Wells Fargo 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

In 2006, we continued to focus on building our business with

investments in additional team members and new banking

stores. The 9% increase in noninterest expense to $20.7 billion

in 2006 from $19.0 billion in 2005 was due primarily to

the increase in salaries, incentive compensation and employee

benefits. We grew our sales and service force by adding

4,497 team members (full-time equivalents), including

1,914 retail platform bankers and 110 private bankers.

Incentive compensation in 2006 also included $134 million

of stock option expense, which we are required to recognize

under FAS 123(R), Share-Based Payment, adopted in 2006.

In 2006, we opened 109 regional banking stores and we

remodeled 528 of our banking stores. We expect to open

another 100 regional banking stores in 2007.

Operating Segment Results

We have three lines of business for management reporting:

Community Banking, Wholesale Banking and Wells Fargo

Financial. For a more complete description of our operating

segments, including additional financial information and the

underlying management accounting process, see Note 19

(Operating Segments) to Financial Statements.

Segment results for prior periods have been revised due

to the realignment of our insurance business into Wholesale

Banking in 2006, designed to leverage the expertise, systems

and resources of the existing businesses.

COMMUNITY BANKING’S net income increased to $5.53 billion

in 2006 from $5.47 billion in 2005. Total revenue for 2006

increased $912 million, or 4%, driven by an improved net

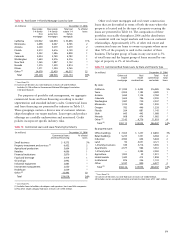

Noninterest Expense

Table 7: Noninterest Expense

(in millions) Year ended December 31, % Change

2006 2005 2004 2006/ 2005/

2005 2004

Salaries $ 7,007 $ 6,215 $ 5,393 13% 15%

Incentive compensation 2,885 2,366 1,807 22 31

Employee benefits 2,035 1,874 1,724 99

Equipment 1,252 1,267 1,236 (1) 3

Net occupancy 1,405 1,412 1,208 —17

Operating leases 630 635 633 (1) —

Outside professional services 942 835 669 13 25

Contract services 579 596 626 (3) (5)

Travel and entertainment 542 481 442 13 9

Advertising and promotion 456 443 459 3(3)

Outside data processing 437 449 418 (3) 7

Postage 312 281 269 11 4

Telecommunications 279 278 296 —(6)

Insurance 257 224 247 15 (9)

Stationery and supplies 223 205 240 9(15)

Operating losses 180 194 192 (7) 1

Security 179 167 161 74

Core deposit intangibles 112 123 134 (9) (8)

Charitable donations 59 61 248 (3) (75)

Net losses from debt

extinguishment 24 11 174 118 (94)

All other 947 901 997 5(10)

Total $20,742 $19,018 $17,573 98

interest margin resulting from solid loan and deposit growth.

Excluding real estate 1-4 family mortgages—the loan cate-

gory affected by the sales of ARMs during the year—total

average loans grew $15.1 billion, or 12%. Average deposit

growth was $18.8 billion, or 7%, and was driven by a 5%

increase in consumer checking accounts and 4% growth in

business checking accounts. Noninterest income increased

$497 million, or 5%, primarily due to strong double-digit

growth in debit and credit card fees, trust and investment

fees, and service charge fee income, driven by the growth in

both consumer and business checking accounts, partially

offset by lower mortgage banking noninterest income. The

provision for credit losses for 2006 decreased $8 million

from 2005, which included incremental losses due to the

change to the bankruptcy law in 2005. Noninterest expense

for 2006 increased $850 million, or 7%, due to the addition

of 2,800 sales and service team members, including 1,914 retail

platform bankers, the opening of 109 banking stores, 246

net new webATM®machines and investments in technology.

WHOLESALE BANKING’S net income was a record $2.09 billion

in 2006, up 17% from $1.79 billion in 2005, driven largely

by an 11% increase in earning assets and an expanding

net interest margin, as well as continued low credit losses.

Average loans increased 15% to $71.4 billion in 2006 from

$62.2 billion in 2005, with double-digit increases across

the majority of the wholesale lending businesses. Average

deposits grew 45% entirely due to increases in interest-bearing

deposits, driven by a mix of organic customer growth,

conversions of customer sweep accounts from off-balance

sheet money market funds into deposits, and continued

growth in foreign central bank deposits. The provision for

credit losses was $16 million in 2006 and $1 million in

2005. Noninterest income increased 15% to $4.31 billion in

2006, due to acquisitions of fee-generating businesses such

as Secured Capital, Reilly Mortgage, Barrington Associates

and Evergreen Funding, along with stronger asset management,

capital markets, insurance and foreign exchange revenue.

Noninterest expense increased 18% to $4.11 billion in 2006

from $3.49 billion in 2005, due to higher personnel-related

expenses, including staff additions, along with higher expenses

from acquisitions, expenses related to higher sales volumes,

and investments in new offices, businesses and systems.

WELLS FARGO FINANCIAL’S net income increased 111% to

$865 million in 2006 from $409 million in 2005. Net income

in 2006 was reduced by an increase of $160 million (pre tax)

in auto losses partially due to growth and seasoning, but

largely due to collection capacity constraints and restrictive

payment extension practices during the integration of the prime

and non-prime auto loan businesses. Net income for 2006

also included a $50 million (pre tax) release of provision for

credit losses releasing the remaining portion of the provision

made for Hurricane Katrina. Net income for 2005 included

incremental losses due to the change in the bankruptcy law, a

first quarter 2005 $163 million charge (pre tax) to conform

Wells Fargo Financial’s charge-off practices with FFIEC

guidelines, and $100 million (pre tax) for estimated losses