Wells Fargo 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Our business units and the office of the Chief Credit

Officer periodically review all credit risk portfolios to ensure

that the risk identification processes are functioning properly

and that credit standards are followed. Business units con-

duct quality assurance reviews to ensure that loans meet

portfolio or investor credit standards. Our loan examiners

and internal auditors also independently review portfolios

with credit risk.

Our primary business focus on middle-market commercial

and residential real estate, auto and small consumer lending,

results in portfolio diversification. We assess loan portfolios

for geographic, industry or other concentrations and use

mitigation strategies, which may include loan sales, syndica-

tions or third party insurance, to minimize these concentra-

tions, as we deem appropriate.

In our commercial loan, commercial real estate loan and

lease financing portfolios, larger or more complex loans are

individually underwritten and judgmentally risk rated. They

are periodically monitored and prompt corrective actions are

taken on deteriorating loans. Smaller, more homogeneous

commercial small business loans are approved and moni-

tored using statistical techniques.

Retail loans are typically underwritten with statistical

decision-making tools and are managed throughout their life

cycle on a portfolio basis. The Chief Credit Officer establishes

corporate standards for model development and validation to

ensure sound credit decisions and regulatory compliance and

approves new model implementation and periodic validation.

Residential real estate mortgages are one of our core

products. We offer a broad spectrum of first mortgage and

junior lien loans that we consider predominantly prime or

near prime. These loans are almost entirely secured by a

primary residence for the purpose of purchase money,

refinance, debt consolidation, or home equity loans. We

do not believe negative amortization or option ARMs

benefit our customers and have not made or purchased

these loan products.

We originate mortgage loans through a variety of sources,

including our retail sales force, licensed real estate brokers

and correspondent lenders. We apply consistent credit poli-

cies, borrower documentation standards, Federal Deposit

Insurance Corporation Improvement Act of 1991 (FDICIA)

compliant appraisal requirements, and sound underwriting,

regardless of application source. We perform quality control

reviews for third party originated loans and actively manage

or terminate sources that do not meet our credit standards.

We believe our underwriting process is well controlled

and appropriate for the needs of our customers. We offer

interest-only products but ensure that the customer qualifies

for higher payments after the initial interest-only period. The

majority of our reduced documentation loans are initiated

based on our determination that the customer is creditworthy

without having to supply unnecessary paperwork. Appraisals

are ordered and reviewed independently to ensure supportable

property values. We obtain mortgage insurance on higher

loan-to-value first mortgage loans, and monitor regional

economic and real estate trends modifying underwriting

standards as needed.

We continue to be among the highest rated loan servicers

for prime and non-prime residential real estate mortgage loans.

High quality servicing improves customer service and has been

demonstrated to result in lower foreclosures and losses.

Each business unit completes quarterly asset quality

forecasts to quantify its intermediate-term outlook for loan

losses and recoveries, nonperforming loans and market trends.

To make sure our overall loss estimates and the allowance

for credit losses is adequate, we conduct periodic stress tests.

This includes a portfolio loss simulation model that simulates

a range of possible losses for various sub-portfolios assuming

various trends in loan quality, stemming from economic

conditions or borrower performance.

We routinely review and evaluate risks that are not

borrower specific but that may influence the behavior of

a particular credit, group of credits or entire sub-portfolios.

We also assess risk for particular industries, geographic

locations such as states or Metropolitan Statistical Areas

(MSAs) and specific macroeconomic trends.

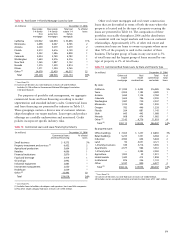

LOAN PORTFOLIO CONCENTRATIONS

Loan concentrations may exist when there are borrowers

engaged in similar activities or types of loans extended to a

diverse group of borrowers that could cause those borrowers

or portfolios to be similarly impacted by economic or other

conditions.

The concentrations of real estate 1-4 family mortgage

loans by state are presented in Table 12. Our real estate 1-4

family mortgage loans to borrowers in the state of California

represented approximately 11% of total loans at December 31,

2006, compared with 14% at the end of 2005. These loans

are mostly within the larger metropolitan areas in California,

with no single area consisting of more than 3% of our total

loans. Changes in real estate values and underlying economic

or market conditions for these areas are monitored continu-

ously within the credit risk management process.

Some of our real estate 1-4 family mortgage loans, includ-

ing first mortgage and home equity products, include an

interest-only feature as part of the loan terms. At December 31,

2006, these loans were approximately 19% of total loans,

compared with 26% at the end of 2005. Substantially all of

these loans are considered to be prime or near prime. We do

not offer option adjustable-rate mortgage products, nor do

we offer variable-rate mortgage products with fixed payment

amounts, commonly referred to within the financial services

industry as negative amortizing mortgage loans.