Wells Fargo 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Note 4: Federal Funds Sold, Securities Purchased Under Resale Agreements

and Other Short-Term Investments

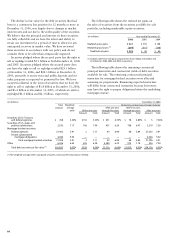

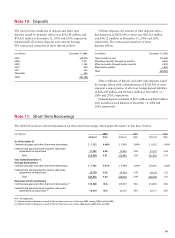

The table to the right provides the detail of federal funds

sold, securities purchased under resale agreements and other

short-term investments.

(in millions) December 31,

2006 2005

Federal funds sold and securities

purchased under resale agreements $5,024 $3,789

Interest-earning deposits 413 847

Other short-term investments 641 670

Total $6,078 $5,306

Federal Reserve Board regulations require that each of our

subsidiary banks maintain reserve balances on deposits with

the Federal Reserve Banks. The average required reserve

balance was $1.7 billion in 2006 and $1.4 billion in 2005.

Federal law restricts the amount and the terms of both

credit and non-credit transactions between a bank and its

nonbank affiliates. They may not exceed 10% of the bank’s

capital and surplus (which for this purpose represents Tier 1

and Tier 2 capital, as calculated under the risk-based capital

guidelines, plus the balance of the allowance for credit losses

excluded from Tier 2 capital) with any single nonbank affiliate

and 20% of the bank’s capital and surplus with all its nonbank

affiliates. Transactions that are extensions of credit may require

collateral to be held to provide added security to the bank.

(For further discussion of risk-based capital, see Note 25.)

Dividends paid by our subsidiary banks are subject to

various federal and state regulatory limitations. Dividends

that may be paid by a national bank without the express

Note 3: Cash, Loan and Dividend Restrictions

approval of the Office of the Comptroller of the Currency

(OCC) are limited to that bank’s retained net profits for the

preceding two calendar years plus retained net profits up to

the date of any dividend declaration in the current calendar

year. Retained net profits, as defined by the OCC, consist

of net income less dividends declared during the period. We

also have state-chartered subsidiary banks that are subject

to state regulations that limit dividends. Under those provi-

sions, our national and state-chartered subsidiary banks

could have declared additional dividends of $4,762 million

at December 31, 2006, without obtaining prior regulatory

approval. Our nonbank subsidiaries are also limited by

certain federal and state statutory provisions and regulations

covering the amount of dividends that may be paid in any

given year. Based on retained earnings at December 31, 2006,

our nonbank subsidiaries could have declared additional

dividends of $3,201 million at December 31, 2006, without

obtaining prior approval.