Wells Fargo 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

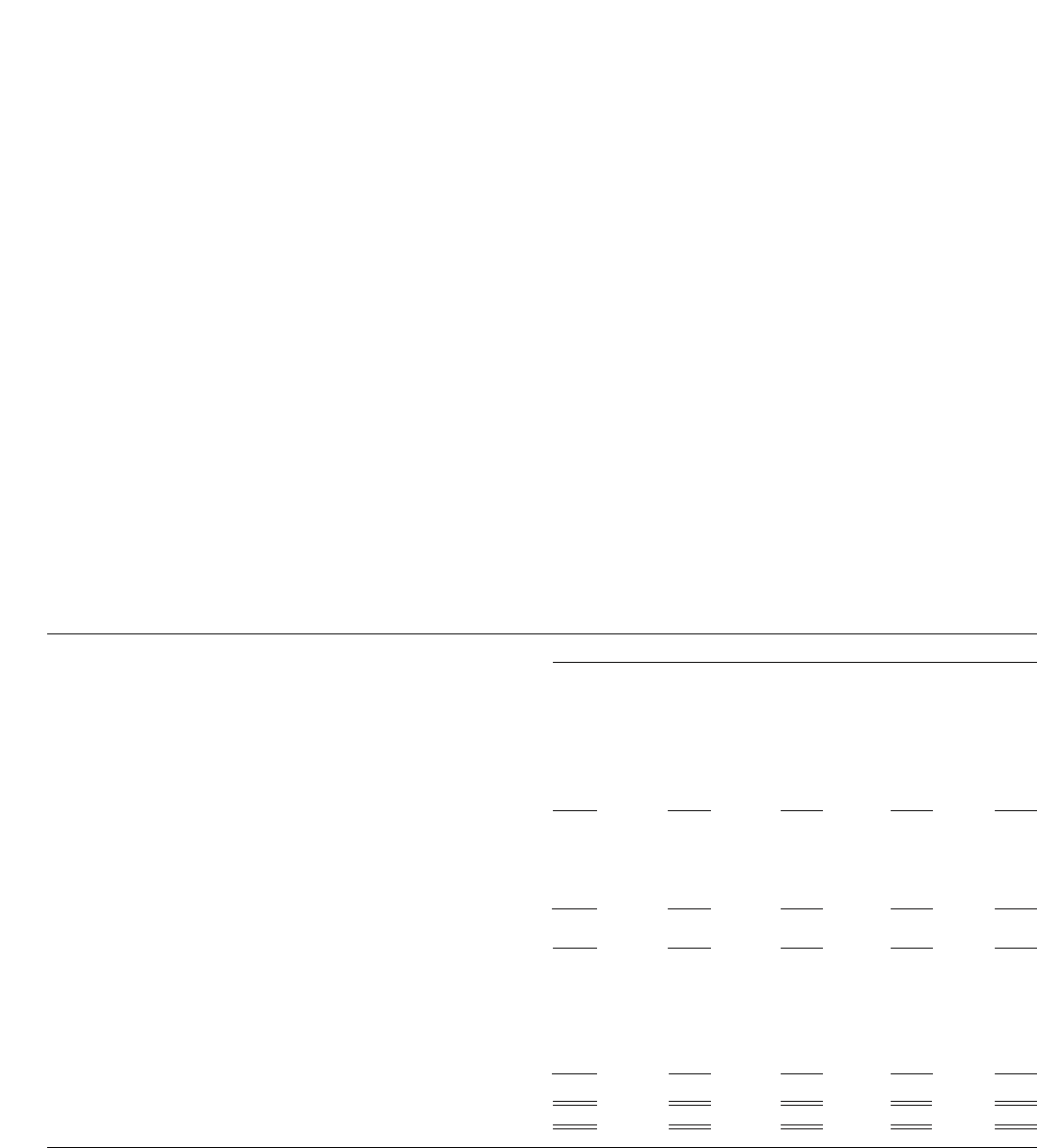

NONACCRUAL LOANS AND OTHER ASSETS

Table 15 shows the five-year trend for nonaccrual loans

and other assets. We generally place loans on nonaccrual

status when:

• the full and timely collection of interest or principal

becomes uncertain;

• they are 90 days (120 days with respect to real estate

1-4 family first and junior lien mortgages and auto

loans) past due for interest or principal (unless both

well-secured and in the process of collection); or

• part of the principal balance has been charged off.

Note 1 (Summary of Significant Accounting Policies) to

Financial Statements describes our accounting policy for

nonaccrual loans.

Consumer loans, primarily residential real estate and

auto, which we believe to have relatively low loss content,

represented about 65% of total nonperforming loans.

Approximately 40% of the $232 million increase in other

foreclosed assets from December 31, 2005, to December 31,

2006, consists of repossessed autos and approximately 60%

is primarily residential real estate loans in foreclosure recorded

at net realizable value. Commercial and commercial real

estate nonperforming loans, $543 million at December 31,

2006, remained at historically low levels and had minimal

land, real estate construction or condo conversion exposure.

We expect that the amount of nonaccrual loans will

change due to portfolio growth, portfolio seasoning, routine

problem loan recognition and resolution through collections,

sales or charge-offs. The performance of any one loan can

be affected by external factors, such as economic or market

conditions, or factors particular to a borrower, such as

actions of a borrower’s management.

If interest due on the book balances of all nonaccrual

loans (including loans that were but are no longer on nonac-

crual at year end) had been accrued under the original terms,

approximately $120 million of interest would have been

recorded in 2006, compared with payments of $51 million

recorded as interest income.

Substantially all of the foreclosed assets at December 31,

2006, have been in the portfolio one year or less.

Table 15: Nonaccrual Loans and Other Assets

(in millions) December 31,

2006 2005 2004 2003 2002

Nonaccrual loans:

Commercial and commercial real estate:

Commercial $ 331 $ 286 $ 345 $ 592 $ 796

Other real estate mortgage 105 165 229 285 192

Real estate construction 78 31 57 56 93

Lease financing 29 45 68 73 79

Total commercial and commercial real estate 543 527 699 1,006 1,160

Consumer:

Real estate 1-4 family first mortgage 688 471 386 274 230

Real estate 1-4 family junior lien mortgage 212 144 92 87 49

Other revolving credit and installment 180 171 160 88 48

Total consumer 1,080 786 638 449 327

Foreign 43 25 21 3 5

Total nonaccrual loans (1) 1,666 1,338 1,358 1,458 1,492

As a percentage of total loans 0.52% 0.43% 0.47% 0.58% 0.78%

Foreclosed assets:

GNMA loans (2) 322 ————

Other 423 191 212 198 195

Real estate and other nonaccrual investments (3) 5 2 2 6 4

Total nonaccrual loans and other assets $2,416 $1,531 $1,572 $1,662 $1,691

As a percentage of total loans 0.76% 0.49% 0.55% 0.66% 0.88%

(1) Includes impaired loans of $230 million, $190 million, $309 million, $629 million and $612 million at December 31, 2006, 2005, 2004, 2003 and 2002, respectively. (See Note 1

(Summary of Significant Accounting Policies) and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements for further discussion of impaired loans.)

(2) As a result of a change in regulatory reporting requirements effective January 1, 2006, foreclosed real estate securing GNMA loans has been classified as nonperforming.

These assets are fully collectible because the corresponding GNMA loans are insured by the FHA or guaranteed by the Department of Veterans Affairs.

(3) Includes real estate investments (contingent interest loans accounted for as investments) that would be classified as nonaccrual if these assets were recorded as loans.