Wells Fargo 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

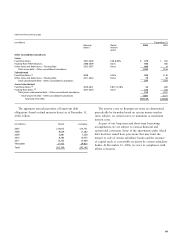

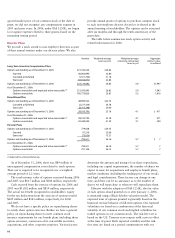

The gross carrying amount of intangible assets and

accumulated amortization was:

Note 8: Intangible Assets

We based our projections of amortization expense shown

above on existing asset balances at December 31, 2006.

Future amortization expense may vary based on additional

core deposit or other intangibles acquired through

business combinations.

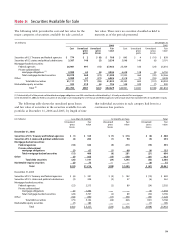

(in millions) December 31,

2006 2005

Gross Accumulated Gross Accumulated

carrying amortization carrying amortization

amount amount

Amortized intangible assets:

MSRs, before valuation

allowance (1):

Residential $— $—$24,957 $11,382

Commercial 457 80 169 46

Core deposit

intangibles 2,374 1,991 2,432 1,943

Credit card and

other intangibles 581 378 567 312

Total intangible

assets $ 3,412 $2,449 $28,125 $13,683

MSRs (fair value) (1) $17,591 $—

Trademark 14 14

(1) Prior to 2006, amortized intangible assets included both residential and commercial

MSRs. Effective January 1, 2006, upon adoption of FAS 156, residential MSRs are

measured at fair value and are no longer amortized.See Note 21 for additional

information on MSRs.

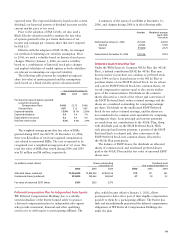

(in millions) Core Other(1) Total

deposit

intangibles

Year ended

December 31, 2006 $112 $100 $212

Estimate for year ended

December 31,

2007 $102 $ 93 $195

2008 94 82 176

2009 86 75 161

2010 77 70 147

2011 19 61 80

(1) Includes amortized commercial MSRs and credit card and other intangibles.

The following table provides the current year and

estimated future amortization expense for amortized

intangible assets.

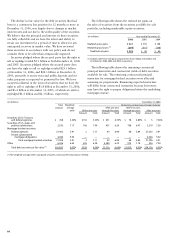

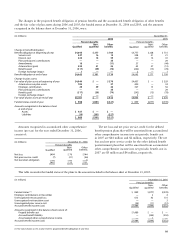

The changes in the carrying amount of goodwill as allocated to our operating segments for goodwill impairment analysis were:

Note 9: Goodwill

For goodwill impairment testing, enterprise-level goodwill

acquired in business combinations is allocated to reporting units

based on the relative fair value of assets acquired and recorded

in the respective reporting units. Through this allocation, we

assigned enterprise-level goodwill to the reporting units that

are expected to benefit from the synergies of the combination.

We used discounted estimated future net cash flows to evaluate

goodwill reported at all reporting units.

For our goodwill impairment analysis, we allocate all

of the goodwill to the individual operating segments. For

management reporting we do not allocate all of the goodwill

to the individual operating segments; some is allocated at

the enterprise level. See Note 19 for further information

on management reporting. The balances of goodwill for

management reporting were:

(in millions) Community Wholesale Wells Fargo Enterprise Consolidated

Banking Banking Financial Company

December 31, 2005 $ 3,516 $ 1,108 $366 $ 5,797 $ 10,787

December 31, 2006 3,538 1,574 366 5,797 11,275

(in millions) Community Wholesale Wells Fargo Consolidated

Banking Banking Financial Company

December 31, 2004 $ 7,291 $ 3,037 $ 353 $ 10,681

Reduction in goodwill related to divested businesses (31) (3) — (34)

Goodwill from business combinations 125 13 — 138

Realignment of automobile financing business (11) — 11 —

Foreign currency translation adjustments — — 2 2

December 31, 2005 7,374 3,047 366 10,787

Goodwill from business combinations 30 458 — 488

Realignment of businesses (primarily insurance) (19) 19 — —

December 31, 2006 $7,385 $3,524 $366 $11,275