Wells Fargo 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

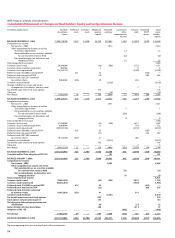

71

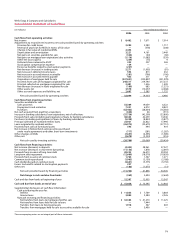

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Cash Flows

(in millions) Year ended December 31,

2006 2005 2004

Cash flows from operating activities:

Net income $ 8,482 $ 7,671 $ 7,014

Adjustments to reconcile net income to net cash provided (used) by operating activities:

Provision for credit losses 2,204 2,383 1,717

Reversal of provision for MSRs in excess of fair value —(378) (208)

Change in fair value of residential MSRs 2,453 ——

Depreciation and amortization 3,221 4,161 3,449

Net gains on securities available for sale (326) (40) (60)

Net gains on mortgage loan origination/sales activities (1,116) (1,085) (539)

Other net losses (gains) (259) (75) 9

Preferred shares released to ESOP 355 307 265

Stock option compensation expense 134 ——

Excess tax benefits related to stock option payments (227) ——

Net decrease (increase) in trading assets 5,271 (1,905) (81)

Net increase in deferred income taxes 593 813 432

Net increase in accrued interest receivable (291) (796) (196)

Net increase in accrued interest payable 455 311 47

Originations of mortgages held for sale (237,841) (230,897) (221,978)

Proceeds from sales of mortgages originated for sale 240,517 214,740 217,272

Principal collected on mortgages originated for sale 2,401 1,426 1,409

Net decrease (increase) in loans originated for sale (109) 683 (1,331)

Other assets, net 3,570 (10,237) (2,468)

Other accrued expenses and liabilities, net 2,607 3,585 1,732

Net cash provided (used) by operating activities 32,094 (9,333) 6,485

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 53,304 19,059 6,322

Prepayments and maturities 7,321 6,972 8,823

Purchases (62,462) (28,634) (16,583)

Net cash acquired from (paid for) acquisitions (626) 66 (331)

Increase in banking subsidiaries’ loan originations, net of collections (37,730) (42,309) (33,800)

Proceeds from sales (including participations) of loans by banking subsidiaries 38,343 42,239 14,540

Purchases (including participations) of loans by banking subsidiaries (5,338) (8,853) (5,877)

Principal collected on nonbank entities’ loans 23,921 22,822 17,996

Loans originated by nonbank entities (26,974) (33,675) (27,751)

Proceeds from sales of foreclosed assets 593 444 419

Net increase in federal funds sold, securities purchased

under resale agreements and other short-term investments (717) (281) (1,287)

Other changes in MSRs (7,657) (4,595) (1,389)

Other, net (2,678) (3,324) (516)

Net cash used by investing activities (20,700) (30,069) (39,434)

Cash flows from financing activities:

Net increase (decrease) in deposits (4,452) 38,961 27,327

Net increase (decrease) in short-term borrowings (11,156) 1,878 (2,697)

Proceeds from issuance of long-term debt 20,255 26,473 29,394

Long-term debt repayment (12,609) (18,576) (19,639)

Proceeds from issuance of common stock 1,764 1,367 1,271

Common stock repurchased (1,965) (3,159) (2,188)

Cash dividends paid on common stock (3,641) (3,375) (3,150)

Excess tax benefits related to stock option payments 227 ——

Other, net (186) (1,673) (13)

Net cash provided (used) by financing activities (11,763) 41,896 30,305

Net change in cash and due from banks (369) 2,494 (2,644)

Cash and due from banks at beginning of year 15,397 12,903 15,547

Cash and due from banks at end of year $ 15,028 $ 15,397 $ 12,903

Supplemental disclosures of cash flow information:

Cash paid during the year for:

Interest $ 11,833 $ 7,769 $ 3,864

Income taxes 3,084 3,584 2,326

Noncash investing and financing activities:

Net transfers from loans to mortgages held for sale $ 32,383 $ 41,270 $ 11,225

Net transfers from loans held for sale to loans —7,444 —

Transfers from loans to foreclosed assets 1,918 567 603

Transfers from mortgages held for sale to securities available for sale —5,490 —

The accompanying notes are an integral part of these statements.