Wells Fargo 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Balance Sheet Analysis

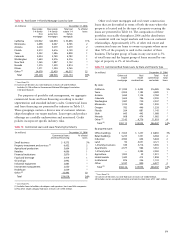

Table 8: Mortgage-Backed Securities

(in billions) Fair Net unrealized Remaining

value gain (loss) maturity

At December 31, 2006 $31.5 $ 0.5 4.2 yrs.

At December 31, 2006,

assuming a 200 basis point:

Increase in interest rates 29.0 (2.0) 7.0 yrs.

Decrease in interest rates 32.0 1.0 1.1 yrs.

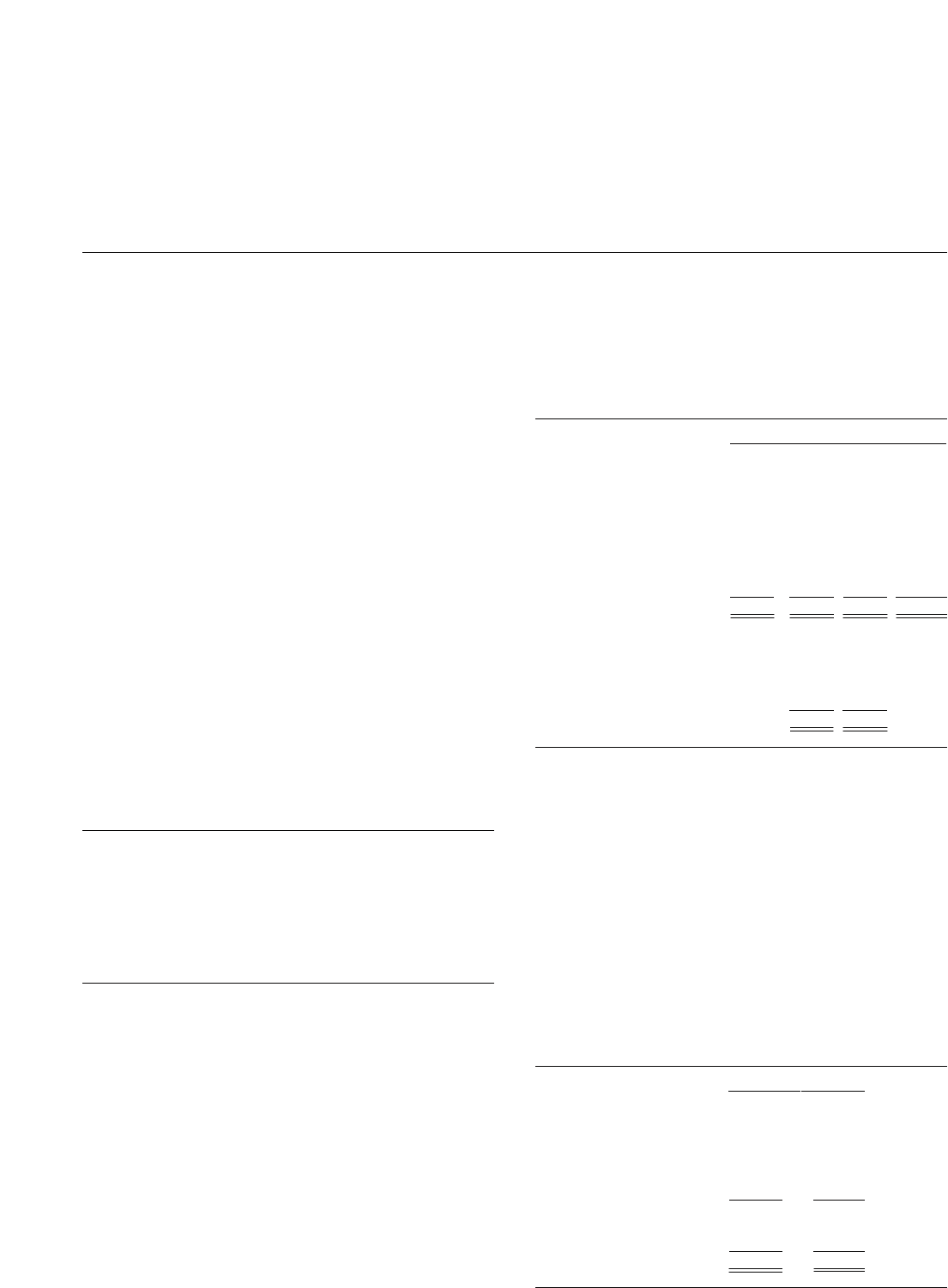

Table 10: Deposits

(in millions) December 31,%

2006 2005 Change

Noninterest-bearing $ 89,119 $ 87,712 2%

Interest-bearing checking 3,540 3,324 6

Market rate and

other savings 140,283 134,811 4

Savings certificates 37,282 27,494 36

Core deposits 270,224 253,341 7

Other time deposits 13,819 46,488 (70)

Deposits in foreign offices 26,200 14,621 79

Total deposits $310,243 $314,450 (1)

Table 9: Maturities for Selected Loan Categories

(in millions) December 31, 2006

Within After After Total

one one year five

year through years

fiveyears

Selected loan maturities:

Commercial $21,735 $35,309 $13,360 $ 70,404

Other real estate mortgage 3,724 11,247 15,141 30,112

Real estate construction 7,114 7,481 1,340 15,935

Foreign 828 4,752 1,086 6,666

Total selected loans $33,401 $58,789 $30,927 $123,117

Sensitivity of loans due after

one year to changes in

interest rates:

Loans at fixed interest rates $12,181 $ 9,108

Loans at floating/variable

interest rates 46,608 21,819

Total selected loans $58,789 $30,927

increased $13.2 billion, or 12%, compared with a year

ago. Mortgages held for sale decreased to $33.1 billion at

December 31, 2006, from $40.5 billion a year ago.

Table 9 shows contractual loan maturities and interest

rate sensitivities for selected loan categories.

Deposits

Year-end deposit balances are shown in Table 10. Comparative

detail of average deposit balances is included in Table 3.

Average core deposits increased $17.2 billion to $260.0 billion

in 2006 from $242.8 billion in 2005, primarily due to an

increase in savings certificates. Average core deposits funded

53.5% and 54.5% of average total assets in 2006 and 2005,

respectively. Total average interest-bearing deposits increased

to $223.8 billion in 2006 from $194.6 billion in 2005, largely

due to organic growth. Total average noninterest-bearing

deposits rose to $89.1 billion in 2006 from $87.2 billion in

2005. Savings certificates increased on average to $32.4 billion

in 2006 from $22.6 billion in 2005.

Securities Available for Sale

Our securities available for sale portfolio consists of both

debt and marketable equity securities. We hold debt securities

available for sale primarily for liquidity, interest rate risk

management and yield enhancement. Accordingly, this

portfolio primarily includes very liquid, high-quality federal

agency debt securities. At December 31, 2006, we held

$41.8 billion of debt securities available for sale, compared

with $40.9 billion at December 31, 2005, with a net unrealized

gain of $722 million and $591 million for the same periods,

respectively. We also held $796 million of marketable equity

securities available for sale at December 31, 2006, and

$900 million at December 31, 2005, with a net unrealized

gain of $204 million and $342 million for the same periods,

respectively.

The weighted-average expected maturity of debt securities

available for sale was 5.2 years at December 31, 2006. Since

75% of this portfolio is mortgage-backed securities, the

expected remaining maturity may differ from contractual

maturity because borrowers may have the right to prepay

obligations before the underlying mortgages mature.

The estimated effect of a 200 basis point increase or

decrease in interest rates on the fair value and the expected

remaining maturity of the mortgage-backed securities avail-

able for sale portfolio is shown in Table 8 below.

See Note 5 (Securities Available for Sale) to Financial

Statements for securities available for sale by security type.

Loan Portfolio

A comparative schedule of average loan balances is included

in Table 3; year-end balances are in Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements.

Total loans at December 31, 2006, were $319.1 billion,

compared with $310.8 billion at year-end 2005, an increase

of 3%. Consumer loans of $190.4 billion at December 31, 2006,

decreased 3% from $196.4 billion a year ago. Excluding 1-4 family

first mortgages (the category affected by ARMs sales), consumer

loans increased 16% from 2005. Commercial and commercial

real estate loans of $122.1 billion at December 31, 2006,

from Hurricane Katrina. Total revenue rose 16% in 2006,

reaching $5.4 billion, compared with $4.7 billion in 2005,

due to higher net interest income. Average loans were

$57.5 billion in 2006, up from $46.9 billion in 2005.

Noninterest expense increased $247 million, or 10%, in

2006 from 2005, reflecting investments in new consumer

finance stores and additional team members.