Wells Fargo 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

remaining maturity of the debt securities within this portfolio

was 5.2 years at December 31, 2006. Of the $41.1 billion

(cost basis) of debt securities in this portfolio at December 31,

2006, $5.0 billion, or 12%, is expected to mature or be

prepaid in 2007 and an additional $7.3 billion, or 18%, in

2008. Asset liquidity is further enhanced by our ability to sell

or securitize loans in secondary markets through whole-loan

sales and securitizations. In 2006, we sold mortgage loans of

$271 billion, including home mortgage loans and commercial

mortgage loans of $51 billion that we securitized. The amount

of mortgage loans, home equity loans and other consumer

loans available to be sold or securitized was approximately

$160 billion at December 31, 2006.

Core customer deposits have historically provided a size-

able source of relatively stable and low-cost funds. Average

core deposits and stockholders’ equity funded 62.4% and

63.2% of average total assets in 2006 and 2005, respectively.

The remaining assets were funded by long-term debt

(including trust preferred securities), deposits in foreign

offices, and short-term borrowings (federal funds purchased,

securities sold under repurchase agreements, commercial

paper and other short-term borrowings). Short-term borrow-

ings averaged $21.5 billion in 2006 and $24.1 billion in

2005. Long-term debt averaged $84.0 billion in 2006 and

$79.1 billion in 2005.

We anticipate making capital expenditures of approxi-

mately $1.2 billion in 2007 for our stores, relocation and

remodeling of Company facilities, and routine replacement

of furniture, equipment and servers. We fund expenditures

from various sources, including cash flows from operations

and borrowings.

Liquidity is also available through our ability to raise

funds in a variety of domestic and international money and

capital markets. We access capital markets for long-term

funding by issuing registered debt, private placements and

asset-backed secured funding. Rating agencies base their ratings

on many quantitative and qualitative factors, including capital

adequacy, liquidity, asset quality, business mix and level and

quality of earnings. Material changes in these factors could

result in a different debt rating; however, a change in debt

rating would not cause us to violate any of our debt covenants.

In September 2003, Moody’s Investors Service rated Wells Fargo

Bank, N.A. as “Aaa,” its highest investment grade, and rated

the Company’s senior debt rating as “Aa1.” In July 2005,

Dominion Bond Rating Service raised the Company’s senior

debt rating to “AA” from “AA(low).” In February 2007,

Standard & Poor’s Ratings Services raised Wells Fargo Bank,

N.A.’s credit rating to “AAA” from “AA+,” and raised the

Company’s senior debt rating to “AA+” from “AA.” Our

bank is now the only U.S. bank to have the highest possible

credit rating from both Moody’s and S&P.

Table 18 provides the credit ratings of the Company and

Wells Fargo Bank, N.A. as of December 31, 2006.

PARENT. Under SEC rules effective December 1, 2005, the

Parent is classified as a “well-known seasoned issuer,” which

allows it to file a registration statement that does not have a

limit on issuance capacity. “Well-known seasoned issuers”

generally include those companies with a public float of

common equity of at least $700 million or those companies

that have issued at least $1 billion in aggregate principal

amount of non-convertible securities, other than common

equity, in the last three years. However, the Parent’s ability

to issue debt and other securities under a registration state-

ment filed with the SEC under these new rules is limited by

the debt issuance authority granted by the Board. The Parent

is currently authorized by the Board to issue $25 billion in

outstanding short-term debt and $95 billion in outstanding

long-term debt, subject to a total outstanding debt limit of

$110 billion. In June 2006, the Parent’s registration state-

ment with the SEC for issuance of senior and subordinated

notes, preferred stock and other securities became effective.

During 2006, the Parent issued a total of $12.1 billion of

registered senior notes, including $3.7 billion (denominated in

euros) sold primarily in Europe and $2.3 billion (denominated

in pounds sterling) sold primarily in the United Kingdom.

The Parent also issued $751 million in junior subordinated

debt (trust preferred securities). Also, in 2006, the Parent

issued $534 million in private placements (denominated

in Australian dollars) under the Parent’s Australian debt

issuance program. We used the proceeds from securities

issued in 2006 for general corporate purposes and expect

that the proceeds in the future will also be used for general

corporate purposes. In January 2007, the Parent issued a

total of $3.7 billion in senior notes, including approximately

$1.5 billion denominated in pounds sterling. The Parent also

issues commercial paper from time to time, subject to its

short-term debt limit.

WELLS FARGO BANK, N.A. Wells Fargo Bank, N.A. is authorized

by its board of directors to issue $20 billion in outstanding

short-term debt and $40 billion in outstanding long-term

debt. In March 2003, Wells Fargo Bank, N.A. established a

$50 billion bank note program under which, subject to any

other debt outstanding under the limits described above, it

may issue $20 billion in outstanding short-term senior notes

and $30 billion in long-term senior notes. Securities are issued

under this program as private placements in accordance with

Office of the Comptroller of the Currency (OCC) regulations.

During 2006, Wells Fargo Bank, N.A. issued $3.2 billion in

long-term senior and subordinated notes, which included

long-term senior notes under the bank note program.

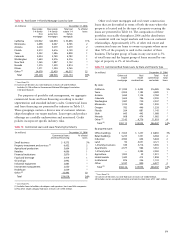

Table 18: Credit Ratings

Wells Fargo & Company Wells Fargo Bank, N.A.

Senior Subordinated Commercial Long-term Short-term

debt debt paper deposits borrowings

Moody’s Aa1 Aa2 P-1 Aaa P-1

Standard &

Poor’s (1) AA+ AA A-1+ AAA A-1+

Fitch, Inc. AA AA- F1+ AA+ F1+

Dominion Bond

Rating Service AA AA(low) R-1(middle) AA(high) R-1(high)

(1) Reflects February 2007 upgrade of credit ratings.