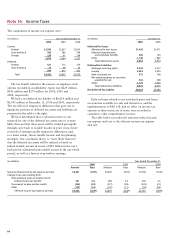

Wells Fargo 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

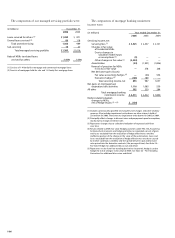

In the normal course of creating securities to sell to

investors, we may sponsor special-purpose entities that

hold, for the benefit of the investors, financial instruments

that are the source of payment to the investors. Special-purpose

entities are consolidated unless they meet the criteria for

a qualifying special-purpose entity in accordance with

FAS 140 or are not required to be consolidated under

existing accounting guidance.

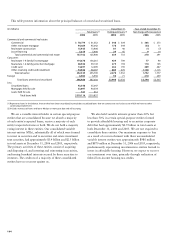

For securitizations completed in 2006 and 2005, we

used the following assumptions to determine the fair value

of mortgage servicing rights and other interests held at the

date of securitization.

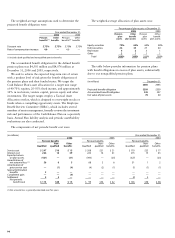

The sensitivities in the previous table are hypothetical

and should be relied on with caution. Changes in fair value

based on a 10% variation in assumptions generally cannot

be extrapolated because the relationship of the change in

the assumption to the change in fair value may not be linear.

Also, in the previous table, the effect of a variation in a

particular assumption on the fair value of the other interests

held is calculated independently without changing any other

assumption. In reality, changes in one factor may result in

changes in another (for example, changes in prepayment

speed estimates could result in changes in the discount rates),

which might magnify or counteract the sensitivities.

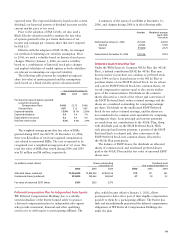

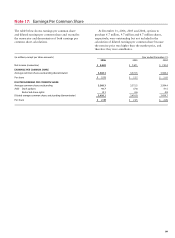

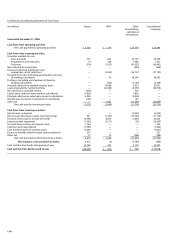

(in millions) Year ended December 31,

2006 2005

Mortgage Other Mortgage Other

loans financial loans financial

assets assets

Sales proceeds from

securitizations $50,767 $103 $40,982 $225

Servicing fees 229 — 154 —

Cash flows on other

interests held 259 3 560 6

Note 20: Securitizations and Variable Interest Entities

We routinely originate, securitize and sell into the secondary

market home mortgage loans and, from time to time, other

financial assets, including student loans, commercial mortgages

and auto receivables. We typically retain the servicing rights

from these sales and may continue to hold other interests.

Through these securitizations, which are structured without

recourse to us and with no restrictions on the other interests

held, we may be exposed to a liability under standard repre-

sentations and warranties we make to purchasers and issuers.

The amount recorded for this liability was not material to

our consolidated financial statements at year-end 2006 or

2005. We do not have significant credit risks from the other

interests held.

We recognized gains of $399 million from sales of

financial assets in securitizations in 2006 and $326 million

in 2005. Additionally, we had the following cash flows with

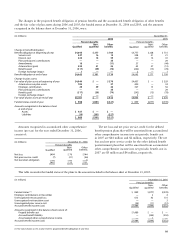

our securitization trusts. Key economic assumptions and the sensitivity of the

current fair value to immediate adverse changes in those

assumptions at December 31, 2006, for mortgage servicing

rights, both purchased and retained, and other interests

held related to residential mortgage loan securitizations

are presented in the following table.

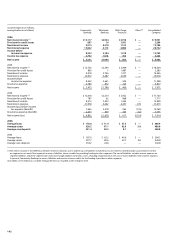

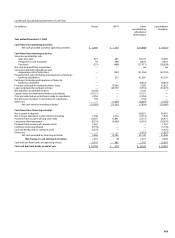

($ in millions) Mortgage Other

servicing rights interests held

Fair value of interests held $18,047 $367

Expected weighted-average life (in years) 5.6 6.3

Prepayment speed assumption (annual CPR) 12.4% 10.4%

Decrease in fair value from

10% adverse change $ 616 $ 14

Decrease in fair value from

25% adverse change 1,439 33

Discount rate assumption 10.8% 11.3%

Decrease in fair value from

100 basis point adverse change $ 651 $ 13

Decrease in fair value from

200 basis point adverse change 1,253 24

Mortgage Other

servicing rights interests held

2006 2005 2006 2005

Prepayment speed

(annual CPR (1)) (2) 15.7% 16.9% 13.9% 12.7%

Life (in years) (2) 5.8 5.6 7.0 7.0

Discount rate (2) 10.5% 10.1% 10.0% 10.2%

(1) Constant prepayment rate.

(2) Represents weighted averages for all other interests held resulting from

securitizations completed in 2006 and 2005.

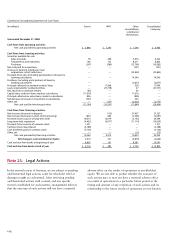

Other interests held – AAA

mortgage-backed securities

2005

Prepayment speed (annual CPR) 26.8%

Life (in years) 2.4

Discount spread to LIBOR curve 0.22%

At December 31, 2005, we also retained some AAA-rated

floating-rate mortgage-backed securities, which were sold

in 2006. The fair value at the date of securitization was

determined using quoted market prices. The implied CPR,

life, and discount spread to the London Interbank Offered

Rate (LIBOR) curve at the date of securitization is presented

in the following table.