Wells Fargo 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

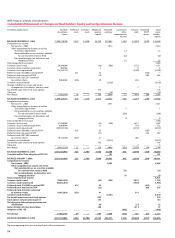

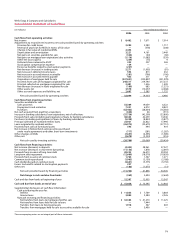

Notes to Financial Statements

Wells Fargo & Company is a diversified financial services

company. We provide banking, insurance, investments, mort-

gage banking and consumer finance through banking stores,

the internet and other distribution channels to consumers,

businesses and institutions in all 50 states of the U.S. and in

other countries. In this Annual Report, when we refer to

“the Company,” “we,” “our” or “us” we mean Wells Fargo

& Company and Subsidiaries (consolidated). Wells Fargo &

Company (the Parent) is a financial holding company and a

bank holding company.

Our accounting and reporting policies conform with

U.S. generally accepted accounting principles (GAAP) and

practices in the financial services industry. To prepare the

financial statements in conformity with GAAP, management

must make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial

statements and income and expenses during the reporting

period. Management has made significant estimates in several

areas, including the allowance for credit losses (Note 6),

valuing residential mortgage servicing rights (Notes 20 and

21) and pension accounting (Note 15). Actual results could

differ from those estimates.

In the Financial Statements and related Notes, all common

share and per share disclosures reflect the two-for-one stock

split in the form of a 100% stock dividend distributed

August 11, 2006.

The following is a description of our significant

accounting policies.

Consolidation

Our consolidated financial statements include the accounts

of the Parent and our majority-owned subsidiaries and vari-

able interest entities (VIEs) (defined below) in which we are

the primary beneficiary. Significant intercompany accounts

and transactions are eliminated in consolidation. If we own

at least 20% of an entity, we generally account for the

investment using the equity method. If we own less than

20% of an entity, we generally carry the investment at cost,

except marketable equity securities, which we carry at fair

value with changes in fair value included in other compre-

hensive income. Assets accounted for under the equity or

cost method are included in other assets.

We are a variable interest holder in certain special-

purpose entities in which we do not have a controlling

financial interest or do not have enough equity at risk for the

entity to finance its activities without additional subordinated

financial support from other parties. Our variable interest

arises from contractual, ownership or other monetary interests

in the entity, which change with fluctuations in the entity’s

net asset value. We consolidate a VIE if we are the primary

beneficiary because we will absorb a majority of the entity’s

expected losses, receive a majority of the entity’s expected

residual returns, or both.

Trading Assets

Trading assets are primarily securities, including corporate

debt, U.S. government agency obligations and other securities

that we acquire for short-term appreciation or other trading

purposes, and the fair value of derivatives held for customer

accommodation purposes or proprietary trading. Trading

assets are carried at fair value, with realized and unrealized

gains and losses recorded in noninterest income. Noninterest

income from trading assets was $544 million, $571 million

and $523 million in 2006, 2005 and 2004, respectively.

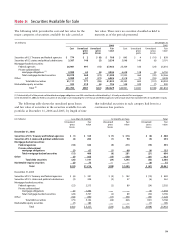

Securities

SECURITIES AVAILABLE FOR SALE Debt securities that we might

not hold until maturity and marketable equity securities are

classified as securities available for sale and reported at esti-

mated fair value. Unrealized gains and losses, after applicable

taxes, are reported in cumulative other comprehensive income.

We use current quotations, where available, to estimate the

fair value of these securities. Where current quotations are

not available, we estimate fair value based on the present

value of future cash flows, adjusted for the credit rating of

the securities, prepayment assumptions and other factors.

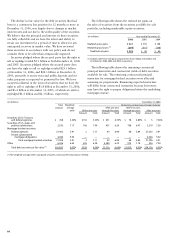

We reduce the asset value when we consider the declines

in the value of debt securities and marketable equity securities

to be other than temporary and record the estimated loss

in noninterest income. We conduct other-than-temporary

impairment analysis on a quarterly basis. The initial indica-

tor of other-than-temporary impairment for both debt and

equity securities is a decline in market value below the

amount recorded for an investment, and the severity and

duration of the decline. In determining whether an impair-

ment is other than temporary, we consider the length of time

and the extent to which market value has been less than

cost, any recent events specific to the issuer and economic

conditions of its industry, and our ability and intent to hold

the investment for a period of time sufficient to allow for

any anticipated recovery.

For marketable equity securities, we also consider the

issuer’s financial condition, capital strength, and near-term

prospects.

For debt securities we also consider:

• the cause of the price decline— general level of interest

rates and industry and issuer-specific factors;

• the issuer’s financial condition, near term prospects

and current ability to make future payments in a

timely manner;

• the issuer’s ability to service debt; and

• any change in agencies’ ratings at evaluation date from

acquisition date and any likely imminent action.

The securities portfolio is an integral part of our asset/

liability management process. We manage these investments

to provide liquidity, manage interest rate risk and maximize

Note 1: Summary of Significant Accounting Policies