Wells Fargo 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

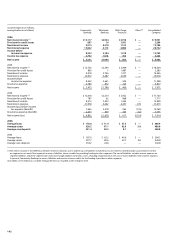

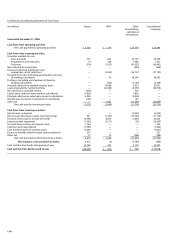

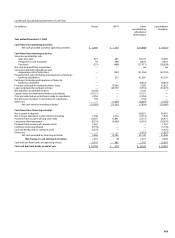

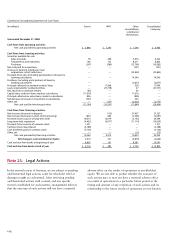

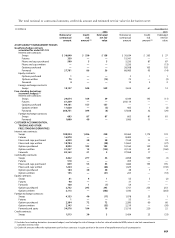

Note 22: Condensed Consolidating Financial Statements

Condensed Consolidating Statement of Income

(in millions) Parent WFFI Other Eliminations Consolidated

consolidating Company

subsidiaries

Year ended December 31, 2006

Dividends from subsidiaries:

Bank $2,176 $ — $ — $(2,176) $ —

Nonbank 876 — — (876) —

Interest income from loans — 5,283 20,370 (42) 25,611

Interest income from subsidiaries 3,266 — — (3,266) —

Other interest income 103 102 6,428 (5)6,628

Total interest income 6,421 5,385 26,798 (6,365) 32,239

Deposits — — 7,174 — 7,174

Short-term borrowings 436 381 1,065 (890) 992

Long-term debt 3,197 1,758 710 (1,543) 4,122

Total interest expense 3,633 2,139 8,949 (2,433) 12,288

NET INTEREST INCOME 2,788 3,246 17,849 (3,932) 19,951

Provision for credit losses —1,061 1,143 —2,204

Net interest income after provision for credit losses 2,788 2,185 16,706 (3,932) 17,747

NONINTEREST INCOME

Fee income –nonaffiliates — 285 8,946 — 9,231

Other 180 259 6,126 (56)6,509

Total noninterest income 180 544 15,072 (56)15,740

NONINTEREST EXPENSE

Salaries and benefits 95 1,128 10,704 — 11,927

Other 22 976 8,753 (936) 8,815

Total noninterest expense 117 2,104 19,457 (936) 20,742

INCOME BEFORE INCOME TAX EXPENSE

(BENEFIT) AND EQUITY IN UNDISTRIBUTED

INCOME OF SUBSIDIARIES 2,851 625 12,321 (3,052) 12,745

Income tax expense (benefit) (165) 205 4,223 — 4,263

Equity in undistributed income of subsidiaries 5,466 — — (5,466) —

NET INCOME $8,482 $ 420 $ 8,098 $(8,518) $ 8,482

Following are the condensed consolidating financial statements

of the Parent and Wells Fargo Financial, Inc. and its wholly-

owned subsidiaries (WFFI). In 2002, the Parent issued a full

and unconditional guarantee of all outstanding term debt

securities and commercial paper of WFFI. WFFI ceased filing

periodic reports under the Securities Exchange Act of 1934

and is no longer a separately rated company. The Parent also

guaranteed all outstanding term debt securities of Wells Fargo

Financial Canada Corporation (WFFCC), WFFI’s wholly-

owned Canadian subsidiary. WFFCC has continued to issue

term debt securities and commercial paper in Canada, fully

guaranteed by the Parent. The Wells Fargo Financial business

segment for management reporting (see Note 19) consists of

WFFI and other affiliated consumer finance entities managed

by WFFI that are included within other consolidating

subsidiaries in the following tables.