Wells Fargo 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

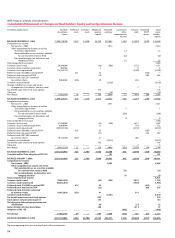

70

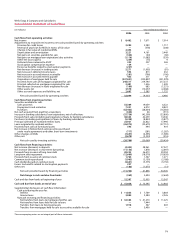

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Changes in Stockholders’ Equity and Comprehensive Income

(in millions, except shares)

Number Preferred Common Additional Retained Cumulative Treasury Unearned Total

of common stock stock paid-in earnings other stock ESOP stock-

shares capital comprehensive shares holders’

income equity

BALANCE DECEMBER 31, 2003 3,396,218,748 $ 214 $5,788 $6,749 $22,842 $ 938 $ (1,833)$(229)$34,469

Comprehensive income:

Net income – 2004 7,014 7,014

Other comprehensive income, net of tax:

Translation adjustments 12 12

Net unrealized losses on securities available

for sale and other interests held (22) (22)

Net unrealized gains on derivatives and

hedging activities 22 22

Total comprehensive income 7,026

Common stock issued 59,939,306 (46) (206) 1,523 1,271

Common stock issued for acquisitions 306,964 1 8 9

Common stock repurchased (76,345,112) (2,188) (2,188)

Preferred stock (321,000) issued to ESOP 321 23 (344) —

Preferred stock released to ESOP (19) 284 265

Preferred stock (265,537) converted

to common shares 9,063,368 (265) 29 236 —

Common stock dividends (3,150) (3,150)

Change in Rabbi trust assets and similar

arrangements (classified as treasury stock) 77

Tax benefit upon exercise of stock options 175 175

Other, net _____________ _____ ______ ______ (18)_____ _______ _____ (18)

Net change (7,035,474) 56 — 163 3,640 12 (414) (60) 3,397

BALANCE DECEMBER 31, 2004 3,389,183,274 270 5,788 6,912 26,482 950 (2,247) (289) 37,866

Comprehensive income:

Net income – 2005 7,671 7,671

Other comprehensive income, net of tax:

Translation adjustments 55

Net unrealized losses on securities available

for sale and other interests held (298) (298)

Net unrealized gains on derivatives and

hedging activities 8 8

Total comprehensive income 7,386

Common stock issued 57,528,986 (52) (198) 1,617 1,367

Common stock issued for acquisitions 3,909,004 12 110 122

Common stock repurchased (105,597,728) (3,159) (3,159)

Preferred stock (363,000) issued to ESOP 362 25 (387) —

Preferred stock released to ESOP (21) 328 307

Preferred stock (307,100) converted

to common shares 10,142,528 (307) 21 286 —

Common stock dividends (3,375) (3,375)

Tax benefit upon exercise of stock options 143 143

Other, net ______________ _____ _______ _______ _________ ______ 3 _____ 3

Net change (34,017,210) 55 — 128 4,098 (285) (1,143) (59) 2,794

BALANCE DECEMBER 31, 2005 3,355,166,064 325 5,788 7,040 30,580 665 (3,390) (348) 40,660

Cumulative effect from adoption of FAS 156 101 101

BALANCE JANUARY 1, 2006 3,355,166,064 325 5,788 7,040 30,681 665 (3,390) (348) 40,761

Comprehensive income:

Net income – 2006 8,482 8,482

Other comprehensive income, net of tax:

Net unrealized losses on securities available

for sale and other interests held (31) (31)

Net unrealized gains on derivatives and

hedging activities 70 70

Total comprehensive income 8,521

Common stock issued 70,063,930 (67) (245) 2,076 1,764

Common stock repurchased (58,534,072) (1,965) (1,965)

Preferred stock (414,000) issued to ESOP 414 29 (443) —

Preferred stock released to ESOP (25) 380 355

Preferred stock (355,659) converted

to common shares 10,453,939 (355) 41 314 —

Common stock dividends (3,641) (3,641)

Tax benefit upon exercise of stock options 229 229

Stock option compensation expense 134 134

Net change in deferred compensation and

related plans 50 (27) 23

Reclassification of share-based plans 308 (211) 97

Adoption of FAS 158 _____________ _____ ______ ______ _______ (402)_______ _____ (402)

Net change 21,983,797 59 — 699 4,596 (363) 187 (63) 5,115

BALANCE DECEMBER 31, 2006 3,377,149,861 $ 384 $5,788 $7,739 $35,277 $ 302 $(3,203) $(411) $45,876

The accompanying notes are an integral part of these statements.