Wells Fargo 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

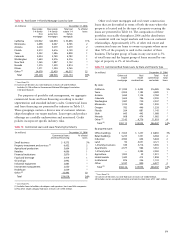

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

Off-Balance Sheet Arrangements,Variable Interest

Entities, Guarantees and Other Commitments

We consolidate our majority-owned subsidiaries and variable

interest entities in which we are the primary beneficiary.

Generally, we use the equity method of accounting if we own

at least 20% of an entity and we carry the investment at cost

if we own less than 20% of an entity. See Note 1 (Summary

of Significant Accounting Policies) to Financial Statements

for our consolidation policy.

In the ordinary course of business, we engage in financial

transactions that are not recorded in the balance sheet, or

may be recorded in the balance sheet in amounts that are

different than the full contract or notional amount of the

transaction. These transactions are designed to (1) meet the

financial needs of customers, (2) manage our credit, market

or liquidity risks, (3) diversify our funding sources or

(4) optimize capital, and are accounted for in accordance

with U.S. generally accepted accounting principles (GAAP).

Almost all of our off-balance sheet arrangements result

from securitizations. We routinely securitize home mortgage

loans and, from time to time, other financial assets, including

student loans, commercial mortgages and auto receivables.

We normally structure loan securitizations as sales, in accor-

dance with FAS 140. This involves the transfer of financial

assets to certain qualifying special-purpose entities that we

are not required to consolidate. In a securitization, we can

convert the assets into cash earlier than if we held the assets

to maturity. Special-purpose entities used in these types

of securitizations obtain cash to acquire assets by issuing

securities to investors. In a securitization, we record a liabili-

ty related to standard representations and warranties we

make to purchasers and issuers for receivables transferred.

Also, we generally retain the right to service the transferred

receivables and to repurchase those receivables from the

special-purpose entity if the outstanding balance of the

receivable falls to a level where the cost exceeds the benefits

of servicing such receivables.

At December 31, 2006, securitization arrangements

sponsored by the Company consisted of $168 billion in

securitized loan receivables, including $109 billion of home

mortgage loans. At December 31, 2006, the retained servicing

rights and other interests held related to these securitizations

were $1,632 million, consisting of $1,223 million in servicing

assets, $358 million in other interests held and $51 million in

securities. Related to our securitizations, we have committed

to provide up to $33 million in credit enhancements.

We also hold variable interests greater than 20% but less

than 50% in certain special-purpose entities formed to provide

affordable housing and to securitize corporate debt that had

approximately $2.9 billion in total assets at December 31,

2006. We are not required to consolidate these entities. Our

maximum exposure to loss as a result of our involvement with

these unconsolidated variable interest entities was approxi-

mately $980 million at December 31, 2006, predominantly

representing investments in entities formed to invest in

affordable housing. However, we expect to recover our

investment over time primarily through realization of federal

low-income housing tax credits.

For more information on securitizations, including sales

proceeds and cash flows from securitizations, see Note 20

(Securitizations and Variable Interest Entities) to Financial

Statements.

Home Mortgage, in the ordinary course of business, origi-

nates a portion of its mortgage loans through unconsolidated

joint ventures in which we own an interest of 50% or less.

Loans made by these joint ventures are funded by Wells Fargo

Bank, N.A. through an established line of credit and are

subject to specified underwriting criteria. At December 31,

2006, the total assets of these mortgage origination joint

ventures were approximately $90 million. We provide liquidity

to these joint ventures in the form of outstanding lines of

credit and, at December 31, 2006, these liquidity commit-

ments totaled $383 million.

We also hold interests in other unconsolidated joint

ventures formed with unrelated third parties to provide

efficiencies from economies of scale. A third party manages

our real estate lending services joint ventures and provides

customers title, escrow, appraisal and other real estate related

services. Our merchant services joint venture includes credit

card processing and related activities. At December 31, 2006,

total assets of our real estate lending and merchant services

joint ventures were approximately $835 million.

In connection with certain brokerage, asset management,

insurance agency and other acquisitions we have made, the

terms of the acquisition agreements provide for deferred

payments or additional consideration, based on certain

performance targets. At December 31, 2006, the amount

of additional consideration we expected to pay was not

significant to our financial statements.

As a financial services provider, we routinely commit to

extend credit, including loan commitments, standby letters

of credit and financial guarantees. A significant portion of

commitments to extend credit may expire without being

drawn upon. These commitments are subject to the same

credit policies and approval process used for our loans. For

more information, see Note 6 (Loans and Allowance for Credit

Losses) and Note 24 (Guarantees) to Financial Statements.

In our venture capital and capital markets businesses, we

commit to fund equity investments directly to investment

funds and to specific private companies. The timing of future

cash requirements to fund these commitments generally

depends on the related investment cycle, the period over

which privately-held companies are funded by investors and

ultimately sold or taken public. This cycle can vary based on

market conditions and the industry in which the companies

operate. We expect that many of these investments will become

public, or otherwise become liquid, before the balance of

unfunded equity commitments is used. At December 31, 2006,