Wells Fargo 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

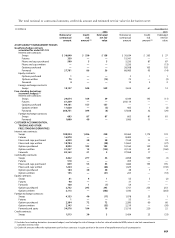

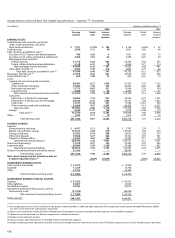

Note 27: Fair Value of Financial Instruments

MORTGAGES HELD FOR SALE

The fair value of mortgages held for sale is based on quoted

market prices or on what secondary markets are currently

offering for portfolios with similar characteristics.

LOANS HELD FOR SALE

The fair value of loans held for sale is based on what

secondary markets are currently offering for portfolios

with similar characteristics.

LOANS

The fair valuation calculation differentiates loans based on

their financial characteristics, such as product classification,

loan category, pricing features and remaining maturity.

Prepayment estimates are evaluated by product and loan rate.

The fair value of commercial loans, other real estate

mortgage loans and real estate construction loans is calculated

by discounting contractual cash flows using discount rates

that reflect our current pricing for loans with similar

characteristics and remaining maturity.

For real estate 1-4 family first and junior lien mortgages,

fair value is calculated by discounting contractual cash flows,

adjusted for prepayment estimates, using discount rates

based on current industry pricing for loans of similar size,

type, remaining maturity and repricing characteristics.

For consumer finance and credit card loans, the portfolio’s

yield is equal to our current pricing and, therefore, the fair

value is equal to book value.

For other consumer loans, the fair value is calculated

by discounting the contractual cash flows, adjusted for

prepayment estimates, based on the current rates we offer

for loans with similar characteristics.

Loan commitments, standby letters of credit and commercial

and similar letters of credit not included in the following table

had contractual values of $216.5 billion, $12.0 billion and

$801 million, respectively, at December 31, 2006, and

$191.4 billion, $10.9 billion and $761 million, respectively,

at December 31, 2005. These instruments generate ongoing

fees at our current pricing levels. Of the commitments at

December 31, 2006, 40% mature within one year. Deferred

fees on commitments and standby letters of credit totaled

$39 million and $47 million at December 31, 2006 and 2005,

respectively. Carrying cost estimates fair value for these fees.

NONMARKETABLE EQUITY INVESTMENTS

There are generally restrictions on the sale and/or liquidation

of our nonmarketable equity investments, including federal

bank stock. Federal bank stock carrying value approximates

fair value. We use all facts and circumstances available to

estimate the fair value of our cost method investments.

We typically consider our access to and need for capital

(including recent or projected financing activity), qualitative

assessments of the viability of the investee, and prospects

for its future.

FAS 107, Disclosures about Fair Value of Financial

Instruments, requires that we disclose estimated fair values

for our financial instruments. This disclosure should be

read with the financial statements and Notes to Financial

Statements in this Annual Report. The carrying amounts in

the following table are recorded in the balance sheet under

the indicated captions.

We base our fair values on the price that would be

received to sell an asset, or paid upon the transfer of a liability,

in an orderly transaction between market participants at the

measurement date. Our fair value measurements are generally

determined based on assumptions that market participants

would use in pricing the asset or liability and are based on

market data obtained from independent sources. However,

in certain cases, we use our own assumptions about

market participant assumptions developed based on the

best information available in the circumstances. These

valuations are our estimates, and are often calculated based

on current pricing policy, the economic and competitive

environment, the characteristics of the financial instruments

and other such factors. Therefore, the results cannot be

determined with precision and may not be realized in an

actual sale or immediate settlement of the instruments. There

may be inherent weaknesses in any calculation technique,

and changes in the underlying assumptions used, including

discount rates and estimates of future cash flows, that

could significantly affect the results.

We have not included certain material items in our

disclosure, such as the value of the long-term relationships

with our deposit, credit card and trust customers, since

these intangibles are not financial instruments. For all

of these reasons, the total of the fair value calculations

presented do not represent, and should not be construed

to represent, the underlying value of the Company.

Financial Assets

SHORT-TERM FINANCIAL ASSETS

Short-term financial assets include cash and due from banks,

federal funds sold and securities purchased under resale

agreements and due from customers on acceptances. The

carrying amount is a reasonable estimate of fair value

because of the relatively short time between the origination

of the instrument and its expected realization.

TRADING ASSETS

Trading assets are carried at fair value.

SECURITIES AVAILABLE FOR SALE

Securities available for sale are carried at fair value.

For further information, see Note 5.