted 4.5 million first-time users.

8. Be Our Customers’ Payment Processor

Wells Fargo must add real value to enable us to be the

intermediary—electronic or paper—whenever and wherever

our customers buy products and services.

• Active online bill payment/presentment customers: 4.8 million,

up 43%.

• Business customers deposited $90 billion in checks via internet

(Desktop Deposit® service—scanning paper checks into screen

images) in ’06.

9. Premier Customers

Attract more and keep all our premier customers.Cross-sell

Wells Fargo products to households that could become

premier customers.Reduce by half the number of customers

who leave us or give us less of their business.

• High-value customers who leave us annually: 5.6% (7.1,‘03)

• Banking households with Portfolio Management Account (PMA):

13.82% (11.07, ’05)

10. People as a Competitive Advantage

Develop, reward and recognize all our team members;

build an inclusive work environment and a more

diverse organization.

• Team member training: 2.7% of total payroll

• Team member tuition reimbursement: $19.3 million (up 23%)

• Almost 100 team member resource groups (64,‘03) bring

together diverse team members with shared interests and

common backgrounds for professional growth.

• 71 diversity councils companywide (39,‘03) advise management

on policy, programs and best practices.

• 4,500 net new team members. Welcome!

Our 10 Strategic Initiatives

Our 10 Strategic Initiatives have guided us the last 10 years toward our vision of satisfying all our customers’financial needs.

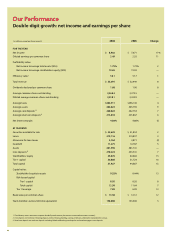

They also help us toward our objective of double-digit growth in revenue,earnings and stock price.Here’s some of our progress.